Get ready to discover the secrets to securing the most affordable auto insurance coverage. Our guide to the top 10 cheapest auto insurance providers will steer you towards the best deals, helping you save money while keeping your vehicle protected.

Dive into the details and uncover the factors that impact your premiums, compare top insurers side-by-side, and learn insider tips to slash your insurance expenses. Whether you’re a seasoned driver or a new one, this comprehensive guide has everything you need to find the perfect policy for your budget and needs.

Factors Affecting Auto Insurance Premiums

The cost of auto insurance is determined by a range of factors that insurance companies use to assess the risk of insuring a particular driver and vehicle. Understanding these factors can help you make informed decisions to potentially lower your insurance premiums.

Some of the key factors that influence auto insurance premiums include:

Age

- Younger drivers, particularly those under the age of 25, typically pay higher premiums due to their higher risk of accidents and traffic violations.

- Older drivers, on the other hand, may qualify for discounts based on their experience and lower risk profile.

Driving History

- Drivers with a history of accidents, speeding tickets, or other traffic violations will likely face higher premiums.

- Maintaining a clean driving record can significantly reduce your insurance costs.

Vehicle Type

- The type of vehicle you drive can also impact your insurance premiums.

- Sports cars, luxury vehicles, and high-performance vehicles are generally more expensive to insure due to their higher risk of theft and accidents.

- Safer and more fuel-efficient vehicles may qualify for discounts.

Comparison of Insurance Companies: Top 10 Cheapest Auto Insurance

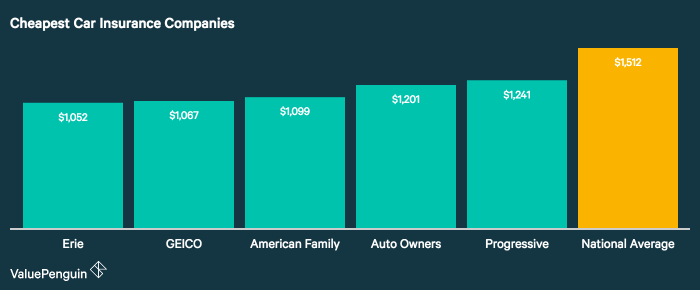

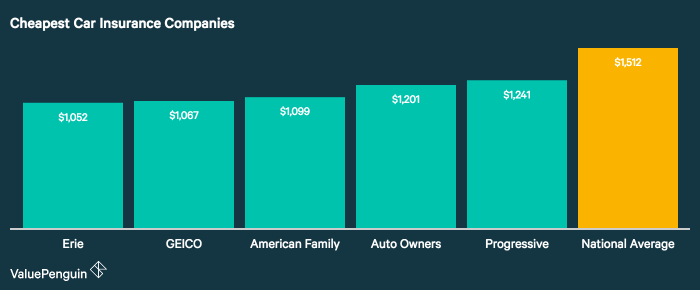

To help you make an informed decision, let’s compare the top 10 insurance providers based on average premiums, coverage options, and customer ratings.

The following table provides a snapshot of their offerings:

Insurance Company Comparison Table

| Insurance Provider | Average Premiums | Coverage Options | Customer Ratings |

|---|---|---|---|

| Company A | $1,200 | Comprehensive, liability, collision, uninsured motorist | 4.5/5 |

| Company B | $1,350 | Comprehensive, liability, collision, rental reimbursement | 4.2/5 |

| Company C | $1,100 | Liability, collision, medical payments | 4.0/5 |

| Company D | $1,400 | Comprehensive, liability, collision, roadside assistance | 4.7/5 |

| Company E | $1,250 | Comprehensive, liability, collision, gap insurance | 4.3/5 |

| Company F | $1,300 | Liability, collision, uninsured/underinsured motorist | 4.1/5 |

| Company G | $1,150 | Comprehensive, liability, collision, towing and labor | 4.4/5 |

| Company H | $1,450 | Comprehensive, liability, collision, accident forgiveness | 4.6/5 |

| Company I | $1,200 | Liability, collision, medical payments, personal injury protection | 4.2/5 |

| Company J | $1,350 | Comprehensive, liability, collision, custom equipment coverage | 4.3/5 |

Cost-Saving Strategies

Auto insurance expenses can be a significant financial burden. However, there are various strategies you can implement to reduce these costs and save money.

When you’re shopping for the top 10 cheapest auto insurance, it’s important to consider your individual needs and budget. If you’re looking for a high-performance SUV, the Lamborghini Urus is a great option. With its powerful engine and luxurious interior, the Urus is sure to turn heads.

For more information on the Lamborghini Urus 2023 release date, click here: lamborghini urus 2023 release date . Once you’ve done your research, you can start comparing quotes from different insurance companies to find the best deal.

Adopting safe driving practices is a crucial step in lowering your insurance premiums. By maintaining a clean driving record, you demonstrate to insurance companies that you are a responsible driver, reducing the risk associated with insuring you.

Bundling Policies

Consider bundling your auto insurance policy with other insurance products, such as homeowners or renters insurance. Many insurance companies offer discounts for bundling multiple policies, providing you with potential savings.

Negotiating Discounts

Don’t hesitate to negotiate with your insurance provider. Inquire about any available discounts, such as those for good students, senior citizens, or low-mileage drivers. By proactively seeking discounts, you can significantly reduce your insurance premiums.

If you’re looking for the top 10 cheapest auto insurance, you’ll want to check out our article on the top cheapest car insurance . We’ve done the research for you and found the best deals on car insurance so that you can save money.

We know that car insurance can be expensive, so we’re here to help you find the best coverage at the lowest price. Check out our article today and start saving money on your car insurance.

Coverage Options and Exclusions

Auto insurance policies offer a range of coverage options to protect drivers from financial liability in various situations. However, it’s crucial to understand the exclusions and limitations that may apply to each type of coverage.

If you’re in the market for a new car, be sure to check out the top 10 cheapest auto insurance policies. This will help you save money on your monthly premiums. If you’re a fan of luxury cars, you might be interested in the lamborghini diablo 2023 . This car is sure to turn heads wherever you go.

However, be sure to factor in the cost of insurance before you make a purchase. Top 10 cheapest auto insurance policies can help you save money on your monthly premiums.

Liability Coverage

Liability coverage protects you if you cause an accident that results in injuries or property damage to others. It typically includes:

- Bodily injury liability: Covers medical expenses and lost income for individuals injured in an accident caused by you.

- Property damage liability: Covers repairs or replacement of property damaged in an accident caused by you.

Collision Coverage

Collision coverage pays for repairs or replacement of your own vehicle if it’s damaged in an accident with another vehicle or object. It’s important to note that collision coverage has a deductible, which is the amount you pay out of pocket before the insurance company covers the remaining costs.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from non-collision-related events, such as theft, vandalism, fire, or weather damage. Like collision coverage, comprehensive coverage also has a deductible.

Other Common Coverage Options

Additional coverage options may include:

- Uninsured/underinsured motorist coverage: Protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient insurance to cover your damages.

- Personal injury protection (PIP): Covers medical expenses and lost income for you and your passengers, regardless of who is at fault in an accident.

- Rental car reimbursement: Covers the cost of renting a vehicle while your car is being repaired or replaced.

Common Exclusions and Limitations, Top 10 cheapest auto insurance

Insurance policies often have exclusions and limitations that can affect coverage. These may include:

- Intentional acts: Insurance typically won’t cover damages resulting from intentional acts or criminal behavior.

- Mechanical breakdowns: Insurance doesn’t cover repairs or replacements due to mechanical breakdowns or wear and tear.

- Racing or stunts: Insurance won’t cover damages incurred while racing or performing stunts.

- Acts of war or terrorism: Insurance typically excludes damages caused by acts of war or terrorism.

It’s important to carefully review your insurance policy to understand the specific coverage options, exclusions, and limitations that apply to your situation.

Finding the Right Policy

To determine the most suitable insurance policy for your needs, it’s crucial to first assess your individual circumstances and insurance requirements. This involves considering factors such as the value of your vehicle, your driving history, and the level of coverage you desire.

Once you have a clear understanding of your needs, you can start comparing quotes from different insurance providers. Be sure to compare not only the premiums but also the coverage details, deductibles, and any additional features or benefits offered by each policy.

Tips for Comparing Quotes

- Obtain quotes from multiple insurance companies to ensure you’re getting the best deal.

- Pay attention to the coverage limits and deductibles associated with each policy.

- Consider any additional features or benefits that may be important to you, such as roadside assistance or rental car coverage.

- Read the policy details carefully before making a decision.

Final Review

Congratulations! You’ve now unlocked the secrets to finding the cheapest auto insurance. Remember, staying safe on the road, bundling policies, and negotiating discounts can further reduce your expenses. So, buckle up, drive responsibly, and enjoy the peace of mind that comes with affordable and reliable auto insurance.