What is the best cheapest car insurance – What is the best and cheapest car insurance? It’s a question that every driver asks at some point. The answer depends on a number of factors, including your age, driving history, location, and the type of car you drive. But there are some general tips that can help you find the best deal on car insurance.

In this guide, we’ll discuss the different types of car insurance coverage available, the factors that affect the cost of insurance, and how to compare insurance providers. We’ll also provide tips on how to get discounts on your car insurance and how to get the most accurate quotes.

Insurance Coverage

Car insurance is a type of insurance that provides financial protection for drivers and their vehicles in the event of an accident or other covered event. There are different types of insurance coverage available for cars, each with its own benefits and limitations.

The most basic type of car insurance is liability coverage. Liability coverage protects drivers from financial responsibility for injuries or damages they cause to other people or their property in an accident. Liability coverage is required by law in most states.

To get the best and cheapest car insurance, it’s important to compare quotes from different providers. If you’re a Honda CR-V owner, you may have come across the term “BSI.” To understand what BSI means on your Honda CR-V, click here . Once you’ve got a clear understanding of your car’s features, you can make an informed decision about your insurance coverage and find the best and cheapest option for your needs.

Collision coverage is another common type of car insurance. Collision coverage protects drivers from financial responsibility for damages to their own vehicle in an accident, regardless of who is at fault. Collision coverage is not required by law, but it is recommended for drivers who want to protect their investment in their vehicle.

Comprehensive coverage is a type of car insurance that provides protection for drivers from financial responsibility for damages to their vehicle caused by events other than an accident, such as theft, vandalism, or fire. Comprehensive coverage is not required by law, but it is recommended for drivers who want to protect their investment in their vehicle.

Example Coverage Options and Costs

- Liability coverage: $100,000/$300,000 – $100 per year

- Collision coverage: $500 deductible – $200 per year

- Comprehensive coverage: $100 deductible – $100 per year

Factors Affecting Cost

The cost of car insurance varies widely depending on several factors. Understanding these factors can help you make informed decisions and potentially reduce your premiums.

Age

- Younger drivers typically pay higher premiums due to their lack of experience and higher risk of accidents.

- As you age and gain more driving experience, your premiums may decrease.

Driving History

- Accidents, traffic violations, and other driving offenses can significantly increase your insurance rates.

- Maintaining a clean driving record is crucial for keeping your premiums low.

Location

- Insurance rates vary based on the location you live in.

- Areas with higher crime rates, traffic congestion, and accident frequency typically have higher premiums.

Tips for Reducing Insurance Costs

- Improve your driving record by avoiding accidents and traffic violations.

- Consider taking a defensive driving course to demonstrate your commitment to safe driving.

- Shop around and compare quotes from multiple insurance companies.

- Increase your deductible to lower your monthly premiums.

- Bundle your car insurance with other policies, such as home or renters insurance.

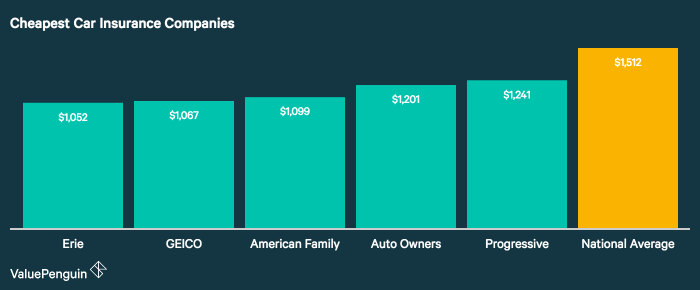

Comparison of Insurance Providers: What Is The Best Cheapest Car Insurance

Choosing the right insurance provider is crucial to secure the best coverage at the most affordable rates. To help you make an informed decision, we’ve compiled a comparison table that Artikels the key features of different insurance providers.

The table includes information on coverage options, rates, customer service ratings, and any unique features or discounts offered by each provider. By comparing these factors, you can identify the provider that best meets your specific needs and budget.

Coverage Options

- Comprehensive coverage: Covers damages to your vehicle from accidents, theft, and vandalism.

- Collision coverage: Covers damages to your vehicle from collisions with other vehicles or objects.

- Liability coverage: Covers damages to other vehicles or property caused by you or a driver on your policy.

- Personal injury protection (PIP): Covers medical expenses and lost wages for you and your passengers.

- Uninsured/underinsured motorist coverage: Covers damages caused by drivers who do not have insurance or have insufficient insurance.

Rates

Insurance rates vary depending on several factors, including your driving history, vehicle type, and location. To get the most accurate rates, it’s recommended to obtain quotes from multiple providers.

Customer Service

Excellent customer service is essential when you need to file a claim or have any questions about your policy. Look for providers with a reputation for responsiveness, helpfulness, and timely claim processing.

Determining the best and cheapest car insurance requires considering various factors. For instance, if you’re comparing the Ford Ranger and Toyota Tacoma, it’s worth exploring ranger vs tacoma reviews to assess their reliability and safety features. Ultimately, the best car insurance for you depends on your specific needs and budget.

Discounts and Savings

Car insurance companies offer various discounts and savings to help policyholders reduce their premiums. These discounts can be based on factors such as age, driving history, vehicle type, and safety features.

Looking for the best and cheapest car insurance can be a daunting task. But with a little research, you can find a policy that meets your needs and budget. If you’re not sure where to start, check out our guide on what is the cheapest and best car insurance . We’ll help you compare quotes from different insurance companies and find the best coverage for your money.

To maximize savings on car insurance, it’s important to be aware of the available discounts and to meet the eligibility criteria for each discount.

Eligibility Criteria, What is the best cheapest car insurance

- Good driver discount:Requires a clean driving record with no accidents or violations within a specified period.

- Multi-car discount:Applies when you insure multiple vehicles with the same company.

- Safe driver discount:Available to drivers who complete a defensive driving course.

- Anti-theft discount:Given to vehicles equipped with anti-theft devices such as alarms or immobilizers.

- Senior citizen discount:Offered to drivers over a certain age (typically 55 or 60) with a good driving record.

Maximizing Savings

- Maintain a clean driving record to qualify for the good driver discount.

- Insure multiple vehicles with the same company to get the multi-car discount.

- Complete a defensive driving course to earn the safe driver discount.

- Install anti-theft devices on your vehicle to receive the anti-theft discount.

- Ask about any additional discounts or promotions offered by the insurance company.

Online Quote Comparison

Obtaining online quotes for car insurance is a convenient way to compare coverage options and rates from multiple providers. The process is typically straightforward and involves the following steps:

- Visit the websites of several insurance providers or use a quote comparison tool.

- Enter your personal and vehicle information, including your age, driving history, and vehicle make and model.

- Provide details about your desired coverage levels and any additional features you want.

- Submit the form and wait for the quotes to be generated.

Using online quote comparison tools offers several advantages. First, it saves you time and effort by allowing you to compare multiple quotes from different providers in one place. Second, it helps you identify the best coverage options and rates that meet your specific needs.

Third, it can be a convenient way to shop for insurance without having to contact each provider individually.

However, there are also some disadvantages to using online quote comparison tools. First, the quotes you receive may not be entirely accurate. This is because insurance companies use a variety of factors to determine your rates, and some of these factors may not be included in the online quote form.

Second, online quote comparison tools may not provide you with all of the information you need to make an informed decision. For example, they may not provide details about the specific coverage limits and exclusions that apply to each policy.

To get the most accurate quotes, it is important to provide complete and accurate information when you fill out the online quote form. You should also take the time to compare the quotes carefully and consider the coverage options and rates that are most important to you.

Concluding Remarks

By following the tips in this guide, you can find the best and cheapest car insurance for your needs. So what are you waiting for? Get started today!