Cheapest minimum car insurance is a must-have for any driver looking to save money on their monthly expenses. But finding the right policy can be a daunting task. That’s why we’ve put together this comprehensive guide to help you understand the ins and outs of minimum car insurance and how to find the best deal.

In this guide, we’ll cover everything you need to know about minimum car insurance, including what it is, how much it costs, and what it covers. We’ll also provide tips on how to compare different policies and find the best deal for your needs.

Cheapest Minimum Car Insurance

Minimum car insurance is the lowest level of coverage required by law in most jurisdictions. It typically includes liability coverage, which protects you if you cause an accident and injure someone else or damage their property. The specific coverage limits and requirements vary depending on the jurisdiction.

If you’re looking for the cheapest minimum car insurance, it’s important to compare quotes from multiple insurance companies. That way, you can make sure you’re getting the best deal on your coverage. And if you’re driving a Camry, you may want to consider getting a transmission warranty.

Camry transmissions are known to be reliable, but they can still fail. A transmission warranty can help you cover the cost of repairs if your transmission fails.

Legal Requirements

The legal requirements for car insurance vary from state to state. In some states, only liability coverage is required, while other states also require coverage for uninsured/underinsured motorists, personal injury protection, and collision damage.

If you’re looking for the cheapest minimum car insurance, it’s important to compare quotes from different providers. You may be able to save money by bundling your insurance with other policies, such as homeowners or renters insurance. If you’re looking for a high-end luxury SUV, you may be interested in the lamborghini urus 2023 release date . This vehicle is expected to be released later this year and is sure to turn heads wherever it goes.

Regardless of the type of car you drive, it’s important to have adequate insurance coverage in place to protect yourself and your vehicle.

It’s important to check the specific requirements in your jurisdiction to ensure you have adequate coverage. Driving without adequate insurance can result in fines, license suspension, or even jail time.

Factors Affecting Minimum Car Insurance Costs

Determining the cost of minimum car insurance involves considering several key factors. These include the driver’s age, driving history, vehicle type, and location. Understanding how each of these elements influences insurance premiums can help you make informed decisions to potentially lower your insurance costs.

Age

Generally, younger drivers pay higher insurance premiums compared to older drivers. This is due to their higher risk of being involved in accidents. As drivers gain experience and demonstrate responsible driving habits, their insurance rates tend to decrease.

Driving History

Your driving history plays a significant role in determining your insurance costs. Drivers with clean driving records, free of accidents and traffic violations, typically receive lower premiums. On the other hand, drivers with a history of accidents, speeding tickets, or other violations may face higher insurance rates.

Vehicle Type

The type of vehicle you drive can also impact your insurance costs. Sports cars, luxury vehicles, and high-performance cars generally have higher insurance premiums compared to standard sedans or economy cars. This is because these vehicles are often more expensive to repair or replace in the event of an accident.

Location, Cheapest minimum car insurance

The location where you live can also affect your insurance rates. Drivers in urban areas typically pay higher premiums compared to those in rural areas. This is due to the increased risk of accidents, theft, and vandalism in densely populated areas.

Comparing Minimum Car Insurance Providers: Cheapest Minimum Car Insurance

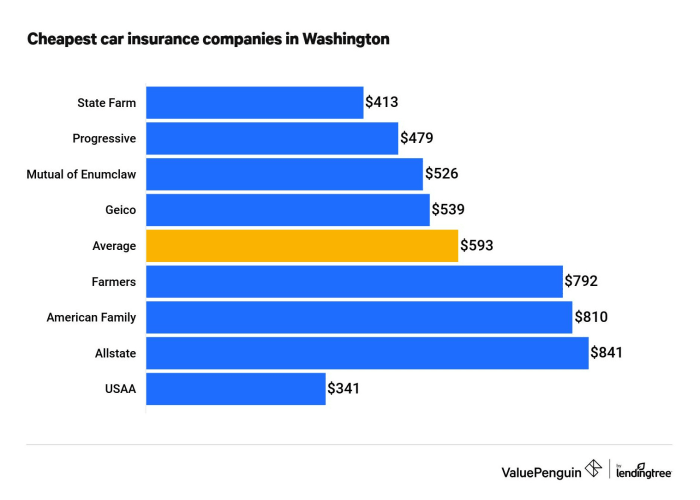

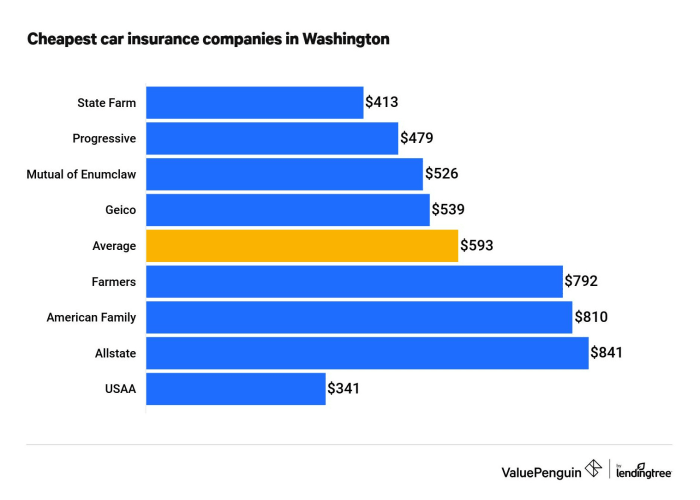

When searching for the most suitable minimum car insurance provider, comparing different options is crucial. This comprehensive guide will assist you in evaluating coverage options, premiums, and customer service to find the most affordable and reliable insurance provider that meets your specific needs.

Coverage Options

Coverage options vary among insurance providers. Ensure you understand the minimum coverage required by your state and consider additional coverage options such as collision, comprehensive, and uninsured/underinsured motorist coverage to protect yourself from potential financial losses.

Premiums

Premiums are the regular payments you make to maintain your insurance policy. Compare premiums from different providers to find the most affordable option that fits your budget. Factors that influence premiums include your driving record, vehicle type, and location.

Customer Service

Excellent customer service is invaluable when filing claims or making inquiries. Look for providers with responsive and helpful customer support channels, including phone, email, and online portals.

Ways to Reduce Minimum Car Insurance Costs

Reducing minimum car insurance costs is essential for saving money while meeting legal requirements. Here are some practical strategies to achieve this:

Improve Driving Habits

- Avoid speeding, reckless driving, and traffic violations. A clean driving record can lead to lower premiums.

- Maintain a good credit score, as insurance companies often consider it a measure of financial responsibility.

- Limit your annual mileage. Driving less reduces the risk of accidents and lowers insurance costs.

Take Defensive Driving Courses

Completing defensive driving courses demonstrates your commitment to safe driving. Insurance companies may offer discounts to policyholders who complete these courses.

Increase Deductibles

A deductible is the amount you pay out of pocket before insurance coverage kicks in. Increasing your deductible lowers your monthly premiums. However, ensure you can afford the higher deductible in case of an accident.

Negotiate with Your Insurance Company

Contact your insurance company and inquire about any discounts or promotions available. They may offer discounts for bundling multiple policies, such as auto and home insurance.

If you’re on a tight budget, finding the cheapest minimum car insurance is a must. But who offers the best deal? To find out, check out this article on who is the cheapest car insurance company . It provides a comprehensive analysis of the top providers, helping you make an informed decision and secure the most affordable coverage for your vehicle.

Understanding the Limitations of Minimum Car Insurance

Minimum car insurance coverage, as mandated by law, provides only the bare minimum protection required to operate a vehicle legally. While it may meet the legal requirements, it falls short in providing comprehensive coverage, leaving you exposed to significant financial risks.

Gaps in Coverage

Minimum insurance typically covers only bodily injury and property damage liability. It does not include:

- Collision coverage:Repairs or replaces your vehicle if it’s damaged in a collision with another vehicle or object.

- Comprehensive coverage:Covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage:Protects you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

Risks Associated with Inadequate Coverage

Driving with minimum insurance can leave you vulnerable to:

- Financial ruin:If you’re involved in an accident and your vehicle is damaged, you’ll have to pay for repairs out of pocket.

- Legal liability:If you cause an accident, minimum insurance may not cover the full extent of the damages, leaving you open to lawsuits.

- Peace of mind:Knowing that you have comprehensive coverage can provide peace of mind and protect you from unexpected expenses.

Examples of Inadequate Protection

- You’re in a collision with a driver who has no insurance:Minimum insurance will not cover your vehicle repairs.

- Your car is stolen:Minimum insurance does not cover theft, leaving you responsible for replacing your vehicle.

- Your car is damaged by a tree branch in a storm:Minimum insurance does not cover damage caused by natural disasters.

Additional Coverage Options to Consider

Minimum car insurance provides basic protection, but additional coverage options can enhance your financial protection. These options cover a wider range of risks, offering peace of mind and reducing the potential for out-of-pocket expenses in the event of an accident.

Collision Coverage

Collision coverage protects your vehicle from damage caused by a collision with another vehicle or object. It covers repairs or replacement costs, regardless of who is at fault. While not required by law, collision coverage is highly recommended, especially if you have a newer or expensive vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision-related damages, such as theft, vandalism, fire, hail, and animal strikes. This coverage is particularly beneficial if you live in an area with a high risk of these events.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you and your passengers from financial losses caused by drivers who are uninsured or underinsured. This coverage is crucial because many drivers on the road do not carry adequate insurance.

Determining Which Coverage Options are Necessary

The best way to determine which additional coverage options are necessary for you is to assess your individual needs and risk tolerance. Consider factors such as the value of your vehicle, your driving habits, and the level of financial protection you desire.

It’s also important to consult with your insurance agent to discuss your options and make an informed decision.

Conclusion

Now that you know everything there is to know about cheapest minimum car insurance, you’re ready to start shopping for a policy. Be sure to compare quotes from multiple insurance companies to find the best deal. And don’t forget to take advantage of any discounts that you may be eligible for.