Does ford lose money on electric vehicles – In the race towards electrification, the question of profitability lingers. Does Ford, one of the leading automakers, lose money on its electric vehicles (EVs)? This article delves into the financial intricacies of Ford’s EV division, examining revenue, expenses, and the impact of market dynamics.

We’ll explore the factors influencing production costs, analyze market demand and competition, and assess the role of government incentives. Finally, we’ll uncover Ford’s long-term strategy for its EV business, highlighting potential risks and opportunities.

Financial Analysis: Does Ford Lose Money On Electric Vehicles

Ford’s electric vehicle (EV) division has experienced significant financial fluctuations in recent years. Analyzing its revenue, expenses, and profitability provides insights into its historical performance and future prospects.

Revenue

Ford’s EV revenue has grown steadily over the past few years. In 2022, it reported EV revenue of $11.4 billion, a 120% increase from $5.2 billion in 2021. This growth was primarily driven by strong demand for the Mustang Mach-E and F-150 Lightning models.

Expenses

Ford’s EV expenses have also increased significantly, mainly due to investments in research and development, production capacity expansion, and battery sourcing. In 2022, the company spent $5.6 billion on EV-related expenses, up from $2.4 billion in 2021. These investments are expected to continue in the coming years as Ford ramps up its EV production.

Ford’s venture into electric vehicles has sparked curiosity about their financial implications. While some question whether Ford loses money on electric vehicles, others wonder about the Bluetooth capabilities of the 2011 Ford Ka. To clarify, you can find information on the 2011 Ford Ka’s Bluetooth features by clicking here . Returning to the topic of Ford’s electric vehicles, the financial viability of these ventures remains a topic of discussion and analysis.

Profitability

Ford’s EV division has yet to achieve profitability. In 2022, it reported an operating loss of $2.3 billion, primarily due to high expenses and low production volumes. However, the company expects to improve its EV profitability in the future as it scales up production and reduces costs.

Production Costs

Ford’s electric vehicles (EVs) have different production costs compared to gasoline-powered vehicles. Let’s explore the key factors that affect these costs and compare them.

The production of EVs involves several unique components, including batteries, electric motors, and power electronics. These components are generally more expensive than traditional internal combustion engines and transmissions.

Battery Costs, Does ford lose money on electric vehicles

Batteries are a major cost driver for EVs, accounting for a significant portion of the total production costs. The cost of batteries is influenced by factors such as the size and capacity of the battery pack, as well as the type of battery technology used (e.g.,

lithium-ion, solid-state).

Electric Motors

Electric motors are another key component that contributes to the production costs of EVs. The power and efficiency of the electric motor can impact its cost, with more powerful motors typically being more expensive.

Cost-Saving Measures

To mitigate the higher production costs of EVs, Ford has implemented various cost-saving measures and efficiency improvements.

The financial viability of Ford’s electric vehicle ventures has been a subject of debate. While the company has invested heavily in this sector, questions remain about its profitability. Ford’s long-standing partnership with Mazda raises another question: does Ford own Mazda ? The answer is no; Mazda is an independent company.

Returning to the topic of electric vehicles, Ford’s strategy and future financial performance in this arena remain to be seen.

- Streamlining production processes to reduce assembly time and labor costs.

- Investing in research and development to improve battery technology and reduce battery costs.

- Partnering with suppliers to optimize the supply chain and negotiate favorable pricing.

Market Demand

Ford’s electric vehicles (EVs) face a growing market demand as consumers become increasingly aware of the environmental benefits and cost savings associated with EV ownership. Key customer segments include environmentally conscious individuals, early adopters of new technology, and urban dwellers with limited parking options.

Factors Influencing Consumer Purchasing Decisions

Several factors influence consumer purchasing decisions for EVs, including:

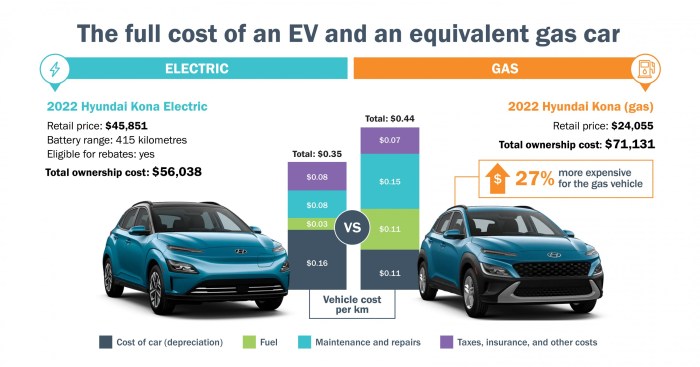

- Price:EVs typically have a higher upfront cost than gasoline-powered vehicles, but ongoing fuel and maintenance savings can offset the initial investment over time.

- Performance:Consumers consider factors such as range, acceleration, and handling when evaluating EVs. Ford’s EVs offer competitive performance compared to gasoline-powered vehicles.

- Environmental Concerns:Growing concerns about climate change and air pollution are driving demand for EVs as consumers seek environmentally friendly transportation options.

- Government Incentives:Government incentives, such as tax credits and rebates, can significantly reduce the cost of purchasing an EV, making them more affordable for consumers.

Competition

Ford faces stiff competition in the electric vehicle (EV) market from both established automakers and EV startups. Key competitors include:*

-*Tesla

The undisputed leader in the EV market, Tesla offers a wide range of high-performance EVs at various price points.

-

-*General Motors

If you’re curious about whether Ford loses money on electric vehicles, you may also wonder if they offer free diagnostics. Well, the answer to that is a bit more straightforward: does ford do free diagnostics . But getting back to the electric vehicle topic, it’s worth noting that Ford has made significant investments in this area, so it’s not a clear-cut answer whether they’re losing money on them.

GM has a strong lineup of EVs, including the Chevrolet Bolt and the GMC Hummer EV.

-

-*Volkswagen

Volkswagen has made a significant investment in EVs and offers several popular models, such as the ID.4 and ID.Buzz.

-

-*Rivian

A relatively new entrant to the EV market, Rivian specializes in electric pickup trucks and SUVs.

Price and Performance Comparison

Ford’s EVs generally compete favorably with those of its competitors in terms of price and performance. The Mustang Mach-E, for example, offers comparable range and performance to the Tesla Model Y at a slightly lower price. However, some competitors, such as Tesla, offer EVs with longer ranges or higher performance at premium prices.

Features and Technology

Ford’s EVs offer a range of features and technologies, including:*

-*FordPass Connect

The question of whether Ford loses money on electric vehicles is a complex one. There are many factors to consider, including the cost of production, the price of batteries, and the demand for electric vehicles. However, it is worth noting that Ford has a long history of producing vehicles that are prone to rust, such as the Ford Cortina.

If you are considering purchasing a Ford vehicle, it is important to do your research and consider the potential for rust issues. For more information on the Ford Cortina’s rust problems, you can visit this website .

A connected vehicle system that provides remote access, vehicle health monitoring, and navigation.

-

-*BlueCruise

A hands-free driver assistance system.

-

-*SYNC 4A

A user-friendly infotainment system with Apple CarPlay and Android Auto integration.

These features are generally comparable to those offered by competitors. However, some competitors, such as Tesla, offer more advanced features, such as over-the-air software updates and self-driving capabilities.

Ford has a modest market share in the global EV market, but it is growing rapidly. In 2022, Ford sold over 61,000 EVs globally, up from just over 27,000 in 2021. The company aims to increase its EV sales to 2 million annually by 2026.The

competitive landscape in the EV market is constantly evolving, with new entrants and technological advancements emerging all the time. Ford will need to continue to innovate and expand its EV offerings to maintain its position in the market.

Government Incentives

Government incentives play a significant role in the electric vehicle (EV) market, influencing consumer purchasing decisions and the profitability of EV manufacturers like Ford.

Ford has been investing heavily in electric vehicles, and it’s unclear whether they’re making money on them yet. However, the company is also installing superchargers, which are fast-charging stations that can charge an electric vehicle in as little as 30 minutes.

This suggests that Ford is confident in the future of electric vehicles and is investing in infrastructure to support their adoption. If Ford is able to successfully transition to electric vehicles, it could be a major player in the automotive industry for years to come.

Does Ford install supercharger is a question that is often asked by people who are considering buying an electric vehicle. The answer is yes, Ford does install superchargers. Ford has a network of over 15,000 superchargers in the United States and Canada.

Governments worldwide offer various incentives to promote EV adoption, such as tax credits, rebates, and subsidies. These incentives reduce the upfront cost of EVs, making them more affordable for consumers.

Impact on Ford’s EV Sales

Government incentives have a positive impact on Ford’s EV sales. For example, the US federal tax credit of up to $7,500 has significantly boosted the demand for Ford’s electric vehicles, such as the Mustang Mach-E and F-150 Lightning.

In addition, state and local incentives further reduce the cost of EVs, making them even more attractive to consumers. This has resulted in increased sales and market share for Ford’s electric vehicles.

Impact on Ford’s Profitability

While government incentives stimulate EV sales, they can also impact Ford’s profitability. The cost of producing EVs is typically higher than gasoline-powered vehicles, and the incentives reduce the selling price of EVs.

However, the increased sales volume and potential cost reductions in the long term can offset the lower profit margins on individual EV sales. Additionally, government incentives can help Ford establish a strong foothold in the growing EV market, which could lead to long-term profitability.

Potential Impact of Changes in Incentives

Changes in government incentives could have a significant impact on Ford’s EV business. A reduction or elimination of incentives could dampen consumer demand and slow down the adoption of EVs.

On the other hand, an extension or increase in incentives could further accelerate EV sales and profitability for Ford. Therefore, Ford must closely monitor changes in government incentives and adjust its EV strategy accordingly.

Long-Term Strategy

Ford’s long-term strategy for its EV business is focused on becoming a global leader in the production and sale of electric vehicles. The company plans to invest heavily in its EV business, with a goal of having 40% of its global sales volume come from EVs by 2030. Ford also plans to develop and launch a range of new EV models, including an all-electric version of its popular F-150 pickup truck.

Product Development Roadmap

Ford has a robust product development roadmap for its EV business. The company plans to launch a number of new EV models in the coming years, including:

- An all-electric version of the F-150 pickup truck, which is expected to be launched in 2022.

- An all-electric version of the Mustang sports car, which is expected to be launched in 2023.

- An all-electric version of the Transit van, which is expected to be launched in 2024.

Market Expansion Plans

Ford plans to expand its EV business into new markets around the world. The company has already announced plans to launch its EVs in China, Europe, and South America. Ford also plans to invest in the development of charging infrastructure in these markets.

Risks and Opportunities

Ford’s EV strategy has a number of potential risks and opportunities.Risks:

- The EV market is still in its early stages of development, and there is no guarantee that Ford will be successful in its efforts to become a leader in this market.

- The EV market is competitive, and Ford faces competition from a number of established automakers, as well as from new entrants to the market.

- The development and production of EVs is expensive, and Ford may not be able to generate sufficient profits from its EV business to justify its investment.

Opportunities:

- The EV market is growing rapidly, and Ford has the opportunity to become a leader in this market by investing in the development and production of EVs.

- The EV market is global, and Ford has the opportunity to expand its EV business into new markets around the world.

- The development and production of EVs is becoming more efficient, and Ford may be able to reduce the cost of its EVs over time.

Closing Notes

The financial performance of Ford’s EV division is a complex interplay of production costs, market demand, competition, and government incentives. While the company faces challenges in achieving profitability, its long-term strategy and commitment to innovation suggest a promising future for Ford’s electric vehicles.