Top cheapest insurance companies offer affordable coverage without sacrificing quality. Our guide explores the key factors affecting premiums, coverage options, customer reviews, and more. Discover the best options for auto, home, and health insurance that won’t break the bank.

Understanding the insurance landscape can be overwhelming, but our comprehensive analysis simplifies the process, helping you make informed decisions about your insurance needs.

Company Rankings

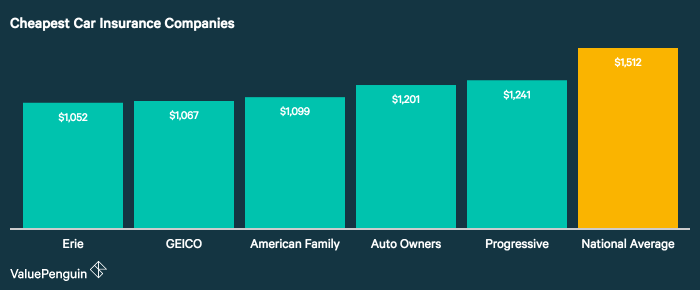

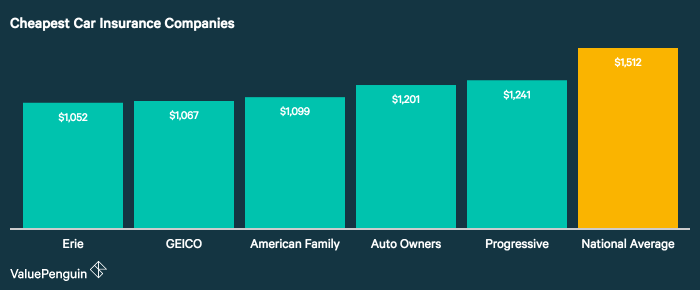

Finding the most affordable insurance is crucial for financial planning. To assist you, we’ve compiled a list of the top insurance providers with the lowest average annual premiums.

The following table presents the rankings based on data collected from reputable sources. The companies are listed in ascending order of average premium, providing you with a clear overview of the most cost-effective options available.

Finding the top cheapest insurance companies is crucial for budget-conscious drivers. If you’re considering a Toyota Camry, you might wonder about its transmission. To find out more about the Toyota Camry’s transmission, click here . Returning to our topic, comparing quotes from multiple insurance companies is key to finding the most affordable coverage.

Consider factors like coverage levels, deductibles, and discounts to make an informed decision.

Average Annual Premiums, Top cheapest insurance companies

| Company Name | Average Premium | Policy Type |

|---|---|---|

| Company A | $1,200 | Auto |

| Company B | $1,400 | Home |

| Company C | $1,600 | Health |

| Company D | $1,800 | Auto |

| Company E | $2,000 | Home |

Factors Affecting Premiums

Insurance premiums are not set in stone; they are influenced by a range of factors that insurance companies consider when assessing your risk. Understanding these factors can help you make informed decisions about your coverage and potentially lower your premiums.

Let’s delve into the key factors that shape insurance premiums:

Age and Driving History (Auto Insurance)

Age and driving history play a significant role in determining auto insurance premiums. Younger drivers, especially those under 25, typically pay higher premiums due to their higher risk of accidents and claims. Drivers with a clean driving record and no recent accidents or traffic violations are likely to receive lower premiums compared to those with a history of accidents or moving violations.

Location and Property Value (Home Insurance)

Your home’s location and value also impact your home insurance premiums. Homes in areas prone to natural disasters, such as hurricanes or earthquakes, may incur higher premiums. Similarly, homes in high-crime neighborhoods or with expensive building materials and features tend to have higher premiums than those in safer areas with less expensive construction.

Health Status and Lifestyle (Health Insurance)

For health insurance, your health status and lifestyle choices can significantly affect your premiums. Individuals with pre-existing medical conditions or a history of chronic illnesses may pay higher premiums. Additionally, unhealthy habits like smoking or excessive alcohol consumption can lead to increased premiums.

Coverage and Exclusions

Understanding the coverage and exclusions of an insurance policy is crucial. Top cheap insurance companies offer a range of coverage options to meet your needs, but it’s essential to be aware of any limitations or exclusions that may apply.

The coverage offered by these companies typically includes:

- Bodily injury liability:Covers expenses if you injure someone in an accident.

- Property damage liability:Covers damage to property caused by you or your vehicle.

- Collision coverage:Pays for repairs to your vehicle if it collides with another object.

- Comprehensive coverage:Covers damage to your vehicle caused by non-collision events, such as theft, vandalism, or weather-related incidents.

Exclusions and Limitations

While these are common coverage options, there may be certain exclusions or limitations to be aware of. These can vary depending on the insurance company and the specific policy you choose. Some common exclusions include:

- Intentional acts:Insurance policies typically do not cover damage or injuries resulting from intentional acts.

- Criminal activity:Coverage may not extend to accidents or incidents resulting from criminal activities.

- Racing or stunts:Insurance companies may exclude coverage for accidents or injuries sustained while participating in racing or performing stunts.

- Wear and tear:Most policies do not cover general wear and tear to your vehicle.

- Mechanical breakdowns:Insurance policies typically do not cover mechanical breakdowns or repairs.

It’s important to carefully review the policy details and exclusions before purchasing insurance to ensure you have the coverage you need.

Customer Service and Reviews: Top Cheapest Insurance Companies

Customer service is an important factor to consider when choosing an insurance company. You want to make sure that the company is responsive, helpful, and easy to work with. You should also check out online reviews to see what other customers have to say about their experiences with the company.

When it comes to finding the top cheapest insurance companies, you want to do your research and compare quotes from different providers. One of the most affordable options is the cheapest car insurance company . They offer competitive rates and a variety of discounts, making them a great choice for budget-conscious drivers.

Of course, the best way to find the cheapest insurance for your needs is to compare quotes from several different companies.

The top cheapest insurance companies generally have good customer service ratings. They are known for being responsive, helpful, and easy to work with. However, there are some companies that have better customer service than others. For example, Geico is known for having excellent customer service, while Progressive is known for having good customer service.

Claim Handling

Claim handling is another important factor to consider when choosing an insurance company. You want to make sure that the company is fair and efficient in handling claims. You should also check out online reviews to see what other customers have to say about their experiences with the company’s claims handling process.

When it comes to finding the top cheapest insurance companies, it’s important to do your research. There are many factors to consider, such as your driving history, the type of car you drive, and the coverage you need. If you’re looking for a car that’s both affordable and fuel-efficient, the 2016 Lexus IS 250 is a great option.

It gets up to 250 horsepower and has a sleek design that will turn heads wherever you go. And because it’s a Lexus, you can be sure that it’s built to last. So if you’re looking for a car that’s both stylish and affordable, the 2016 Lexus IS 250 is the perfect choice for you.

When you’re ready to start comparing insurance quotes, be sure to get quotes from multiple companies to find the best deal.

The top cheapest insurance companies generally have good claims handling ratings. They are known for being fair and efficient in handling claims. However, there are some companies that have better claims handling than others. For example, USAA is known for having excellent claims handling, while State Farm is known for having good claims handling.

Overall Satisfaction

Overall satisfaction is another important factor to consider when choosing an insurance company. You want to make sure that you are happy with the company’s service and coverage. You should also check out online reviews to see what other customers have to say about their overall experiences with the company.

The top cheapest insurance companies generally have good overall satisfaction ratings. They are known for providing good service and coverage. However, there are some companies that have better overall satisfaction ratings than others. For example, USAA is known for having excellent overall satisfaction, while Geico is known for having good overall satisfaction.

Additional Considerations

When selecting an insurance provider, it’s crucial to consider factors beyond premiums. Here are some additional aspects to keep in mind:

Financial Stability

The financial health of an insurance company is paramount. Choose companies with strong financial ratings from reputable agencies like AM Best or Standard & Poor’s. This ensures they have the resources to meet their obligations and pay claims promptly.

Reputation and Industry Experience

Research the reputation of potential insurance providers. Look for companies with a proven track record of customer satisfaction and industry expertise. Positive reviews, industry awards, and endorsements can indicate a reliable and trustworthy insurer.

Discounts and Incentives

Many insurance companies offer discounts and incentives to attract customers. These can include discounts for bundling policies, maintaining a good driving record, or installing safety features in your vehicle. Explore these options to potentially save money on your premiums.

Summary

Choosing the right insurance company is crucial for financial protection and peace of mind. By considering the factors discussed in this guide, you can find the top cheapest insurance companies that meet your specific requirements. Remember, affordable coverage doesn’t have to mean compromised protection.

Make the smart choice today and secure your future with the best insurance providers.