What are the cheapest car insurance companies – Navigating the labyrinth of car insurance companies can be a daunting task, especially when you’re on a budget. But fear not, for we’ve meticulously curated a guide to unveil the cheapest car insurance companies, empowering you with the knowledge to protect your ride without breaking the bank.

In this comprehensive exploration, we’ll delve into the intricacies of car insurance costs, empowering you to make informed decisions that safeguard your finances. Buckle up and get ready to discover the secrets to unlocking the most affordable car insurance policies.

Top Budget-Friendly Car Insurance Providers

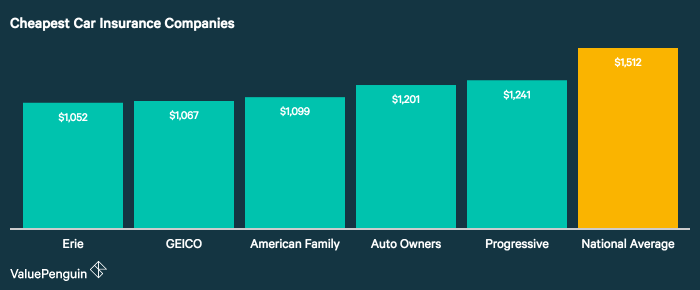

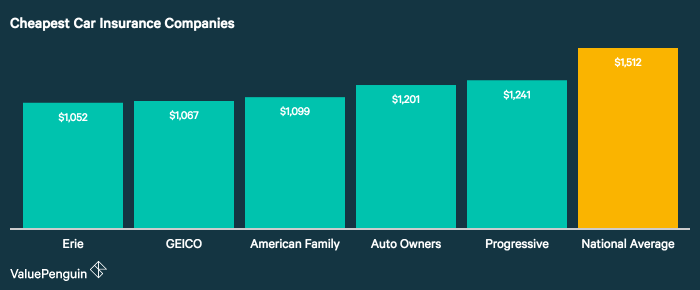

Finding affordable car insurance can be a daunting task, but it’s essential to protect yourself financially in case of an accident. Here are some of the most budget-friendly car insurance companies based on factors such as average premiums, customer satisfaction, and coverage options:

These providers offer competitive rates and a range of coverage options to meet your needs and budget. When comparing quotes, be sure to consider factors such as your driving history, vehicle type, and coverage limits to find the best deal.

To find the cheapest car insurance companies, it’s important to compare quotes from multiple providers. One way to do this is by visiting websites that offer who has the cheapest car insurance . These websites allow you to enter your information and receive quotes from different insurance companies.

By comparing quotes, you can find the cheapest car insurance company for your needs.

Cheapest Car Insurance Companies, What are the cheapest car insurance companies

- Geico:Known for its low rates and excellent customer service.

- State Farm:Offers a variety of discounts and a strong reputation for reliability.

- Progressive:Provides competitive rates and flexible coverage options.

- USAA:Exclusive to military members and their families, offers competitive rates and comprehensive coverage.

- Erie Insurance:Known for its personalized service and competitive rates.

Factors Influencing Car Insurance Costs

Car insurance premiums are not fixed and can vary significantly depending on several factors. Understanding these factors can help you make informed decisions and potentially lower your insurance costs.

Driving History

Your driving record is a crucial factor in determining your insurance premiums. Insurers consider factors such as traffic violations, accidents, and DUIs. A clean driving record typically results in lower premiums, while a history of accidents or violations can lead to higher costs.

Vehicle Type

The type of vehicle you drive also affects your insurance premiums. Sports cars, luxury vehicles, and high-performance vehicles generally have higher premiums than sedans, hatchbacks, and other more common vehicles. This is because these vehicles are often more expensive to repair or replace in the event of an accident.

Age

Age is another important factor that insurers consider when calculating premiums. Younger drivers, especially those under the age of 25, typically pay higher premiums due to their higher risk of accidents. As you get older and gain more driving experience, your premiums may decrease.

Location

Your location can also impact your insurance costs. Insurers consider factors such as crime rates, traffic congestion, and weather conditions in your area. If you live in an area with high crime rates or frequent accidents, you may pay higher premiums.

Comparing Quotes from Multiple Insurers

Shopping around for car insurance is crucial to find the most affordable option. Comparing quotes from multiple insurance companies allows you to see the range of prices available and choose the one that fits your budget and needs best.

Before signing up with any car insurance company, make sure you check out what are the cheapest car insurance companies. That way, you can save a few bucks and use it to customize your ride. If you own a 2015 Ford Fiesta ST, you might want to check out the 2015 ford fiesta st specs to see what upgrades you can make to improve your driving experience.

Then, go back to researching what are the cheapest car insurance companies so you can get the best deal on your insurance.

To gather quotes effectively, follow these tips:

- Determine your coverage needs:Decide on the level of coverage you need, including liability, collision, and comprehensive.

- Gather your information:Have your driver’s license, vehicle registration, and insurance history ready.

- Get quotes online:Many insurance companies offer online quoting tools that allow you to compare quotes quickly and easily.

- Contact insurance agents:Speak to independent insurance agents who represent multiple companies to get quotes from various providers.

- Compare carefully:Pay attention to the coverage limits, deductibles, and premiums when comparing quotes.

Understanding Coverage Options: What Are The Cheapest Car Insurance Companies

Car insurance coverage options vary in scope and purpose, designed to protect you and your vehicle in different scenarios. Understanding these options is crucial to tailoring an insurance plan that meets your specific needs and budget.

The main types of car insurance coverage include:

Liability Coverage

- Covers bodily injury and property damage you cause to others in an accident.

- Required by law in most states.

- Protects your assets from lawsuits resulting from accidents.

Collision Coverage

- Covers damage to your own vehicle caused by a collision with another vehicle or object.

- Optional but highly recommended.

- Helps pay for repairs or replacement of your vehicle.

Comprehensive Coverage

- Covers damage to your vehicle caused by non-collision events, such as theft, vandalism, fire, or natural disasters.

- Optional but can provide peace of mind.

- Helps protect your vehicle from unexpected losses.

Discounts and Savings

Car insurance companies offer various discounts and savings opportunities to help policyholders reduce their premiums. These discounts can be based on factors such as safe driving habits, vehicle safety features, and bundling policies.

Common Discounts

- Good driver discount:Rewarding policyholders with a clean driving record for a certain period (e.g., 3-5 years) with lower premiums.

- Accident-free discount:Similar to the good driver discount, but specifically for policyholders who have been accident-free for a set duration.

- Defensive driving course discount:Completing an approved defensive driving course can qualify policyholders for discounts on their premiums.

- Multi-car discount:Insuring multiple vehicles with the same insurer often leads to reduced premiums for each vehicle.

- Anti-theft device discount:Installing anti-theft devices, such as alarms or immobilizers, can lower premiums by reducing the risk of vehicle theft.

- Bundling discount:Combining car insurance with other insurance policies (e.g., home, renters) from the same insurer can result in significant savings.

- Loyalty discount:Long-term policyholders with the same insurer may be eligible for loyalty discounts as a reward for their continued business.

Example:A driver with a good driving record and no accidents for the past 5 years may qualify for a good driver discount of 15%, which could translate to a premium reduction of $100 per year on a policy with an annual premium of $670.

If you’re looking for the cheapest car insurance companies, it’s worth doing your research to find the best deal. According to recent studies, some of the most affordable options include Geico, State Farm, and Progressive. To learn more about who has the cheapest auto insurance, check out this informative article: who has the cheapest auto insurance . This article provides a comprehensive overview of the cheapest car insurance companies, helping you make an informed decision.

Maintaining Low Insurance Costs

Maintaining low car insurance premiums is crucial for saving money and ensuring financial stability. Here are some tips to help you keep your insurance costs in check:

Improving Driving Habits:Responsible driving habits can significantly reduce insurance premiums. Avoid speeding, reckless driving, and traffic violations. Maintain a clean driving record by obeying traffic laws and practicing defensive driving techniques.

Defensive Driving Courses

Taking defensive driving courses can demonstrate your commitment to safe driving and may qualify you for discounts on your insurance premiums. These courses teach advanced driving techniques and help you develop defensive strategies to avoid accidents.

Maintaining a Good Credit Score

Insurance companies often consider your credit score when calculating your premiums. A higher credit score indicates financial responsibility and stability, which can lead to lower insurance costs. Monitor your credit report regularly and take steps to improve your score if necessary.

Conclusion

Remember, finding the cheapest car insurance companies is not merely about cutting corners; it’s about finding the right balance between coverage, affordability, and peace of mind. By understanding the factors that influence premiums and comparing quotes, you can make an informed decision that protects both your car and your wallet.

So, embrace the journey and let us guide you towards the most cost-effective car insurance solution.