The cheapest car insurance companies can save you hundreds of dollars on your premiums. But how do you find the best rates? This guide will provide you with everything you need to know about finding the cheapest car insurance companies, including factors that affect rates, discounts, and customer service.

When it comes to finding the cheapest car insurance companies, there are a few things you need to keep in mind. First, your driving history is one of the most important factors that will affect your rates. Drivers with clean records will typically pay less than those with accidents or tickets.

Second, your age is also a factor. Younger drivers are typically considered to be higher risk, and they will pay more for insurance than older drivers.

Companies with the Lowest Rates

Finding the cheapest car insurance can be a challenge, especially with so many different companies and policies to choose from. However, by comparing quotes from multiple insurers, you can find the best rates for your individual needs.

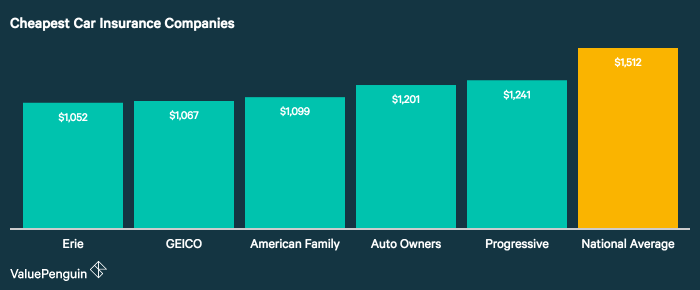

The following table compares the average rates of the cheapest car insurance companies for different coverage levels:

| Company | Average Rate |

|---|---|

| Geico | $524 |

| State Farm | $558 |

| Progressive | $572 |

| Allstate | $586 |

| Farmers | $600 |

As you can see, Geico offers the cheapest rates for all coverage levels. However, it is important to note that these are just averages. Your individual rate may vary depending on your driving history, age, location, and other factors.

Young Drivers

Young drivers are typically charged higher car insurance rates than older drivers. This is because they are considered to be a higher risk. However, there are a few things that young drivers can do to lower their rates, such as:

- Maintain a good driving record

- Take a defensive driving course

- Add a parent or guardian to their policy

- Drive a safe car

Seniors

Seniors are typically charged lower car insurance rates than younger drivers. This is because they are considered to be a lower risk. However, there are a few things that seniors can do to further lower their rates, such as:

- Take a senior driving course

- Install safety features in their car

- Drive less frequently

Good Drivers

Good drivers are typically charged lower car insurance rates than drivers with poor driving records. This is because they are considered to be a lower risk. However, there are a few things that good drivers can do to further lower their rates, such as:

- Maintain a clean driving record

- Take a defensive driving course

- Drive a safe car

- Park their car in a safe location

Factors Influencing Premiums

The cost of car insurance is not a fixed amount. It varies depending on several factors that insurance companies use to assess the risk of insuring a particular driver. These factors include:

Driving History

Your driving history is one of the most important factors that insurance companies consider when setting your rates. If you have a clean driving record with no accidents or traffic violations, you will likely be eligible for lower rates. However, if you have a history of accidents or traffic violations, your rates will likely be higher.

Age

Your age is another factor that can affect your car insurance rates. Younger drivers are typically considered to be higher risk than older drivers, so they often pay higher rates. As you get older, your rates will likely decrease.

Location

The location where you live can also affect your car insurance rates. If you live in an area with a high rate of accidents or theft, your rates will likely be higher. However, if you live in an area with a low rate of accidents and theft, your rates will likely be lower.

There are many car insurance companies out there, but who has the cheapest car insurance? This article takes a look at some of the cheapest car insurance companies and what they offer. The cheapest car insurance companies will vary depending on your individual circumstances, so it’s important to compare quotes from several different companies before making a decision.

Vehicle Type

The type of vehicle you drive can also affect your car insurance rates. Sports cars and luxury cars are typically more expensive to insure than sedans and economy cars. This is because sports cars and luxury cars are more likely to be involved in accidents and are more expensive to repair.

If you’re looking for the cheapest car insurance companies, you’ve come to the right place. We’ve done the research for you and found the best deals on auto insurance. Check out our article what are the cheapest auto insurance companies to learn more about the cheapest car insurance companies and how to get the best deal on your policy.

Discounts and Savings

The cheapest car insurance companies offer various discounts and savings opportunities to help you reduce your premiums. These discounts can range from safe driving habits to bundling policies and more.

Here are some common discounts you may be eligible for:

Safe Driver Discounts, The cheapest car insurance companies

- Accident-free discount:This discount rewards drivers who have maintained a clean driving record for a certain period of time, typically three to five years.

- Defensive driving course discount:Taking a defensive driving course can help you learn safe driving techniques and qualify for a discount on your insurance.

Vehicle-Related Discounts

- Anti-theft device discount:Installing an anti-theft device in your car can help deter theft and qualify you for a discount.

- Low mileage discount:If you drive less than a certain number of miles per year, you may qualify for a low mileage discount.

Other Discounts

- Bundling discount:If you bundle your car insurance with other policies, such as home or renters insurance, you may qualify for a discount.

- Loyalty discount:Some insurance companies offer discounts to customers who have been with them for a certain period of time.

The availability and eligibility requirements for these discounts can vary depending on the insurance company, so it’s important to check with your insurer to see what discounts you may qualify for.

Customer Service and Reviews

Customer service is a crucial aspect of car insurance. A company with excellent customer service can make a significant difference in your experience, especially when you need to file a claim or make changes to your policy.

It can be challenging to find the most affordable car insurance companies. Fortunately, top affordable car insurance companies provide options that won’t break the bank. These companies offer competitive rates, flexible coverage, and excellent customer service. So, if you’re looking for a way to save money on car insurance without sacrificing quality, be sure to check out these top-rated providers.

When evaluating the cheapest car insurance companies, take the time to read customer reviews and feedback. Check online review platforms and forums to see what others have to say about their experiences with different providers. Look for companies with consistently positive reviews and a reputation for providing helpful and responsive customer support.

Importance of Customer Satisfaction

Customer satisfaction is paramount in the insurance industry. A company that values customer satisfaction is more likely to go the extra mile to ensure you have a positive experience. This can include providing personalized recommendations, promptly addressing your concerns, and resolving issues efficiently.

When you choose a car insurance company with high customer satisfaction, you gain peace of mind knowing that you have a partner who genuinely cares about your needs. This can make a world of difference in the long run, especially if you ever need to rely on your insurance coverage.

Online Quoting and Comparison Tools

Online quoting and comparison tools are invaluable resources for finding the cheapest car insurance rates. They allow you to quickly and easily compare quotes from multiple insurers, saving you time and money.

To use these tools effectively, follow these steps:

Getting Started

- Gather your personal information, including your driving history, vehicle details, and address.

- Visit reputable insurance comparison websites or use your insurer’s online quoting tool.

- Enter your information accurately and completely.

Comparing Quotes

- Review the quotes carefully, paying attention to the coverage, deductibles, and premiums.

- Compare the rates and coverage offered by different insurers.

- Consider your budget and coverage needs when making a decision.

Potential Pitfalls

- Not providing accurate information can result in inaccurate quotes.

- Beware of hidden fees or additional charges.

- Some comparison tools may not include all insurers, so it’s advisable to shop around independently as well.

Wrap-Up: The Cheapest Car Insurance Companies

Finding the cheapest car insurance companies can save you a lot of money. By following the tips in this guide, you can find the best rates and get the coverage you need to protect yourself and your vehicle.