Cheapest best insurance? Yes, it exists! Dive into this captivating exploration where we uncover the secrets to securing the most affordable and effective insurance coverage. From understanding the factors that shape insurance costs to comparing quotes and negotiating the best rates, we’ll empower you to make informed decisions that protect your finances and give you peace of mind.

In this comprehensive guide, we’ll delve into the different types of insurance coverage available, from health and auto to home and life insurance. We’ll break down the essential features and benefits of each type, helping you determine the right coverage for your unique needs and budget.

Affordable Insurance Options

Securing adequate insurance coverage doesn’t have to break the bank. Understanding the factors that influence insurance costs and exploring budget-friendly options can help you find the right protection without overspending.

Factors that impact insurance premiums include your age, health, driving record, location, and the type and amount of coverage you need. Comparing quotes from multiple insurance providers can help you find the most affordable option for your specific needs.

Comparison of Insurance Providers

The following table provides a comparison of premiums and coverage details from different insurance providers:

| Provider | Premium | Coverage |

|---|---|---|

| Provider A | $1,000 | Comprehensive coverage, including liability, collision, and uninsured motorist protection |

| Provider B | $800 | Liability-only coverage |

| Provider C | $1,200 | Comprehensive coverage with higher deductibles |

Benefits and Drawbacks of Budget-Friendly Insurance Plans

Choosing a budget-friendly insurance plan can offer several benefits, such as:

- Lower monthly premiums

- Reduced financial burden in the event of an accident

However, there are also potential drawbacks to consider:

- Limited coverage options

- Higher deductibles

- Lower payout amounts in the event of a claim

Types of Insurance Coverage

Understanding the different types of insurance coverage available is crucial for making informed decisions about your financial security. From health to auto, home, and life insurance, each type offers unique protection and benefits.

To help you navigate the complexities of insurance, we’ve compiled a comprehensive overview of the most common coverage options, highlighting their essential features and benefits.

Health Insurance

Health insurance provides coverage for medical expenses, including doctor visits, hospital stays, and prescription drugs. It protects you from the financial burden of unexpected medical bills and helps ensure access to quality healthcare.

- Covers a wide range of medical services

- Helps pay for doctor visits, hospitalizations, and medications

- Protects against high medical costs in case of illness or injury

Auto Insurance

Auto insurance is mandatory in most states and provides financial protection in case of accidents. It covers damages to your vehicle, as well as injuries or property damage caused to others.

- Mandatory in most states

- Covers vehicle damage, injuries, and property damage

- Provides peace of mind in case of an accident

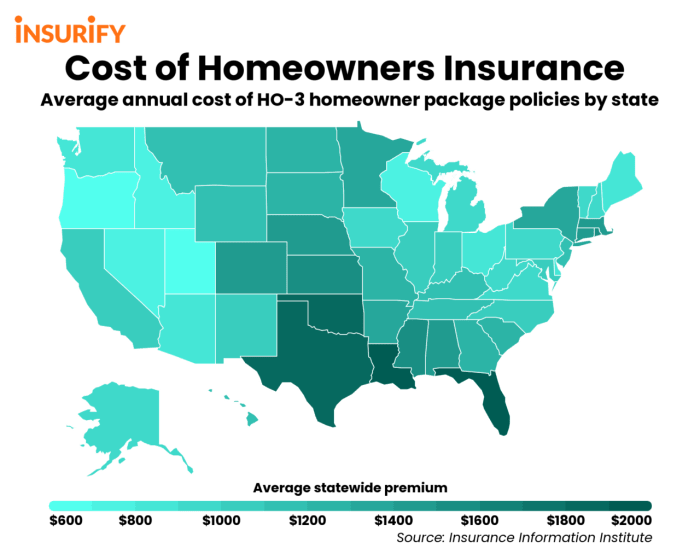

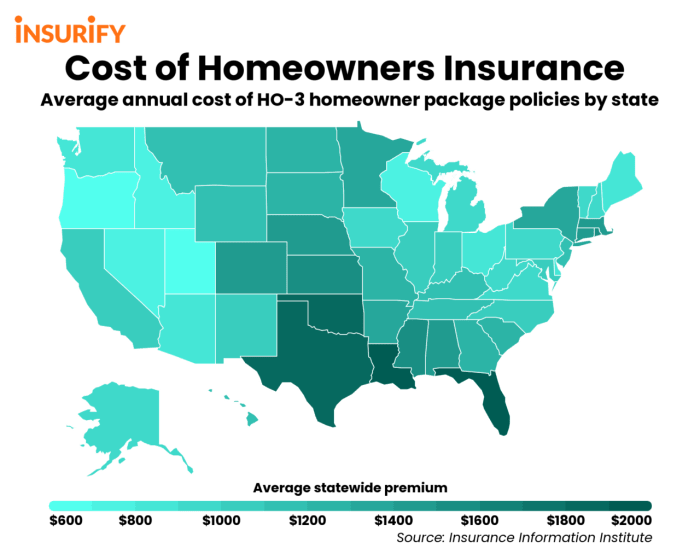

Home Insurance

Home insurance protects your home and belongings from damage or loss due to events such as fire, theft, or natural disasters. It also provides liability coverage in case someone is injured on your property.

To ensure you’re getting the best coverage at the lowest cost, it’s wise to compare quotes from multiple providers. If you’re looking for the cheapest best insurance, it’s worth checking out the top 10 cheapest car insurance companies in usa . These companies consistently offer competitive rates and excellent customer service, making them a great choice for drivers who want to save money without sacrificing quality.

- Protects your home and belongings from damage or loss

- Provides liability coverage in case of accidents on your property

- Helps ensure financial stability in case of unexpected events

Life Insurance

Life insurance provides financial support to your loved ones in the event of your death. It helps cover expenses such as funeral costs, outstanding debts, and future living expenses.

- Provides financial support to loved ones in case of death

- Covers funeral costs, outstanding debts, and future living expenses

- Ensures financial security for your family

Comparing Insurance Quotes

Finding the most affordable and suitable insurance coverage requires comparing quotes from multiple providers. This comprehensive guide will equip you with the knowledge and strategies to obtain, compare, and negotiate the best insurance rates.

Cheapest best insurance can be hard to find. So, here’s an interesting article on top 5 cheapest insurance companies that might help you. There you go! Some quick insight on cheapest best insurance.

To ensure a fair and accurate comparison, it’s essential to gather quotes for the same coverage levels and policy terms from different insurance companies.

When looking for the cheapest best insurance, it’s crucial to compare quotes from various providers. Lowest car insurance companies offer competitive rates and often provide additional discounts and perks. By exploring your options and choosing the right insurer, you can secure the most affordable and comprehensive coverage for your vehicle, ensuring peace of mind while on the road.

Obtaining Insurance Quotes

- Online Comparison Tools:Utilize websites that allow you to compare quotes from multiple insurers simultaneously.

- Insurance Agents:Contact independent insurance agents who represent various companies and can provide tailored quotes.

- Directly from Insurers:Visit the websites of individual insurance companies to request quotes.

Comparing Insurance Quotes

Once you have obtained quotes from several providers, it’s crucial to compare them meticulously. Consider the following factors:

- Coverage:Ensure that all quotes provide the same level of coverage and meet your specific needs.

- Premiums:Compare the annual or monthly premiums to determine the cost of the policy.

- Deductibles:The deductible is the amount you pay out of pocket before the insurance coverage kicks in. Higher deductibles typically result in lower premiums.

Negotiating the Best Rates

After comparing quotes, don’t hesitate to negotiate with insurance companies to secure the most favorable rates:

- Bundle Policies:Combining multiple policies, such as auto and home insurance, often qualifies you for discounts.

- Raise Deductibles:Increasing your deductible can significantly reduce your premiums.

- Maintain a Good Credit Score:A higher credit score indicates lower risk and can lead to lower insurance rates.

- Shop Around Regularly:Don’t be afraid to compare quotes from different providers periodically to ensure you’re getting the best deal.

Factors to Consider When Choosing Insurance

Selecting the right insurance plan is crucial for financial protection. Here are key factors to consider:

1. Financial Stability: Ensure the insurer has a strong financial foundation to cover claims. Check their ratings from independent agencies like AM Best or Standard & Poor’s.

Customer Service

- Assess the insurer’s responsiveness and availability through multiple channels (phone, email, online).

- Check reviews and testimonials from customers to gauge their satisfaction with the insurer’s service.

Reputation

- Research the insurer’s industry reputation, awards, and recognition.

- Check for any history of complaints or lawsuits to evaluate their ethical practices.

Questions to Ask Insurance Providers

- What is your financial stability rating?

- How do you handle claims?

- What is your customer service record?

- Do you have any pending lawsuits or complaints?

Checklist for Evaluating Insurance Options

- Financial Stability Rating

- Customer Service Record

- Reputation and Industry Recognition

- Coverage Options and Premiums

- Exclusions and Limitations

Additional Considerations

Beyond the basics, there are additional factors that can influence your insurance coverage and costs. Understanding these considerations can help you make informed decisions and optimize your insurance strategy.

Bundling Insurance Policies

Bundling multiple insurance policies with the same provider can often result in significant savings. This is because insurance companies offer discounts for customers who insure multiple assets or coverages under one account. Bundling can reduce the overall cost of insurance while providing comprehensive protection.

Impact of Credit Scores on Insurance Premiums

Your credit score is a key factor in determining your insurance premiums. Insurance companies use credit scores to assess your financial responsibility and predict the likelihood of filing claims. Generally, individuals with higher credit scores qualify for lower insurance premiums, while those with lower credit scores may pay higher rates.

Tips for Reducing Insurance Costs, Cheapest best insurance

There are several strategies you can employ to reduce your insurance costs:

- Increase your deductible:Choosing a higher deductible can lower your premiums. However, ensure you can afford the deductible in the event of a claim.

- Consider discounts:Many insurance companies offer discounts for safe driving, loyalty, and other factors. Inquire about available discounts and take advantage of those that apply to you.

- Shop around:Comparing quotes from multiple insurance providers can help you find the most competitive rates. Use online quote comparison tools or consult with an insurance agent to explore your options.

- Negotiate:Don’t be afraid to negotiate with your insurance company. Explain your financial situation and request a lower premium. They may be willing to work with you to find a mutually acceptable rate.

Last Word: Cheapest Best Insurance

Choosing the cheapest best insurance doesn’t have to be a daunting task. By following the expert advice and tips Artikeld in this guide, you can navigate the insurance landscape with confidence. Remember, the best insurance policy is the one that meets your specific needs and provides the protection you deserve at a price you can afford.

So, let’s get started on your journey to finding the cheapest best insurance today!