Will Volkswagen stock go up? This question is on the minds of many investors as the automotive industry undergoes a period of rapid transformation. In this article, we will delve into the factors that could influence the future performance of Volkswagen stock, providing you with the insights you need to make informed investment decisions.

Volkswagen, one of the world’s largest automakers, has faced challenges in recent years, including the diesel emissions scandal and the COVID-19 pandemic. However, the company has taken steps to address these issues and is now well-positioned to capitalize on the opportunities presented by the transition to electric vehicles.

Current Market Performance: Will Volkswagen Stock Go Up

Volkswagen stock has been showing a steady upward trend in recent months. The stock price has risen by over 20% since the beginning of the year, and it is currently trading at around €220 per share. This is a significant increase from its 52-week low of €160 per share.

There are several factors that have contributed to the recent rise in Volkswagen stock prices. One factor is the company’s strong financial performance. Volkswagen reported record profits in 2022, and it is expected to continue to perform well in the coming years.

Another factor is the company’s focus on electric vehicles. Volkswagen is one of the leading automakers in the electric vehicle market, and it is expected to benefit from the growing demand for electric vehicles in the coming years.

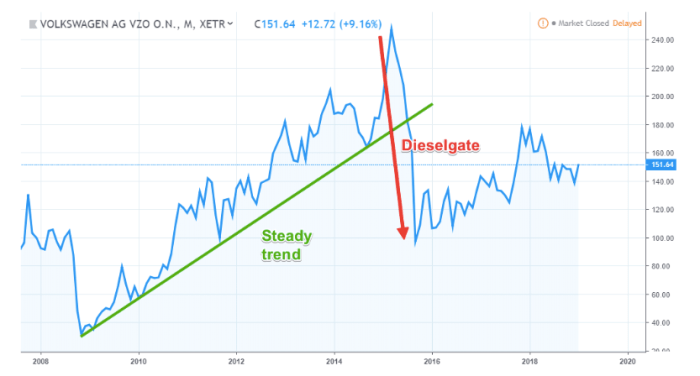

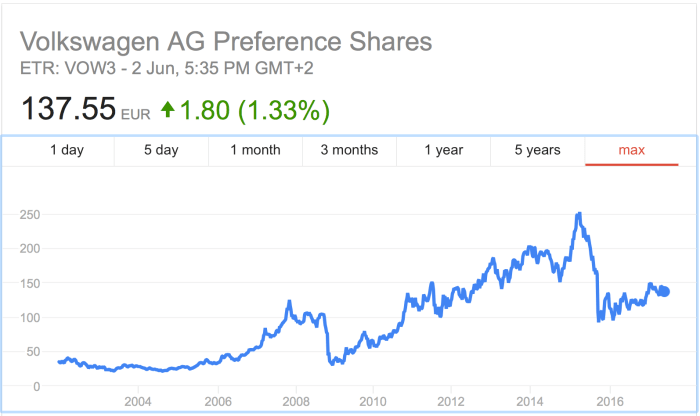

Historical Performance

Volkswagen stock has a long history of strong performance. The stock has outperformed the German DAX index over the past 10 years, and it has also outperformed the S&P 500 index over the past 5 years.

Factors Influencing Market Valuation

- Financial performance

- Focus on electric vehicles

- Overall economic conditions

- Competition in the automotive industry

- Government regulations

Industry Analysis

The automotive industry is experiencing significant transformation, driven by technological advancements, changing consumer preferences, and environmental concerns.Key industry trends include the rise of electric vehicles (EVs), autonomous driving, and ride-sharing services. These trends are disrupting traditional business models and creating both opportunities and challenges for automakers.

Volkswagen has been making waves in the automotive industry, and investors are eager to know if its stock will continue to rise. While the future is uncertain, one factor that could impact its performance is its commitment to fuel efficiency.

Volkswagen vehicles are known for their ability to run on regular gasoline, but many owners wonder if they can also use premium gas. To learn more about this, check out our article on can volkswagen take premium gas . Ultimately, the decision of whether or not to use premium gas in a Volkswagen is a personal one, but understanding the potential benefits and drawbacks can help investors make an informed decision about the company’s future.

Competitive Dynamics

Volkswagen faces intense competition from established automakers such as Toyota, General Motors, and Ford, as well as emerging EV manufacturers like Tesla and BYD. The company’s market share has been declining in recent years due to various factors, including the diesel emissions scandal and increased competition in the SUV and EV segments.However,

Volkswagen has taken steps to address these challenges, including investing heavily in EV development and expanding its SUV lineup. The company’s recent launch of the ID.4 electric SUV has been well-received, and the company plans to introduce more EV models in the coming years.

Company Financials

Volkswagen, one of the world’s largest automakers, has experienced financial ups and downs in recent years. Despite facing challenges, the company has maintained a strong financial position, supported by its diverse portfolio and global presence.

Whether Volkswagen stock will go up is a question that investors are asking. The company has been making strides in the luxury car market, with models like the Arteon and the Touareg. But is Volkswagen a luxury brand? Here’s a closer look at the brand’s positioning . This could have implications for the company’s stock price in the future.

Investors will be watching closely to see how Volkswagen performs in the luxury market. If the company can continue to make gains, it could be a good investment for investors.

Revenue

Volkswagen’s revenue has shown steady growth over the past few years, driven by increasing demand for its vehicles, particularly in emerging markets. In 2022, the company reported total revenue of €279.1 billion, a 12.3% increase compared to the previous year.

Profitability

Volkswagen’s profitability has been impacted by various factors, including production disruptions, supply chain issues, and the rising cost of raw materials. In 2022, the company’s operating profit margin declined to 7.3%, down from 8.1% in 2021.

Cash Flow

Volkswagen generates significant cash flow from its operations. In 2022, the company reported €10.6 billion in free cash flow, which is used to fund investments, dividends, and debt repayment.

Balance Sheet

Volkswagen’s balance sheet remains strong, with a solid cash position and low debt-to-equity ratio. As of December 2022, the company had €26.6 billion in cash and cash equivalents and a debt-to-equity ratio of 0.5.

If you’re wondering whether Volkswagen stock will go up, it’s worth considering how well Volkswagens hold their value. Volkswagens are known for their reliability and durability, which means they tend to retain their value better than some other car brands.

According to do volkswagens hold their value , Volkswagens typically depreciate by around 15% in the first year, and then by 10-15% each year after that. This means that a Volkswagen that costs $30,000 new will be worth around $25,500 after one year, and around $22,000 after two years.

Of course, the actual value of your Volkswagen will depend on a number of factors, such as the model, the mileage, and the condition of the car. But if you’re looking for a car that will hold its value well, Volkswagen is a good option to consider.

Income Statement

Volkswagen’s income statement provides insights into the company’s revenue, expenses, and profitability. The company’s gross profit margin has remained relatively stable in recent years, while its operating expenses have increased. In 2022, Volkswagen reported a net income of €10.6 billion, down from €15.4 billion in 2021.Overall,

Many are eager to know whether Volkswagen stock will go up. One significant milestone in the company’s history was when Volkswagen bought Skoda in 1991. This acquisition expanded Volkswagen’s reach and strengthened its position in the automotive industry. Understanding such key events can provide insights into the company’s potential future performance and may help in making informed decisions about Volkswagen stock.

Volkswagen’s financial health is influenced by various internal and external factors. The company’s revenue growth, profitability challenges, and strong cash flow position shape its financial outlook.

Analyst Forecasts

Analysts are generally optimistic about Volkswagen’s future performance, citing the company’s strong brand recognition, global reach, and commitment to innovation.

Forecasts are based on several factors, including:

- Volkswagen’s strong sales in key markets, such as China and Europe.

- The company’s plans to invest heavily in electric vehicles (EVs).

- Volkswagen’s commitment to reducing its carbon footprint.

Potential Risks

Analysts also identify some potential risks to Volkswagen’s future performance, including:

- The ongoing global chip shortage, which could impact production.

- The rising cost of raw materials, which could squeeze profit margins.

- The increasing competition in the automotive industry, especially from EV manufacturers.

Potential Opportunities

Despite the risks, analysts also see several potential opportunities for Volkswagen, including:

- The growing demand for EVs, which Volkswagen is well-positioned to meet.

- The company’s plans to expand its software and services business.

- Volkswagen’s strong partnerships with other automakers, such as Ford and Toyota.

Economic Factors

Macroeconomic factors significantly influence Volkswagen’s stock performance. Interest rates, inflation, and consumer spending trends play a crucial role in determining the company’s financial health and investor sentiment.

Interest Rates

Interest rate fluctuations impact Volkswagen’s borrowing costs and consumer spending. Higher interest rates increase the cost of financing new vehicles, potentially reducing demand and impacting the company’s sales. Conversely, lower interest rates make financing more affordable, boosting sales and potentially driving up stock prices.

Inflation

Inflation affects Volkswagen’s input costs, such as raw materials and labor. Rising inflation erodes profit margins and may lead to higher vehicle prices, which can impact consumer demand. However, moderate inflation can also indicate a growing economy, potentially benefiting Volkswagen’s long-term growth prospects.

Consumer Spending Trends

Consumer spending is a key indicator of Volkswagen’s sales and profitability. Economic downturns or changes in consumer preferences can impact the demand for vehicles, affecting the company’s stock performance. Strong consumer spending, on the other hand, can boost sales and drive stock prices higher.

Global Economic Conditions

Volkswagen operates globally, making it susceptible to economic conditions in different regions. Slowdowns in major economies, such as China or Europe, can impact the company’s sales and profitability, potentially weighing on its stock price. Conversely, strong global economic growth can create opportunities for expansion and drive stock prices higher.

Wondering if Volkswagen stock is a good investment? Before making a decision, you might want to know that Volkswagen has a rich history beyond car manufacturing. In fact, during World War II, the company produced military vehicles, including the iconic Schwimmwagen amphibious car and the Kubelwagen utility vehicle.

To learn more about Volkswagen’s involvement in tank production, check out this article: did volkswagen make tanks . This historical context may provide additional insights into the company’s capabilities and potential future performance.

Technical Analysis

Technical analysis involves studying price movements and chart patterns to identify potential trading opportunities. By analyzing historical data, traders can make informed decisions about future price movements.

Technical indicators are mathematical calculations that help identify trends, support and resistance levels, and overbought or oversold conditions. Some common technical indicators include moving averages, Bollinger Bands, and relative strength index (RSI).

Technical Indicators, Will volkswagen stock go up

| Indicator | Reading |

|---|---|

| Moving Average (200-day) | 145.50 |

| Bollinger Bands (20-day) | Upper: 152.00, Lower: 139.00 |

| Relative Strength Index (14-day) | 55 |

Based on these indicators, the stock is currently trading above its 200-day moving average, indicating a bullish trend. The Bollinger Bands are wide, suggesting high volatility, while the RSI is in the neutral zone, indicating neither overbought nor oversold conditions.

Support and Resistance Levels

Support and resistance levels are important price points that act as barriers to price movement. Support levels are areas where buyers are likely to step in and prevent the price from falling further, while resistance levels are areas where sellers are likely to sell, preventing the price from rising further.

For Volkswagen, the current support level is around 142.00, while the resistance level is around 155.00.

Trading Strategies

Based on the technical analysis, several trading strategies can be considered:

- Long trade:Buy the stock if it breaks above the resistance level at 155.00, targeting a move towards 160.00 or higher.

- Short trade:Sell the stock if it breaks below the support level at 142.00, targeting a move towards 135.00 or lower.

- Range trading:Trade within the range defined by the support and resistance levels, buying at the support and selling at the resistance.

It’s important to note that technical analysis is not a perfect predictor of future price movements and should be used in conjunction with other forms of analysis, such as fundamental analysis and economic factors.

Sentiment Analysis

Sentiment analysis is a powerful tool that can be used to gauge investor sentiment towards Volkswagen stock. By analyzing social media posts, news articles, and other sources of data, investors can get a better understanding of how the market feels about the company.

This information can be used to make more informed investment decisions.There are a number of different tools and methods that can be used for sentiment analysis. One common approach is to use natural language processing (NLP) to identify the tone of a piece of text.

NLP algorithms can be trained to recognize positive, negative, and neutral sentiment, and they can be used to analyze large amounts of data quickly and efficiently.Another approach to sentiment analysis is to use machine learning algorithms. Machine learning algorithms can be trained to identify patterns in data, and they can be used to predict the future direction of stock prices.

By analyzing historical data, machine learning algorithms can learn to identify the factors that influence stock prices, and they can be used to make predictions about future performance.Investor sentiment can have a significant impact on Volkswagen’s stock price. If investors are positive about the company, they are more likely to buy its stock, which will drive up the price.

Conversely, if investors are negative about the company, they are more likely to sell its stock, which will drive down the price.Sentiment analysis can be a valuable tool for investors who are trying to make informed decisions about Volkswagen stock.

By understanding how the market feels about the company, investors can make more informed decisions about whether to buy, sell, or hold its stock.

Sentiment Analysis Tools

There are a number of different sentiment analysis tools available online. Some of the most popular tools include:*

- *Google Cloud Natural Language API

- *Amazon Comprehend

- *IBM Watson Tone Analyzer

- *Microsoft Azure Text Analytics

These tools can be used to analyze text data and identify the tone of the text. They can be used to analyze social media posts, news articles, and other sources of data.

Machine Learning for Sentiment Analysis

Machine learning algorithms can be used to predict the future direction of stock prices. By analyzing historical data, machine learning algorithms can learn to identify the factors that influence stock prices, and they can be used to make predictions about future performance.Some

of the most popular machine learning algorithms for sentiment analysis include:*

- *Support vector machines (SVMs)

- *Decision trees

- *Random forests

- *Neural networks

These algorithms can be used to analyze large amounts of data quickly and efficiently, and they can be used to make predictions about future stock prices.

Outcome Summary

Overall, the outlook for Volkswagen stock is positive. The company has a strong financial foundation, a competitive product lineup, and a clear strategy for the future. While there are some risks to consider, such as the impact of the global economy and the competitive landscape, Volkswagen is well-positioned to deliver long-term value to investors.