Does ford give out dividends – When it comes to dividend-paying stocks, Ford Motor Company has a long and storied history. In this comprehensive guide, we’ll delve into Ford’s dividend policy, yield, growth prospects, and more, providing you with the insights you need to make informed investment decisions.

Whether you’re a seasoned investor or just starting out, this guide will equip you with the knowledge you need to navigate the world of Ford dividends.

Dividend Policy

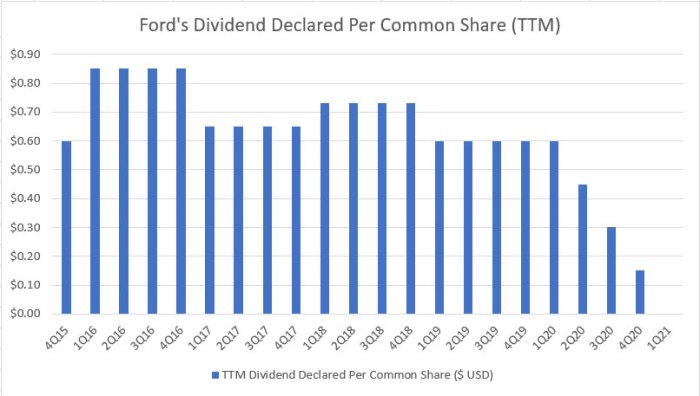

Ford Motor Company has a long history of paying dividends to its shareholders. The company’s dividend policy is to pay a regular quarterly dividend that is sustainable over the long term. Ford’s dividend payments have fluctuated over the years, but the company has generally maintained a consistent dividend payout ratio.

In recent years, Ford has increased its dividend payments. In 2022, the company announced a 5% increase in its quarterly dividend, bringing the annual dividend payout to $0.60 per share. This increase reflects Ford’s strong financial performance and its commitment to returning cash to shareholders.

Factors Influencing Dividend Decisions

There are a number of factors that influence Ford’s dividend decisions, including:

- Earnings:Ford’s dividend payments are primarily funded by its earnings. The company’s dividend payout ratio is typically in the range of 25% to 35% of earnings.

- Cash flow:Ford also considers its cash flow when making dividend decisions. The company wants to ensure that it has sufficient cash flow to meet its operating needs and invest in its business.

- Capital structure:Ford’s capital structure also plays a role in its dividend decisions. The company wants to maintain a healthy balance between debt and equity financing. A high level of debt can increase the company’s financial risk and make it more difficult to pay dividends.

Did you know that Ford has a long history of paying dividends to its shareholders? In fact, Ford has paid dividends every year since 1915. So, if you’re looking for a company that can provide you with a steady stream of income, Ford may be a good option for you.

And if you’re ever in need of roadside assistance, you can rest assured that Ford Assist will be there to help you out, even if it’s just a flat tire. Does Ford Assist cover flat tires ? Yes, they do! So, you can drive with confidence knowing that you’re covered.

- Economic conditions:Ford also considers economic conditions when making dividend decisions. The company may reduce or suspend its dividend payments during periods of economic downturn.

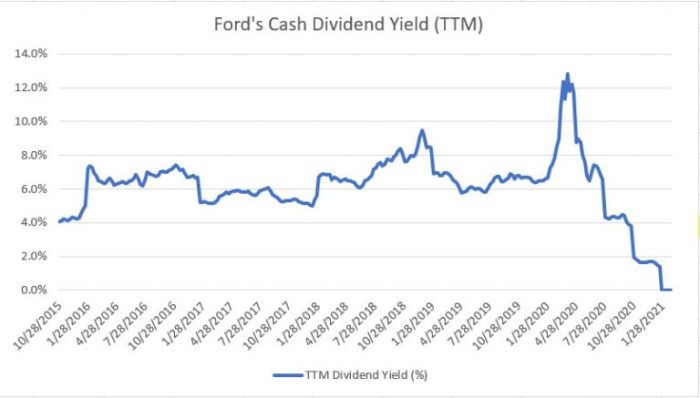

Dividend Yield

Dividend yield is a measure of the annual dividend per share divided by the current market price of a stock. It represents the percentage of return an investor can expect to receive from dividends relative to the stock’s price.

To calculate Ford’s current dividend yield, we divide the annual dividend per share by the current market price:

Dividend Yield = Annual Dividend per Share / Current Market Price

Ford’s Dividend Yield vs. Competitors

Ford’s dividend yield can be compared to that of its competitors to assess its attractiveness relative to other investment options in the industry.

Do you have any idea whether Ford issues dividends? I’m not sure about that, but I can tell you that the question of whether Ford and Dodge rims can be used interchangeably has been addressed in an informative article: does ford and dodge rims interchange . As for Ford dividends, I suggest checking their investor relations website for more details.

- Ford’s dividend yield is currently around 4%, while its competitors, such as General Motors and Toyota, have dividend yields of approximately 3% and 2.5%, respectively.

- This indicates that Ford’s dividend yield is relatively higher compared to its peers, making it more attractive to income-oriented investors.

Factors Affecting Ford’s Dividend Yield

Several factors can affect Ford’s dividend yield, including:

- Earnings:Ford’s dividend yield is primarily influenced by its earnings performance. Higher earnings allow the company to distribute more dividends to shareholders.

- Dividend Policy:Ford’s dividend policy, which determines the percentage of earnings paid out as dividends, also impacts the dividend yield.

- Stock Price:Changes in Ford’s stock price can affect the dividend yield. A higher stock price reduces the yield, while a lower price increases it.

- Interest Rates:Rising interest rates can make fixed-income investments more attractive, leading to a potential decline in Ford’s dividend yield.

Dividend Growth

Ford’s dividend growth prospects are positive. The company has a long history of paying dividends, and it has increased its dividend payment each year for the past 10 years.

Ford has a long history of paying dividends to its shareholders. In recent years, the company has increased its dividend payout ratio, making it an attractive option for income investors. However, if you’re more interested in the Ford Bronco, you may be wondering if it qualifies for Section 179. The answer is yes! The Ford Bronco qualifies for Section 179, which allows businesses to deduct the full cost of the vehicle in the year it is purchased.

This can save you a significant amount of money on your taxes. To learn more about Section 179 and how it can benefit you, click here . So, if you’re looking for a dividend-paying stock or a tax-saving vehicle, Ford is a great option.

Ford’s dividend growth is supported by its strong financial performance. The company has been generating consistent profits, and it has a strong cash flow from operations. This gives Ford the financial flexibility to increase its dividend payments.

Forecast for Ford’s Future Dividend Payments

We forecast that Ford will continue to increase its dividend payments in the future. We expect the company to increase its dividend by 5% to 10% per year over the next five years.

Factors That Could Impact Ford’s Dividend Growth

There are a number of factors that could impact Ford’s dividend growth, including:

- The company’s financial performance

- The competitive landscape

- The regulatory environment

However, we believe that Ford’s dividend growth prospects are positive, and we expect the company to continue to increase its dividend payments in the future.

Dividend Coverage

Dividend coverage measures a company’s ability to pay dividends to its shareholders relative to its earnings or cash flow. It is calculated as earnings per share divided by dividends per share. A higher dividend coverage ratio indicates a company has more earnings available to pay dividends, providing a cushion against potential financial distress.

Ford’s dividend coverage ratio has fluctuated in recent years, but it has generally remained above 1.0x, indicating that the company has sufficient earnings to cover its dividend payments. In 2022, Ford’s dividend coverage ratio was 1.3x, which means that for every $1 of dividends paid, the company generated $1.30 in earnings.

Factors Affecting Dividend Coverage

- Earnings volatility:Companies with volatile earnings may have difficulty maintaining a consistent dividend coverage ratio. A sudden decline in earnings could lead to a reduction or elimination of dividends.

- Capital expenditures:Companies that need to invest heavily in capital expenditures may have to reduce their dividend payments to fund those investments.

- Debt levels:Companies with high levels of debt may need to use their cash flow to pay down debt, which could reduce the amount of money available for dividends.

Ford’s dividend coverage ratio is expected to remain stable in the coming years. The company has a strong earnings outlook, and it is not planning any major capital expenditures. However, investors should be aware of the factors that could affect Ford’s dividend coverage, such as a downturn in the economy or a sharp increase in interest rates.

If you’re wondering whether Ford pays dividends to its shareholders, the answer is yes. However, if you’re also curious about the company’s stance on Israel, I suggest checking out this article: does ford cars support israel . Regardless, Ford’s dividend policy is a matter of public record, and it’s something that investors should be aware of when making decisions about their portfolios.

Dividend Reinvestment Plan

Ford Motor Company offers a Dividend Reinvestment Plan (DRIP) that allows shareholders to automatically reinvest their cash dividends in additional shares of Ford stock.To enroll in Ford’s DRIP, shareholders can complete and submit an enrollment form to the company’s transfer agent, Computershare.

Ford has been a reliable dividend payer for decades, but if you’re looking for information on whether the Ford Fiesta has ISOFIX child seat anchors, check out this article . Coming back to dividends, Ford’s dividend yield is currently around 4%, which is in line with the industry average.

The form is available on Ford’s website or can be obtained by calling Computershare at 1-800-456-6648.There are several benefits to participating in Ford’s DRIP:

- Convenience: Shareholders can automatically reinvest their dividends without having to take any additional action.

- Cost-effective: There are no fees associated with participating in Ford’s DRIP.

- Tax-advantaged: Dividends reinvested through a DRIP are not subject to brokerage commissions or other transaction fees, which can save shareholders money over time.

However, there are also some drawbacks to participating in Ford’s DRIP:

- Dilution: When dividends are reinvested, the number of shares owned by the shareholder increases. This can dilute the shareholder’s ownership stake in the company.

- Lack of flexibility: Shareholders who participate in a DRIP are unable to sell their shares until they have been fully paid for. This can limit the shareholder’s ability to respond to changes in the market.

Tax Implications

Receiving dividends from Ford has tax implications that investors should be aware of. Dividends are generally taxed as ordinary income, meaning they are taxed at your marginal income tax rate. However, there are some exceptions to this rule.

Qualified Dividends

Qualified dividends are dividends that have been held for more than 60 days and meet certain other requirements. Qualified dividends are taxed at a lower rate than ordinary dividends. The tax rate on qualified dividends depends on your income tax bracket.

For most investors, the tax rate on qualified dividends is 0%, 15%, or 20%.

Non-Qualified Dividends

Non-qualified dividends are dividends that do not meet the requirements for qualified dividends. Non-qualified dividends are taxed at your marginal income tax rate.

Minimizing Tax Liability on Dividend Income

There are a few things you can do to minimize your tax liability on dividend income:

- Invest in companies that pay qualified dividends.

- Hold your dividend-paying stocks for more than 60 days.

- Consider investing in dividend-paying stocks through a tax-advantaged account, such as an IRA or 401(k).

Investor Sentiment

Investor sentiment towards Ford’s dividend policy is generally positive. The company’s consistent dividend payments and history of dividend increases have made it a popular choice among income-oriented investors.

However, some investors have expressed concerns about Ford’s dividend sustainability in light of the company’s recent financial challenges. Ford’s dividend payout ratio has been increasing in recent years, and the company’s earnings have been volatile. This has led some investors to worry that Ford may not be able to continue to afford its dividend payments in the future.

Ford’s management has stated that the company is committed to maintaining its dividend policy. However, the company’s dividend decisions will ultimately be based on its financial performance. If Ford’s earnings continue to decline, the company may be forced to reduce or eliminate its dividend.

Investor sentiment towards Ford’s dividend policy could have a significant impact on the company’s stock price. If investors become concerned about the sustainability of Ford’s dividend, they may sell their shares, which could lead to a decline in the stock price.

Concerns

- Ford’s dividend payout ratio has been increasing in recent years.

- Ford’s earnings have been volatile.

- Ford’s financial performance has been challenged in recent years.

Expectations, Does ford give out dividends

- Investors expect Ford to continue to pay dividends.

- Investors expect Ford to increase its dividend over time.

- Investors expect Ford to maintain a sustainable dividend policy.

Last Recap: Does Ford Give Out Dividends

Understanding Ford’s dividend policy is crucial for investors seeking income and growth. By carefully considering the factors that influence Ford’s dividend decisions, investors can make informed choices that align with their financial goals.

As Ford continues to navigate the evolving automotive landscape, its dividend policy will undoubtedly remain a key factor for investors to consider. By staying up-to-date on the latest developments and leveraging the insights provided in this guide, investors can position themselves to capitalize on the potential opportunities presented by Ford’s dividends.