In the realm of auto insurance, finding the most affordable options can be a daunting task. Enter our comprehensive guide to the top cheapest auto insurance companies, where we unveil the secrets to securing the best coverage without breaking the bank.

Delve into the intricacies of pricing structures, coverage options, and the factors that determine affordability. We’ll also explore customer service ratings, financial stability, and value-added services to help you make an informed decision.

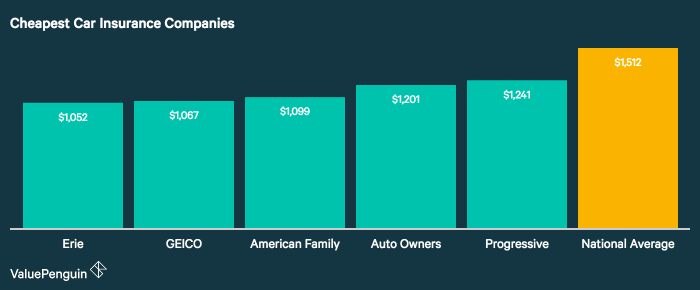

The auto insurance industry is highly competitive, with numerous companies vying for customers’ business. Among these, several stand out for offering consistently low rates and affordable coverage options.

Factors contributing to affordability include operational efficiency, favorable loss ratios, and a focus on low-risk drivers. Companies with a high market share often benefit from economies of scale, allowing them to pass on savings to consumers.

- Geico: 15.2% market share

- State Farm: 14.3% market share

- Progressive: 12.1% market share

- Allstate: 9.7% market share

- Farmers Insurance: 5.6% market share

Pricing and Coverage Options: Top Cheapest Auto Insurance Companies

The pricing structure of auto insurance varies between companies. Some insurers use a tiered system based on factors like driving history, age, and vehicle type. Others offer flat rates or discounts for multiple policies. Understanding the coverage options and how they impact premiums is crucial.

Auto insurance policies typically include liability, collision, and comprehensive coverage. Liability covers damages or injuries caused to others, while collision covers damage to your vehicle in an accident. Comprehensive coverage protects against non-collision events like theft, vandalism, or weather damage.

Deductibles

Deductibles represent the amount you pay out of pocket before insurance coverage kicks in. Higher deductibles lower premiums, while lower deductibles increase premiums. Choosing a deductible depends on your financial situation and risk tolerance.

Discounts, Top cheapest auto insurance companies

Many insurance companies offer discounts for various factors, such as:

- Good driving record

- Multi-policy discounts

- Safety features on your vehicle

- Bundling home and auto insurance

Customer Service and Reputation

Evaluating the customer service ratings of the top auto insurance companies is crucial. Positive customer experiences indicate a company’s commitment to providing exceptional service, handling claims efficiently, and resolving disputes fairly.

Analyzing online reviews and testimonials offers valuable insights into customer satisfaction. Reading experiences shared by policyholders provides a comprehensive understanding of the company’s customer service quality.

So, you’re looking for the top cheapest auto insurance companies? You can get the cheapest car insurance company for you by following the link: what is the cheapest car insurance company . You can then compare and contrast the various companies and choose the one that best suits your needs.

Ultimately, the top cheapest auto insurance companies will vary depending on your individual circumstances.

Claims Handling

The claims handling process is a critical aspect of customer service. A streamlined and efficient process ensures that claims are processed promptly and fairly.

If you’re looking for the top cheapest auto insurance companies, you’ll want to read this 2018 Toyota 4Runner review . This review provides a comprehensive look at the 4Runner’s features, performance, and safety ratings. It also includes a comparison of the 4Runner to other popular SUVs in its class.

After reading this review, you’ll be well-informed to make a decision about whether the 4Runner is the right SUV for you and also find the cheapest auto insurance companies to protect your investment.

- Assess the companies’ claims response times.

- Examine the ease of filing and tracking claims online or through mobile apps.

- Analyze customer reviews regarding the clarity of communication and support provided throughout the claims process.

Dispute Resolution

Handling disputes effectively is essential for maintaining customer satisfaction. A fair and transparent dispute resolution mechanism ensures that customer concerns are addressed promptly and resolved amicably.

- Evaluate the companies’ dispute resolution processes.

- Assess the availability of independent arbitration or mediation services.

- Review customer feedback on the fairness and effectiveness of the dispute resolution process.

Financial Stability and Reliability

Assessing the financial stability of insurance companies is crucial for consumers as it directly impacts the reliability and security of their coverage. Companies with strong financial backing are better equipped to meet their obligations, pay claims promptly, and weather economic downturns.Financial

stability can be measured by various factors, including:

Assets

Assets represent the total value of a company’s resources, such as cash, investments, and real estate. A higher level of assets indicates a company’s ability to cover its liabilities and pay claims.

Liabilities

Liabilities are the total amount of money a company owes, including outstanding claims, unearned premiums, and other obligations. A lower liability-to-asset ratio suggests a company’s financial strength.

Claims Payout Ratio

The claims payout ratio measures the percentage of premiums used to pay claims. A lower ratio indicates that the company is able to manage its expenses efficiently and has a strong financial position.

Special Features and Value-Added Services

Many auto insurance companies offer unique features and value-added services to enhance the insurance experience for their customers. These services can range from accident forgiveness to roadside assistance, and can add value to your policy.

It’s important to consider the cost implications of these additional services when choosing an insurance company. Some services may come with an additional cost, while others may be included in the base price of the policy.

Accident Forgiveness

- Protects your insurance rate from increasing after a single at-fault accident.

- May come with restrictions, such as only applying to one accident per policy term.

- Can provide peace of mind for drivers who are concerned about their insurance rates increasing after an accident.

Roadside Assistance

- Provides 24/7 assistance with services such as towing, flat tire changes, and battery jumps.

- Can be a valuable service for drivers who travel frequently or live in remote areas.

- May come with an additional cost, but can be worth the investment for added convenience and peace of mind.

Rental Car Reimbursement

- Covers the cost of a rental car while your own vehicle is being repaired after an accident.

- Can help you maintain your mobility while your car is out of commission.

- May come with a daily or weekly limit, so it’s important to check the policy details.

Target Audience and Niche Markets

The top auto insurance companies have diverse target audiences and niche markets. Understanding these factors is crucial as they influence pricing and coverage options.

The target audience for each company varies depending on their market strategy and product offerings. Some companies focus on providing affordable coverage to low-risk drivers, while others cater to high-risk drivers or specific demographics like young drivers or seniors.

If you’re on the hunt for top cheapest auto insurance companies, you’ll want to check out our comprehensive list of cheapest car insurance companies . We’ve done the research to help you find the best deals on car insurance, so you can save money and drive with confidence.

With our list, you’ll be able to compare quotes from multiple insurers and find the cheapest auto insurance company for your needs.

Niche Markets

- Low-risk drivers:Companies like GEICO and USAA target low-risk drivers with good driving records and credit scores.

- High-risk drivers:Companies like Progressive and The General specialize in providing coverage to drivers with poor driving records or other high-risk factors.

- Young drivers:Companies like Allstate and State Farm offer programs and discounts tailored to young drivers, who are typically considered higher-risk.

- Seniors:Companies like AARP and MetLife provide coverage options designed for seniors, addressing their specific needs and concerns.

- Usage-based insurance:Companies like Metromile and Milewise offer usage-based insurance policies that track driving habits and adjust premiums accordingly.

By targeting specific niche markets, companies can tailor their products and services to meet the unique needs of those customers. This specialization allows them to offer more competitive pricing and coverage options within their target markets.

Emerging Trends and Future Outlook

The auto insurance industry is constantly evolving, with new technologies and consumer demands shaping its future.One major trend is the rise of telematics, which uses devices to track driving behavior and provide insurers with valuable data. This data can be used to offer personalized rates and discounts to drivers who are considered low-risk.Another

trend is the growing popularity of usage-based insurance (UBI), which charges drivers based on how much they drive. This type of insurance can be beneficial for drivers who do not drive very often, as they can save money on their premiums.

Regulatory Changes

The regulatory landscape for auto insurance is also changing, with many states implementing new laws and regulations to protect consumers. These changes can impact the pricing and coverage offerings of insurance companies.

Future Outlook

The future of the auto insurance industry is bright, with continued growth expected in the coming years. As new technologies and consumer demands emerge, insurance companies will need to adapt to meet the changing needs of their customers.

Ending Remarks

Whether you’re a seasoned driver or a new road warrior, our analysis of the top cheapest auto insurance companies empowers you with the knowledge to choose the perfect provider for your needs. Embrace the freedom of affordable protection and enjoy peace of mind behind the wheel.