Who is the cheapest car insurance company? It’s a question that many drivers ask themselves when they’re shopping for car insurance. The answer, unfortunately, is not always straightforward. There are a number of factors that can affect the cost of car insurance, including your age, driving record, and the type of car you drive.

However, there are some general tips that you can follow to find the cheapest car insurance company for your needs.

In this article, we’ll take a look at some of the factors that affect the cost of car insurance, and we’ll provide some tips on how to find the cheapest car insurance company for your needs.

Company Comparison

When comparing insurance companies, consider factors such as coverage options, customer service, financial stability, and discounts. Research companies thoroughly to find the best fit for your needs.

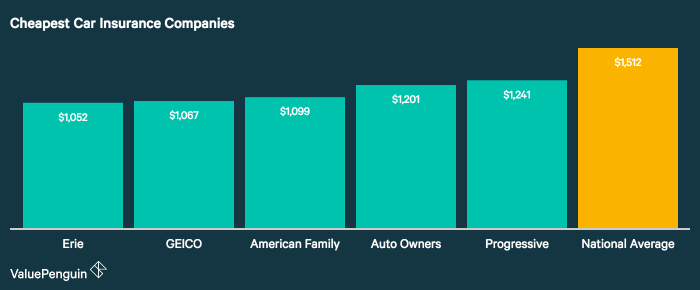

The following table provides a comparison of average premiums and key features of different insurance companies:

Average Premiums and Key Features, Who is the cheapest car insurance company

| Company | Average Premium | Key Features |

|---|---|---|

| Geico | $1,500 | 24/7 customer service, accident forgiveness |

| Progressive | $1,600 | Usage-based insurance, Snapshot program |

| State Farm | $1,700 | Wide range of coverage options, discounts for safe drivers |

| Allstate | $1,800 | Personalized coverage, Drivewise program |

| Farmers | $1,900 | Local agents, roadside assistance |

Coverage Options

When selecting car insurance, understanding the various coverage options is crucial. These options determine the extent of financial protection you receive in the event of an accident or other covered incident.

Coverage levels impact premiums, with higher coverage limits typically resulting in higher premiums. However, it’s important to strike a balance between affordability and adequate protection.

Liability Coverage

Liability coverage is mandatory in most states and protects you from financial responsibility if you cause an accident that injures others or damages their property. It includes:

- Bodily injury liability: Covers expenses related to injuries sustained by others in an accident you cause.

- Property damage liability: Covers costs associated with damage to another person’s property, such as their vehicle or home.

Collision Coverage

Collision coverage protects your own vehicle from damage sustained in an accident, regardless of fault. This coverage is optional but highly recommended if you have a financed or leased vehicle.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision-related events, such as theft, vandalism, or damage caused by natural disasters. This coverage is also optional but recommended for newer vehicles or those in high-risk areas.

Before you hit the road, it’s important to have the right car insurance coverage. But with so many companies out there, who is the cheapest car insurance company? To find out, be sure to compare quotes from multiple insurers. And while you’re at it, you might also want to check out Does Honda Lease Include Oil Change: A Comprehensive Guide . This guide can help you understand what’s included in your Honda lease, so you can make sure you’re getting the most out of your money.

Then, you can get back to the task of finding the cheapest car insurance company for your needs.

Discounts and Savings

Insurance companies offer various discounts to help you save money on your car insurance premiums. These discounts can range from being a safe driver to bundling your policies.

Figuring out who is the cheapest car insurance company can be a bit of a hassle, but it’s worth it to save some money. If you’re thinking about buying a Honda, you might be wondering if the lease buyout includes tax.

Does Honda Lease Buyout Include Tax? The answer is yes, the lease buyout includes tax, so you’ll need to factor that into your budget. Once you’ve got that figured out, you can start shopping around for the cheapest car insurance company.

To qualify for these discounts, you may need to meet certain criteria, such as maintaining a clean driving record, taking a defensive driving course, or installing certain safety features in your car.

If you’re wondering who the cheapest car insurance company is, you’re in luck! Check out Does HondaLink Offer Remote Start: Your Comprehensive Guide for more information on how to find the best rates. And while you’re there, don’t forget to check out our other articles on car insurance!

Negotiating Lower Premiums

- Shop around:Get quotes from multiple insurance companies to compare rates and find the best deal.

- Raise your deductible:Increasing your deductible can lower your premiums, but make sure you can afford to pay the deductible if you need to file a claim.

- Ask for discounts:Inquire about any discounts you may qualify for, such as good driver discounts, multi-car discounts, or loyalty discounts.

- Bundle your policies:Combining your car insurance with other policies, such as homeowners or renters insurance, can often save you money.

- Maintain a good credit score:Insurance companies often use your credit score to determine your premiums, so maintaining a good credit score can help you get lower rates.

Customer Service: Who Is The Cheapest Car Insurance Company

Customer service is a crucial aspect of choosing an insurance company. It determines how smoothly your interactions with the company will be, especially during the claim process.

A good customer service experience involves prompt and helpful responses, clear communication, and a willingness to go the extra mile. For instance, if you have a question about your policy, a responsive and knowledgeable customer service representative can quickly provide you with the necessary information.

Positive Customer Service Experiences

- Quick and efficient claim processing

- Personalized and tailored solutions

- Proactive communication and updates

- Empathetic and understanding staff

- Positive reviews and testimonials

Negative Customer Service Experiences

- Long wait times for responses

- Unresponsive or unhelpful staff

- Unclear or confusing communication

- Unresolved issues or complaints

- Negative reviews and feedback

Researching a Company’s Customer Service Record

To research a company’s customer service record, consider the following:

- Read online reviews and testimonials on websites like Trustpilot and the Better Business Bureau (BBB).

- Contact the company directly and ask about their customer service policies and procedures.

- Inquire with friends, family, or colleagues who have experience with the company.

- Check the company’s social media presence to see how they interact with customers.

- Consider industry awards and recognition for customer service excellence.

Financial Stability

When selecting an insurance company, financial stability should be a top priority. A financially stable insurer can ensure your claims are paid promptly and that your coverage remains intact.

For instance, if an insurance company faces financial difficulties, it may delay or deny claims, or even become insolvent, leaving policyholders with unpaid claims.

Assessing Financial Stability

- Ratings from Independent Agencies:Agencies like A.M. Best, Moody’s, and Standard & Poor’s provide financial stability ratings for insurance companies. Higher ratings indicate stronger financial health.

- Financial Statements:Review the company’s annual reports and financial statements to assess its assets, liabilities, and solvency ratios.

- Industry News and Reports:Keep up with industry news and reports to monitor any changes in the financial standing of insurance companies.

Reputation and Reviews

Reputation and reviews play a significant role in choosing an insurance company. They offer valuable insights into the experiences of previous customers, giving you a glimpse of the company’s strengths and weaknesses.

Positive reviews highlight the company’s responsive customer service, fair claim settlements, and competitive rates. Conversely, negative reviews can red-flag issues such as delayed claims processing, high premiums, or poor communication.

Finding Reliable Reviews

To find reliable reviews, consider the following:

- Independent Review Websites:Sites like Trustpilot, Google My Business, and ConsumerAffairs collect reviews from verified customers.

- Industry Publications:Reputable magazines and websites often publish reviews and ratings of insurance companies based on their research and analysis.

- Social Media:Social media platforms like Facebook and Twitter can provide insights into customer experiences and company reputation.

Conclusion

Finding the cheapest car insurance company can be a challenge, but it’s definitely worth it. By following the tips in this article, you can save yourself a lot of money on your car insurance premiums.

3 thoughts on “Who is the Cheapest Car Insurance Company?”