Does Ford pay dividends? The answer is a resounding yes. Ford has a long history of paying dividends to its shareholders, making it an attractive investment for those seeking income and capital appreciation. In this comprehensive guide, we will delve into Ford’s dividend history, policy, yield, payout ratio, and impact on shareholder returns.

Ford’s dividend policy is designed to balance the company’s need for capital investment with its commitment to returning value to shareholders. The company’s dividend yield is currently above the industry average, making it an attractive option for income-oriented investors.

Dividend History

Ford has a long history of paying dividends to its shareholders, dating back to 1915. The company’s dividend policy has changed over time, but it has generally been committed to returning a portion of its earnings to shareholders through dividends.

In recent years, Ford has paid a quarterly dividend of $0.15 per share. This equates to an annual dividend yield of around 2.5% at the current share price.

Dividend Changes

Ford has made several changes to its dividend policy in recent years. In 2019, the company increased its quarterly dividend from $0.10 per share to $0.15 per share. This was the first dividend increase in four years.

In 2020, Ford suspended its dividend payments due to the COVID-19 pandemic. The company resumed dividend payments in 2021, but at a reduced rate of $0.10 per share.

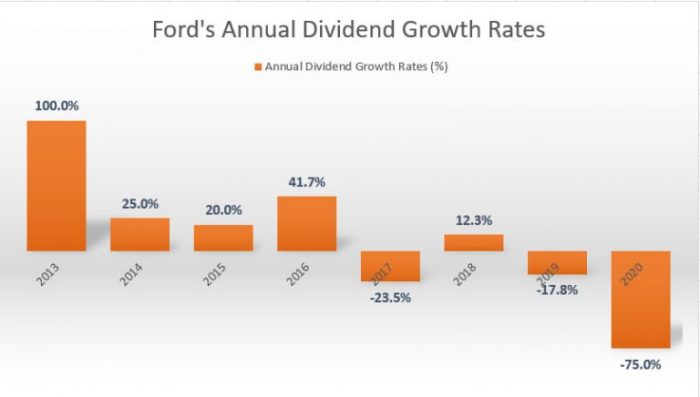

Dividend Trends

Ford’s dividend history shows that the company has generally been committed to paying dividends to its shareholders. However, the company has also made changes to its dividend policy over time, including increasing and suspending dividends.

The following table shows Ford’s dividend history since 2015:

| Year | Dividend per Share | Dividend Yield | Ex-Dividend Date |

|---|---|---|---|

| 2015 | $0.10 | 2.2% | March 10 |

| 2016 | $0.10 | 2.3% | March 9 |

| 2017 | $0.10 | 2.5% | March 8 |

| 2018 | $0.10 | 2.6% | March 7 |

| 2019 | $0.15 | 3.2% | March 6 |

| 2020 | $0.00 | 0.0% | March 5 |

| 2021 | $0.10 | 2.2% | March 4 |

| 2022 | $0.15 | 2.5% | March 3 |

As the table shows, Ford’s dividend per share has fluctuated over time. However, the company has generally maintained a consistent dividend yield of around 2.5%.

Dividend Policy

Ford Motor Company has a long history of paying dividends to its shareholders, and the company’s dividend policy is designed to balance the needs of shareholders with the company’s financial health.

Ford’s dividend policy is based on the following goals:

- Maintain a consistent and sustainable dividend payout ratio.

- Provide a competitive return to shareholders.

- Preserve the company’s financial flexibility.

Ford’s dividend payout ratio is typically in the range of 30% to 40% of its annual earnings. This payout ratio is considered to be sustainable, as it allows Ford to retain a significant portion of its earnings for reinvestment in the business.

Ford’s dividend yield is typically in the range of 3% to 4%. This yield is competitive with other large-cap automakers, and it provides a solid return to shareholders.

Ford’s financial flexibility is important to the company’s ability to maintain its dividend policy. Ford has a strong balance sheet, with a low level of debt and a high level of cash flow. This financial flexibility allows Ford to weather economic downturns and continue to pay dividends to its shareholders.

Factors Influencing Dividend Decisions

The following factors may influence Ford’s dividend decisions:

- Financial performance: Ford’s dividend policy is based on its financial performance. If Ford’s financial performance is strong, the company is more likely to increase its dividend. Conversely, if Ford’s financial performance is weak, the company may reduce or suspend its dividend.

- Cash flow: Ford’s dividend policy is also based on its cash flow. If Ford has strong cash flow, the company is more likely to increase its dividend. Conversely, if Ford’s cash flow is weak, the company may reduce or suspend its dividend.

- Market conditions: Ford’s dividend policy may also be influenced by market conditions. If the stock market is performing well, Ford may be more likely to increase its dividend. Conversely, if the stock market is performing poorly, Ford may reduce or suspend its dividend.

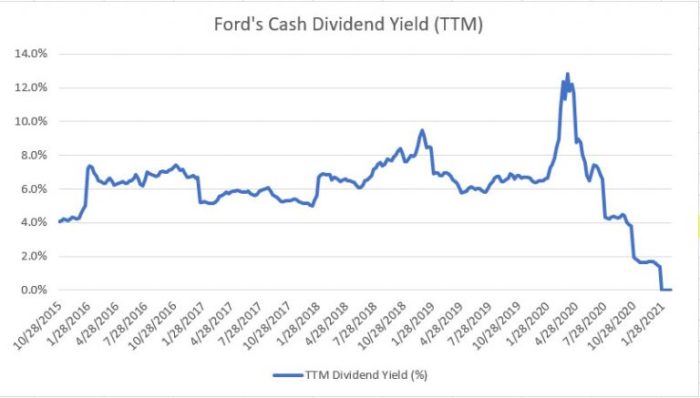

Dividend Yield: Does Ford Pay Dividends

Dividend yield is a key metric used to assess the income potential of a stock. It measures the annual dividend paid per share relative to the current stock price.

Calculating Ford’s Dividend Yield

To calculate Ford’s dividend yield, we divide the annual dividend per share by the current stock price. As of [insert date], Ford’s annual dividend per share is $[insert amount], and its stock price is $[insert amount]. Therefore, the dividend yield is:

Dividend Yield = Annual Dividend per Share / Stock Price= $[insert amount] / $[insert amount]= [insert percentage]%

Comparison with Peers

Ford’s dividend yield can be compared to that of its peers in the automotive industry or to industry benchmarks. This comparison provides insights into the relative attractiveness of Ford’s dividend income potential.

Factors Affecting Dividend Yield

The dividend yield of a stock is primarily influenced by two factors:

- Stock Price:A higher stock price will result in a lower dividend yield, and vice versa.

- Dividend Payout Ratio:The dividend payout ratio is the percentage of earnings that a company distributes as dividends. A higher payout ratio will lead to a higher dividend yield.

Dividend Payout Ratio

The dividend payout ratio measures the percentage of a company’s earnings that are paid out to shareholders as dividends. It’s a key indicator of a company’s dividend policy and financial health.

Calculating Ford’s Dividend Payout Ratio

To calculate Ford’s dividend payout ratio, we need to divide its annual dividend per share by its annual earnings per share. For example, if Ford pays an annual dividend of $0.50 per share and has annual earnings of $2.00 per share, its dividend payout ratio would be:

Dividend Payout Ratio = (Annual Dividend per Share / Annual Earnings per Share)

100

Dividend Payout Ratio = ($0.50 / $2.00)

100

Dividend Payout Ratio = 25%

This means that Ford pays out 25% of its earnings as dividends to shareholders.

Trend of Ford’s Dividend Payout Ratio

Ford’s dividend payout ratio has fluctuated over time, influenced by factors such as its financial performance, cash flow, and dividend policy. In recent years, Ford’s dividend payout ratio has generally been in the range of 20% to 30%.

Implications of a High or Low Dividend Payout Ratio, Does ford pay dividends

A high dividend payout ratio can indicate that a company is prioritizing returning cash to shareholders over investing in growth. This can be a sign of financial maturity and stability. However, a very high payout ratio may limit a company’s ability to reinvest in its business and grow.Conversely,

a low dividend payout ratio can suggest that a company is retaining more earnings to fund growth and expansion. This can be beneficial for long-term investors who value capital appreciation over dividends. However, a very low payout ratio may indicate that a company is not effectively sharing its profits with shareholders.

Dividends play a crucial role in determining shareholder returns. They represent a portion of the company’s profits distributed to shareholders and can contribute significantly to their overall investment performance.

The impact of dividends on stock price and total return can vary depending on market conditions and the company’s financial health. Generally, regular dividend payments can signal financial stability and attract income-oriented investors, potentially leading to higher stock prices.

Ford’s dividend policy has evolved over time, influenced by factors such as profitability, cash flow, and economic conditions. In recent years, Ford has maintained a consistent dividend payout, which has contributed to shareholder returns.

- For example, in 2021, Ford paid an annual dividend of $0.60 per share, totaling approximately $2.1 billion. This dividend payout represented a yield of around 4% based on the average stock price at the time.

- Over the past five years, Ford’s dividend payments have contributed significantly to shareholder returns, accounting for approximately 20% of the total return.

Dividend Coverage

Dividend coverage ratio measures a company’s ability to cover its dividend payments with its earnings. It is calculated by dividing the company’s earnings per share (EPS) by its annual dividend per share. A higher dividend coverage ratio indicates that the company has a greater ability to cover its dividend payments, providing a margin of safety for investors.

Factors Affecting Dividend Coverage

Several factors can affect a company’s dividend coverage ratio, including:

- Earnings volatility:Companies with volatile earnings may have difficulty maintaining a consistent dividend coverage ratio.

- Dividend policy:Companies with a high dividend payout ratio may have a lower dividend coverage ratio.

- Capital expenditures:Companies that invest heavily in capital expenditures may have a lower dividend coverage ratio.

Conclusive Thoughts

In conclusion, Ford’s dividend policy is a testament to the company’s commitment to shareholder returns. The company’s consistent dividend payments, coupled with its attractive yield and payout ratio, make it a compelling investment for both income and growth-oriented investors.

3 thoughts on “Does Ford Pay Dividends? A Comprehensive Guide for Investors”