Does ford credit refinance – Unveiling the intricacies of Ford Credit refinancing, this guide embarks on a journey to decipher its eligibility criteria, potential benefits, and the step-by-step process involved. Dive into the realm of vehicle financing and discover how Ford Credit can empower you with tailored refinancing solutions.

Whether you seek to lower interest rates, adjust monthly payments, or simply optimize your loan terms, Ford Credit refinancing presents a spectrum of opportunities. As we delve into the specifics, you’ll gain a comprehensive understanding of this financial tool and its implications.

Introduction

Refinancing involves obtaining a new loan to pay off an existing one, typically with more favorable terms such as lower interest rates or extended repayment periods. Ford Credit, a division of Ford Motor Company, offers vehicle financing options to customers.

Refinancing with Ford Credit can provide several benefits, including potentially lower monthly payments, reduced interest charges, and improved cash flow. It can also help consolidate multiple loans into a single payment, simplifying financial management.

Eligibility

Eligibility for Ford Credit refinancing depends on factors such as your credit history, income, and the value of your vehicle. Generally, borrowers with good credit scores and a positive payment history have a higher chance of qualifying for favorable refinancing terms.

Eligibility Criteria for Ford Credit Refinancing

To qualify for Ford Credit refinancing, you must meet certain eligibility criteria. These requirements help Ford Credit assess your financial situation and determine whether you’re a suitable candidate for refinancing.

The primary factors considered include your credit score, loan history, and vehicle age.

Wondering if Ford Credit offers refinancing? They certainly do! And while you’re considering your refinancing options, have you checked out the Ford Bronco? It’s a great choice for those who need a spacious vehicle. Does the Ford Bronco have a 3rd row? Click here to find out.

Now, back to Ford Credit refinancing – they offer competitive rates and flexible terms to help you save money on your car loan.

Credit Score

Your credit score is a numerical representation of your creditworthiness. It reflects your ability to manage debt and make timely payments. A higher credit score generally indicates a lower risk to lenders and can lead to better refinancing terms, such as lower interest rates and monthly payments.

If you’re looking into refinancing your Ford loan, Ford Credit offers competitive rates and flexible terms. Did you know that Ford doesn’t own Cummins? Learn more about the relationship between Ford and Cummins here. But getting back to Ford Credit refinancing, they make it easy to apply online and get pre-approved in minutes.

Loan History

Your loan history shows how you’ve managed previous loans. Lenders will review your payment history, including any missed or late payments. A consistent history of on-time payments demonstrates your reliability and increases your chances of refinancing approval.

Ford Credit offers refinancing options for those with existing Ford loans, but they also have a program called Ford Options that can help people with bad credit get approved for a new Ford vehicle. If you’re struggling to get approved for a car loan, you can learn more about Ford Options by clicking here . Ford Options can help you get into a new Ford even if you have bad credit, so it’s worth checking out if you’re in the market for a new car.

Vehicle Age

The age of your vehicle can also impact your eligibility for refinancing. Older vehicles may be less likely to qualify for refinancing, as they may have lower resale value and higher repair costs.

Benefits of Refinancing with Ford Credit

Refinancing your auto loan with Ford Credit can offer several potential advantages, including:

Lower Interest Rates

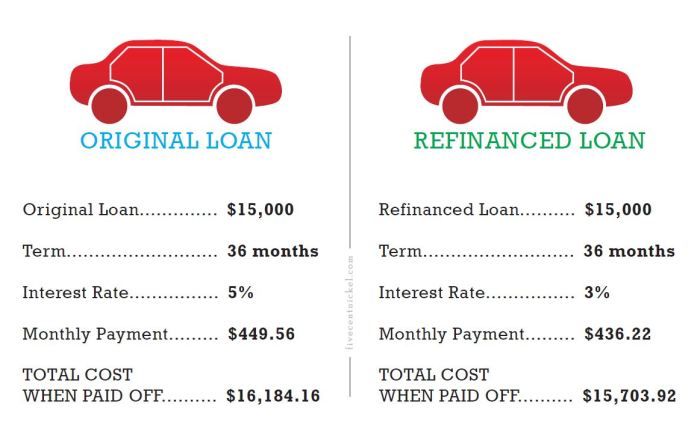

If your credit score has improved since you first financed your vehicle, you may be eligible for a lower interest rate on your refinanced loan. This can result in significant savings over the life of your loan, especially if you have a long loan term.

Ford Credit offers refinancing options to help you lower your monthly payments or interest rates. If you’re considering refinancing your Ford loan, you may also be interested in learning if Ford accepts trade-ins . Trading in your current vehicle can help you reduce the amount you owe on your loan, making refinancing even more beneficial.

Reduced Monthly Payments

A lower interest rate can also lead to lower monthly payments, making it easier to fit your car payment into your budget. This can free up cash flow for other expenses or savings goals.

Shorter Loan Term

Refinancing your loan can also allow you to shorten your loan term, which can save you money on interest charges over the long run. However, keep in mind that a shorter loan term will result in higher monthly payments.

Improved Loan Terms

Refinancing with Ford Credit may also allow you to negotiate improved loan terms, such as a lower down payment or a longer loan term. This can make your loan more affordable and manageable.

Process for Refinancing with Ford Credit

Refinancing your Ford loan with Ford Credit can be a straightforward process. Follow these steps to initiate and complete the refinancing:

To refinance your Ford loan with Ford Credit, you’ll need to meet certain eligibility criteria, such as having a good credit score, a steady income, and a vehicle that meets Ford Credit’s requirements. If you meet these criteria, you can follow these steps to refinance your loan:

Step 1: Submit an Application

You can apply for refinancing online or by visiting a Ford dealership. You’ll need to provide your personal and financial information, as well as information about your vehicle.

If you’re considering refinancing your Ford loan, you may be wondering if Ford Credit offers refinancing. The answer is yes! Ford Credit does offer refinancing options, so you can potentially lower your interest rate and monthly payments. While you’re exploring your refinancing options, you may also be curious about the features of the new Ford Bronco.

Did you know that the Ford Bronco has a 360-degree camera? Learn more about the Ford Bronco’s 360-degree camera and other features. Returning to the topic of refinancing, Ford Credit offers competitive rates and flexible terms, so you can find a refinancing plan that meets your needs.

Step 2: Provide Documentation

Once you’ve submitted your application, Ford Credit will request documentation to verify your information. This may include proof of income, proof of insurance, and a copy of your vehicle’s title.

Step 3: Close the Loan

Once your application is approved, you’ll need to sign a new loan agreement. You’ll also need to pay any closing costs, which may include a loan origination fee and a title fee.

Alternatives to Ford Credit Refinancing

Refinancing your auto loan through Ford Credit is not your only option. You may consider exploring other lenders such as banks, credit unions, or online lenders to find the best refinancing deal for your needs.

Each option has its own set of benefits and drawbacks:

Banks

- Pros:

- Established and reputable lenders

- Competitive interest rates

- Variety of loan terms and options

- Cons:

- May require a higher credit score for approval

- Stricter application process

- Fees may be higher compared to other options

Credit Unions

- Pros:

- Typically offer lower interest rates than banks

- More flexible loan terms

- Membership requirements may be easier to meet

- Cons:

- May have limited loan options

- Membership eligibility may be restricted

- Fewer physical locations than banks

Online Lenders

- Pros:

- Convenient and quick application process

- May offer pre-approval with minimal impact on your credit score

- Can provide competitive interest rates

- Cons:

- May have higher interest rates than traditional lenders

- Limited loan terms and options

- May require a higher credit score for approval

Considerations for Refinancing with Ford Credit

Before refinancing with Ford Credit, it’s crucial to weigh the potential benefits and drawbacks. Here are some factors to consider:

Fees and Costs, Does ford credit refinance

Refinancing may involve fees such as application fees, processing fees, and prepayment penalties. Ensure you understand all the costs associated with the process and factor them into your decision.

Impact on Credit Score

Refinancing can impact your credit score. Applying for a new loan can result in a hard inquiry, which can temporarily lower your score. However, if you have improved your credit since your original loan, refinancing could potentially improve your score.

Availability of Better Options

Explore other financing options before committing to Ford Credit. Compare interest rates, terms, and fees from multiple lenders to ensure you secure the best possible deal. Consider your financial situation and long-term goals when making a decision.

Concluding Remarks: Does Ford Credit Refinance

In the tapestry of vehicle financing, Ford Credit refinancing emerges as a versatile tool, offering a path to financial flexibility and optimized loan terms. By carefully considering the factors discussed in this guide, you can make an informed decision that aligns with your financial goals.

Whether you choose to refinance with Ford Credit or explore alternative options, the knowledge gained here will guide you towards a financing solution that empowers your automotive journey.

1 thought on “Does Ford Credit Refinance: Explore Your Vehicle Financing Options”