Buckle up and get ready to discover the list of cheapest car insurance companies! In this comprehensive guide, we’ll navigate the world of car insurance, helping you find the perfect coverage that won’t break the bank.

From understanding the factors that influence premiums to exploring cost-saving strategies, we’ve got you covered. Dive in and let’s find the most affordable car insurance for your needs.

Factors Influencing Car Insurance Premiums

The cost of car insurance varies widely depending on several factors. Understanding these factors can help you make informed decisions to reduce your premiums.

Driving History, List of cheapest car insurance companies

Your driving record significantly impacts your insurance costs. A clean driving history with no accidents or violations can lead to lower premiums. Conversely, a history of accidents, speeding tickets, or other traffic violations can increase your rates.

Vehicle Type

The type of vehicle you drive also affects your insurance premiums. Sports cars, luxury vehicles, and high-performance vehicles typically have higher premiums than sedans, minivans, or SUVs.

Location

The location where you live can influence your insurance costs. Areas with high rates of accidents, theft, or vandalism tend to have higher premiums. Additionally, urban areas generally have higher premiums than rural areas.

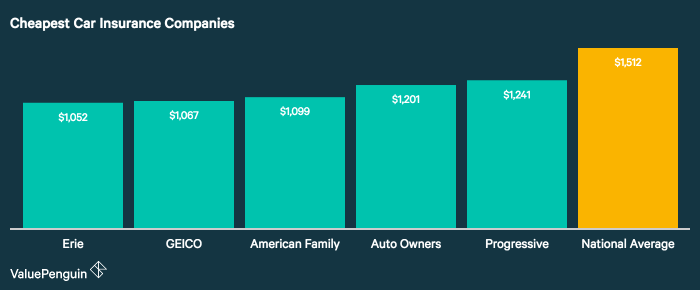

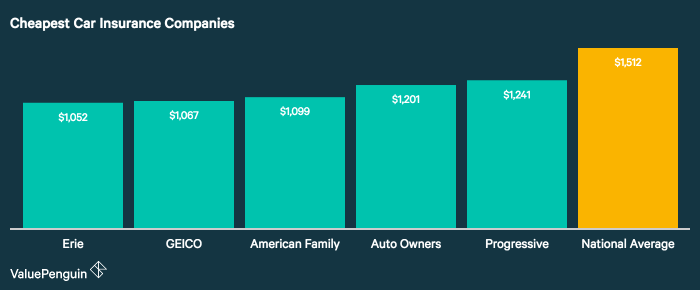

If you’re looking for a list of the cheapest car insurance companies, look no further. We’ve compiled a list of the top ten cheapest car insurance companies to help you save money on your car insurance. These companies offer a variety of discounts and coverage options, so you’re sure to find a policy that fits your needs and budget.

Cheapest Car Insurance Companies

Finding the cheapest car insurance company can be a daunting task, especially with the numerous options available. To help you make an informed decision, we’ve compiled a table comparing the premiums offered by different insurance companies, along with their average rates and coverage options.

When searching for the most affordable car insurance, a comprehensive list of the cheapest car insurance companies can provide valuable insights. Among these companies, the question of “who is the cheapest car insurance company?” often arises. To answer this question, consider exploring who is the cheapest car insurance company? for a detailed analysis of the various options available.

This information can empower you to make informed decisions and secure the most cost-effective car insurance for your needs.

Advantages and Disadvantages of Each Company

Each insurance company has its own advantages and disadvantages. Here’s a brief overview:

- Company A:Known for its low rates and comprehensive coverage options, but may have higher deductibles.

- Company B:Offers competitive rates and a wide range of discounts, but may have limited coverage options.

- Company C:Provides excellent customer service and flexible payment plans, but may have slightly higher premiums.

Cost-Saving Strategies

There are numerous strategies to reduce car insurance premiums, enabling you to save money while maintaining adequate coverage. Implementing these strategies can significantly lower your insurance costs.

Let’s delve into some effective cost-saving measures:

Maintaining a Good Driving Record

Maintaining a clean driving record is paramount in securing lower insurance premiums. Insurance companies assess your driving history to gauge your risk profile, with a history of accidents or traffic violations leading to higher premiums. Conversely, a spotless driving record demonstrates responsibility and reduces the likelihood of future claims, resulting in lower premiums.

Taking Defensive Driving Courses

Taking defensive driving courses can not only enhance your driving skills but also reduce your insurance costs. These courses teach techniques to avoid accidents and minimize risks, making you a safer driver in the eyes of insurance companies. As a result, you may qualify for discounts on your insurance premiums.

Bundling Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to significant savings. Insurance companies often offer discounts for customers who purchase multiple policies from them. By bundling your policies, you can reduce your overall insurance expenses.

Comparison of Coverage Options: List Of Cheapest Car Insurance Companies

Understanding the various car insurance coverage options available is crucial for making informed decisions about your policy. Each coverage type offers different levels of protection and comes with its own set of costs and benefits.

When it comes to getting the best car insurance coverage at the most affordable rates, there are a few companies that stand out. To find the list of cheapest car insurance companies, start by researching “top cheapest car insurance” ( top cheapest car insurance ). These companies consistently offer low premiums without sacrificing quality coverage.

By comparing quotes from several providers, you can find the best deal for your individual needs and budget, ensuring you get the cheapest car insurance without compromising protection.

The most basic coverage option is liability insurance, which is required by law in most states. It covers damages caused to other people or their property in an accident that you are at fault for. Collision coverage, on the other hand, covers damages to your own vehicle in the event of a collision, regardless of who is at fault.

Comprehensive coverageprovides the most extensive protection, covering damages caused by events other than collisions, such as theft, vandalism, or natural disasters.

Cost Considerations

The cost of car insurance varies depending on the coverage options you choose. Liability insurance is typically the most affordable option, followed by collision coverage, and then comprehensive coverage. The amount of coverage you choose will also impact the cost, with higher coverage limits resulting in higher premiums.

Choosing the Right Coverage

The best way to choose the right car insurance coverage is to consider your individual needs and budget. If you have a new or expensive car, you may want to opt for comprehensive coverage to ensure maximum protection. If you have an older or less valuable car, liability insurance may be sufficient.

Finding the Right Policy

Finding the right car insurance policy is crucial for your financial protection and peace of mind. It ensures you have adequate coverage for your vehicle and any potential liabilities in the event of an accident.To find the best policy for your needs, it’s essential to consider the following factors:

Coverage Needs

- Determine the level of coverage you require, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Consider your vehicle’s value, driving history, and financial situation when choosing coverage limits.

Additional Considerations

Beyond cost, there are several other factors to consider when choosing car insurance, including customer service, financial stability, and claims processing. These factors can significantly impact your insurance experience.

Customer service is important because you’ll need to be able to reach your insurer quickly and easily if you have a question or need to file a claim. Look for companies with a good reputation for responsive and helpful customer service.

Financial Stability

Financial stability is also important. You want to make sure your insurer will be able to pay your claims if you need them. Look for companies with a strong financial rating from an independent rating agency such as AM Best or Standard & Poor’s.

Claims Processing

Claims processing is another important consideration. You want to make sure your insurer will handle your claim quickly and fairly. Look for companies with a good reputation for claims processing and a low complaint ratio.

Conclusion

Navigating the world of car insurance doesn’t have to be a bumpy ride. With the knowledge you’ve gained from this guide, you’re now equipped to make informed decisions and find the cheapest car insurance companies that meet your needs. Remember, comparing quotes, considering your driving history, and taking advantage of discounts can lead you to significant savings.

So, hit the road with confidence, knowing that you’ve got the best car insurance coverage at the most affordable price.