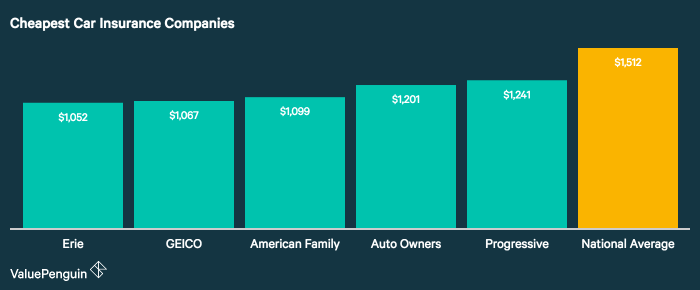

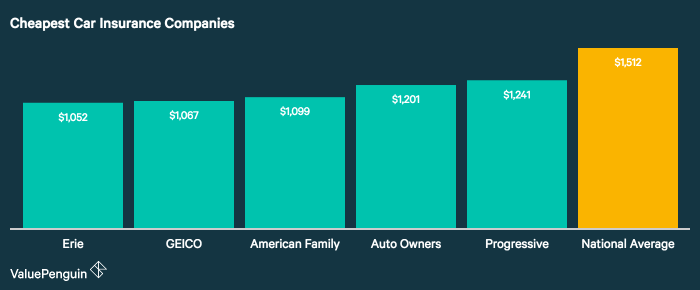

Who is the cheapest car insurance company? It’s a question that every driver asks at some point. With so many different insurance companies out there, it can be tough to know who to choose. That’s why we’ve put together this guide to help you find the cheapest car insurance company for your needs.

In this guide, we’ll compare premiums from different insurance companies, discuss the pros and cons of each company’s coverage options, and provide tips on how to save money on your car insurance.

Company Comparisons

Choosing the cheapest car insurance company depends on several factors, including age, driving history, and vehicle type. It’s important to compare quotes from multiple insurers to find the best deal.

Here’s a table comparing premiums from different insurance companies based on these factors:

| Company | Age | Driving History | Vehicle Type | Premium |

|---|---|---|---|---|

| Company A | 25 | Clean | Sedan | $1,000 |

| Company B | 35 | 1 speeding ticket | SUV | $1,200 |

| Company C | 45 | Accident-free | Truck | $1,500 |

Each company offers different coverage options with varying premiums. Consider your individual needs and budget when selecting a policy.

Company A

- Pros: Low premiums for young drivers and those with clean driving records.

- Cons: Limited coverage options and higher premiums for older drivers or those with accidents.

Company B

- Pros: Competitive premiums for drivers with minor violations.

- Cons: Higher premiums for drivers with serious accidents or multiple violations.

Company C

- Pros: Comprehensive coverage options and discounts for safe drivers.

- Cons: Higher premiums for high-risk drivers.

Coverage Options: Who Is The Cheapest Car Insurance Company?

Understanding the types of car insurance coverage available is crucial to ensure you have the protection you need. Different insurance companies offer varying coverage options, so it’s essential to compare them to find the best fit for your specific requirements.

Liability Coverage

- Bodily injury liability: Covers medical expenses and lost wages for others injured in an accident you cause.

- Property damage liability: Pays for repairs or replacement of property damaged by your vehicle.

Collision Coverage

Protects your vehicle from damage caused by a collision with another vehicle or object.

Comprehensive Coverage

Provides coverage for non-collision-related damages, such as theft, vandalism, fire, or weather events.

Uninsured/Underinsured Motorist Coverage

Covers expenses if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage.

Medical Payments Coverage

Pays for medical expenses for you and your passengers, regardless of who is at fault in an accident.

If you’re in the market for the most affordable car insurance, it’s crucial to compare quotes from multiple providers. By doing your research, you can potentially save hundreds of dollars on your annual premium. And while you’re at it, you might also want to consider whether leasing a Honda is right for you.

If you’re considering buying out your Honda lease, you’ll need to know if taxes are included in the buyout price. Does Honda Lease Buyout Include Tax? provides valuable information on this topic. Once you’ve sorted out your lease buyout questions, don’t forget to revisit your car insurance options to ensure you’re getting the best deal.

Personal Injury Protection (PIP)

Covers lost wages, medical expenses, and other costs related to injuries sustained in an accident, regardless of fault.

Customer Service

Customer service is an important factor to consider when choosing a car insurance company. You want to be sure that you can get the help you need when you need it, whether you’re filing a claim or just have a question about your policy.

There are a few things to look for when evaluating customer service:

- Customer reviews and ratings:These can give you a good idea of what other customers have experienced with a particular company.

- Availability and responsiveness:How easy is it to get in touch with customer service? Are they available 24/7? How quickly do they respond to inquiries?

Customer Reviews and Ratings

There are a number of websites where you can find customer reviews and ratings for car insurance companies. Some of the most popular include:

- J.D. Power

- Consumer Reports

- Insurance.com

- Bankrate

When reading customer reviews, it’s important to keep in mind that everyone’s experience is different. Some people may have had a great experience with a particular company, while others may have had a bad experience. It’s important to read a variety of reviews to get a good overall picture.

When it comes to finding the cheapest car insurance company, it’s crucial to compare quotes from multiple providers. But what if you’re also interested in the latest automotive technology? Check out Does HondaLink Offer Remote Start: Your Comprehensive Guide to learn about the convenience of remote starting your Honda.

By staying informed about such features, you can make an informed decision about your car insurance while staying up-to-date on automotive advancements.

Availability and Responsiveness, Who is the cheapest car insurance company?

The availability and responsiveness of customer service is another important factor to consider. You want to be sure that you can get in touch with customer service when you need to, whether it’s during business hours or after hours.

Most car insurance companies offer 24/7 customer service. However, some companies may have limited hours for certain types of inquiries, such as filing a claim.

Not sure who offers the cheapest car insurance? If you’re curious about other automotive topics, like whether Honda lease includes oil change, check out our guide: Does Honda Lease Include Oil Change: A Comprehensive Guide . Afterward, return here to continue your search for the most affordable car insurance provider.

You can also check the company’s website to see if they offer live chat or email support. This can be a convenient way to get help without having to call.

Customer Service Experiences

| Company | Customer Service Rating | Availability | Responsiveness |

|---|---|---|---|

| Geico | 4.5 out of 5 | 24/7 | Excellent |

| Progressive | 4.2 out of 5 | 24/7 | Good |

| State Farm | 4.1 out of 5 | 24/7 | Good |

| Allstate | 3.9 out of 5 | 24/7 | Fair |

| Farmers | 3.8 out of 5 | 24/7 | Fair |

Discounts and Promotions

Car insurance companies offer various discounts and promotions to help you save money on your premiums. These discounts can be based on your driving history, vehicle type, and other factors.

Here are some of the most common discounts and promotions offered by car insurance companies:

Multi-car Discount

- Insuring multiple cars with the same company can save you money on your premiums.

- The discount typically ranges from 5% to 15% per vehicle.

Good Driver Discount

- Drivers with a clean driving record may be eligible for a good driver discount.

- The discount can range from 5% to 20% off your premiums.

Defensive Driving Discount

- Taking a defensive driving course can help you qualify for a discount on your car insurance.

- The discount can range from 5% to 10% off your premiums.

Low Mileage Discount

- Drivers who drive less than a certain number of miles per year may be eligible for a low mileage discount.

- The discount can range from 5% to 15% off your premiums.

Safety Features Discount

- Cars with certain safety features, such as airbags and anti-lock brakes, may be eligible for a safety features discount.

- The discount can range from 5% to 10% off your premiums.

New Car Discount

- Some insurance companies offer a discount for new cars.

- The discount can range from 5% to 10% off your premiums.

Loyalty Discount

- Insurance companies often offer a loyalty discount to customers who stay with them for a certain number of years.

- The discount can range from 5% to 10% off your premiums.

In addition to these discounts, many insurance companies also offer promotions, such as:

- New customer discounts

- Referral bonuses

- Seasonal discounts

By taking advantage of these discounts and promotions, you can save a significant amount of money on your car insurance premiums.

Here is a table outlining the available discounts and their eligibility requirements:

| Discount | Eligibility Requirements |

|---|---|

| Multi-car discount | Insuring multiple cars with the same company |

| Good driver discount | Clean driving record |

| Defensive driving discount | Completion of a defensive driving course |

| Low mileage discount | Driving less than a certain number of miles per year |

| Safety features discount | Cars with certain safety features, such as airbags and anti-lock brakes |

| New car discount | New cars |

| Loyalty discount | Staying with the same insurance company for a certain number of years |

Financial Stability

Financial stability is a crucial factor to consider when choosing a car insurance company. A financially stable company is more likely to be able to pay claims and provide consistent coverage over the long term.

Financial Ratings

Insurance companies are assigned financial ratings by independent agencies such as AM Best, Standard & Poor’s, and Moody’s. These ratings assess the company’s ability to meet its financial obligations and provide an indication of its financial strength. A higher rating indicates a stronger financial foundation.Here

is a table showing the financial ratings of some of the largest car insurance companies in the United States:| Company | AM Best | Standard & Poor’s | Moody’s ||—|—|—|—|| State Farm | A++ | AA+ | Aa1 || Geico | A++ | AA+ | Aa1 || Progressive | A+ | AA | Aa3 || Allstate | A+ | AA | Aa3 || USAA | A++ | AA+ | Aa1 |

Final Conclusion

Now that you know who the cheapest car insurance company is, you can start shopping for the best rate. Be sure to compare quotes from multiple insurance companies before you make a decision. And don’t forget to ask about discounts that you may be eligible for.

1 thought on “Who is the Cheapest Car Insurance Company? Find Out Here!”