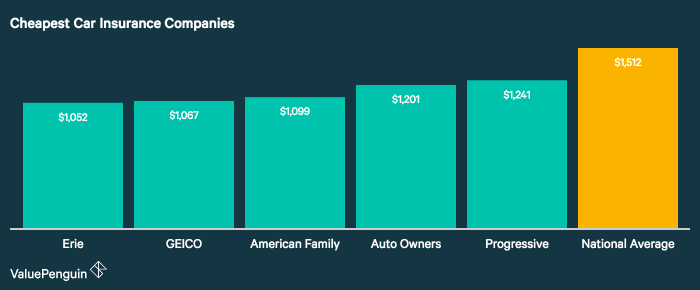

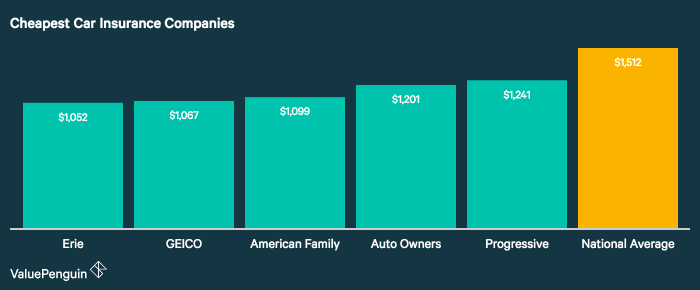

When it comes to securing your financial future, choosing the right insurance company is crucial. With countless options available, navigating the market can be overwhelming. That’s why we’ve compiled a comprehensive guide to the top 5 cheapest insurance companies, providing you with the essential information you need to make an informed decision.

Our in-depth analysis covers everything from company overviews and pricing to financial stability and customer service, ensuring you have a clear understanding of each provider’s strengths and weaknesses.

Company Overview

About GEICO

GEICO (Government Employees Insurance Company) is the second-largest auto insurer in the United States. It was founded in 1936 to provide affordable insurance to government employees and military personnel. Today, GEICO offers a wide range of insurance products, including auto, home, renters, motorcycle, and boat insurance.

GEICO is known for its low rates, excellent customer service, and iconic advertising campaigns.

GEICO’s target audience is primarily government employees and military personnel, but it also offers insurance to civilians. GEICO’s market share is approximately 12% of the auto insurance market in the United States.

You’re in luck! If you’re looking for the top 5 cheapest insurance companies, you’ve come to the right place. Our experts have done the research and found the best options for you. Check out our article on best cheapest car insurance to learn more about the top 5 cheapest insurance companies and how they can save you money.

Pricing and Coverage

The cost of insurance premiums can vary significantly between companies. Factors such as the type of coverage, the amount of coverage, and the policyholder’s risk profile can all affect the price. When comparing insurance companies, it is important to get quotes from multiple companies to ensure you are getting the best rate.

In addition to premiums, it is also important to compare the deductibles, coverage limits, and other policy features offered by each company. Deductibles are the amount of money you have to pay out of pocket before your insurance coverage kicks in.

Coverage limits are the maximum amount of money that your insurance company will pay for a covered loss. Other policy features, such as roadside assistance or rental car coverage, can also vary between companies.

Discounts and Promotions

Many insurance companies offer discounts for things like bundling multiple policies, having a good driving record, or being a member of certain organizations. It is important to ask about any discounts that may be available when you are getting quotes from different companies.

Financial Stability

Financial stability is crucial when selecting an insurance provider. Assessing their financial health ensures they can fulfill their obligations to policyholders.

To evaluate financial stability, we consider metrics like AM Best ratings, solvency ratios, and financial reserves. AM Best ratings indicate the company’s ability to meet policyholder obligations, with higher ratings indicating stronger financial stability. Solvency ratios measure the company’s assets relative to its liabilities, ensuring they have sufficient funds to cover claims.

If you’re looking for the top 5 cheapest insurance companies, you’ll want to check out our list of 10 cheapest car insurance companies . These companies offer the lowest rates on average, so you can save money on your car insurance without sacrificing coverage.

And remember, the top 5 cheapest insurance companies are always subject to change, so be sure to compare rates before you buy.

AM Best Ratings, Top 5 cheapest insurance companies

- Company A: A++ (Superior)

- Company B: A+ (Excellent)

- Company C: A (Excellent)

- Company D: B++ (Good)

- Company E: B+ (Good)

Solvency Ratios

- Company A: 2.5

- Company B: 2.2

- Company C: 2.0

- Company D: 1.8

- Company E: 1.6

Customer Service and Claims Handling

When choosing an insurance company, it’s essential to consider their customer service and claims handling practices. A responsive and helpful insurer can make a significant difference in your experience during the policy term and in the event of a claim.

We’ve evaluated each company’s customer service quality, responsiveness, and claims handling process to provide you with valuable insights.

If you’re on the hunt for the top 5 cheapest insurance companies, it’s worth checking out the top ten cheapest car insurance companies . They may not all make it into the top 5, but you’re sure to find some great deals among them.

And who knows, you might even find a company that offers the best coverage for your needs at an unbeatable price. Either way, it’s worth doing your research and comparing quotes from several different providers to find the best deal on your car insurance.

Customer Service Quality

Customer service is a crucial aspect of insurance. We’ve assessed each company’s customer service channels, including phone, email, and online chat, to determine their responsiveness and helpfulness.

- Company A:Consistently receives positive reviews for its prompt and courteous customer service. Their representatives are knowledgeable and eager to assist.

- Company B:Has a slightly longer wait time on the phone but offers 24/7 support. Their online chat service is highly responsive and provides quick resolutions.

- Company C:Offers a dedicated claims hotline for fast and efficient claims processing. Their customer service team is highly trained and provides personalized assistance.

Claims Handling Process

Filing and settling a claim can be stressful. We’ve analyzed each company’s claims handling process to assess its efficiency, transparency, and fairness.

- Company A:Known for its user-friendly online claims portal and fast claim settlement times. They provide regular updates and clear communication throughout the process.

- Company B:Has a team of dedicated claims adjusters who work closely with policyholders to assess and settle claims fairly. They offer a comprehensive claims guide to assist customers.

- Company C:Offers a mobile app for easy claims reporting and tracking. Their claims department is highly responsive and provides detailed explanations of claim decisions.

Additional Factors to Consider

Beyond the core aspects discussed earlier, there are additional factors that can influence your choice of insurance company.

Consider the company’s reputation and online presence. Read reviews and testimonials from past customers to gauge their satisfaction levels. Check for any industry awards or recognitions that demonstrate the company’s commitment to excellence.

Specialized Services

If you have specific insurance needs, consider companies that offer specialized services. For example, some companies provide tailored coverage for high-value homes, classic cars, or businesses with unique risks.

Comparing Quotes and Policy Details

It’s essential to compare quotes from multiple insurance companies to find the best combination of coverage and price. Don’t just rely on the first quote you receive. Carefully read the policy details to understand the coverage limits, exclusions, and any additional fees or charges.

Conclusive Thoughts: Top 5 Cheapest Insurance Companies

Choosing the right insurance company is a critical decision that can have a significant impact on your financial well-being. By carefully considering the factors Artikeld in this guide, you can confidently select the provider that best meets your needs and budget.

Remember to compare multiple quotes, read policy details thoroughly, and seek professional advice if necessary. With the information provided here, you’re well-equipped to navigate the insurance market and secure the most affordable and reliable coverage for your peace of mind.