Why volkswagen stock is down has become a pressing question among investors, as the automotive giant’s shares have taken a significant hit in recent months. This in-depth analysis will delve into the key factors driving this decline, examining both external and internal challenges, industry dynamics, and future prospects.

From the impact of the global economic downturn to the effects of supply chain disruptions and semiconductor shortages, this exploration will leave no stone unturned in uncovering the reasons behind Volkswagen’s stock performance.

Industry Analysis: Why Volkswagen Stock Is Down

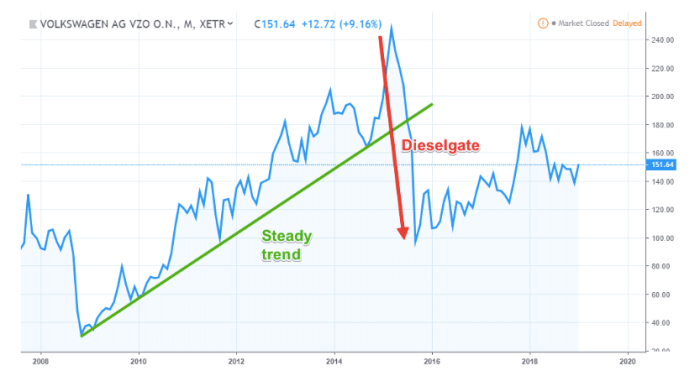

Volkswagen’s stock performance has lagged behind that of its competitors in recent years. This is due in part to the company’s ongoing struggles with the diesel emissions scandal, as well as its slow response to the shift towards electric vehicles.

Volkswagen’s stock has taken a hit lately due to a combination of factors. The company has been plagued by emissions scandals, and it is facing increased competition from electric vehicle makers. Did you know that Volkswagen also has a history of manufacturing tanks? Click here to learn more about Volkswagen’s involvement in tank production.

Despite its challenges, Volkswagen remains a major player in the automotive industry. The company is investing heavily in electric vehicles, and it is confident that it can regain its former glory.

The competitive landscape in the automotive industry is becoming increasingly challenging. New entrants, such as Tesla and Nio, are disrupting the market with innovative electric vehicles. Traditional automakers, such as Volkswagen, are facing pressure to adapt to these new technologies.

The recent decline in Volkswagen stock prices is due to several factors, including supply chain disruptions, chip shortages, and the ongoing war in Ukraine. As a result, production has been impacted, leading to lower sales and profits. However, Volkswagen’s long-term prospects remain strong, especially in the electric vehicle market.

For more information on Volkswagen’s history and its transition to electric vehicles, check out was auto volkswagen . Despite the current challenges, Volkswagen is well-positioned to benefit from the growing demand for electric vehicles and is expected to remain a major player in the automotive industry.

Volkswagen’s Competitive Advantages

Despite the challenges, Volkswagen has several competitive advantages that could help it to regain market share in the coming years.

- Strong brand recognition: Volkswagen is one of the most recognizable brands in the world.

- Global presence: Volkswagen has a presence in over 150 countries, which gives it a significant advantage over its competitors.

- Broad product portfolio: Volkswagen offers a wide range of vehicles, from small cars to SUVs to luxury sedans.

Analyst Ratings and Market Sentiment

To gauge the market’s sentiment towards Volkswagen, we’ll examine analyst ratings and recent news coverage.

Analyst Ratings

According to Bloomberg, Volkswagen currently has a consensus rating of “Buy” from analysts. The average price target for the stock is €250, indicating a potential upside of approximately 15% from its current price.

Market Sentiment, Why volkswagen stock is down

Market sentiment towards Volkswagen has been positive in recent months. Positive news coverage has focused on the company’s strong sales in China and its progress in developing electric vehicles. However, there have also been concerns about the company’s exposure to the ongoing semiconductor shortage and supply chain disruptions.

Final Review

In conclusion, the decline in Volkswagen’s stock price is a multifaceted issue influenced by a combination of external and internal factors. While the company faces challenges, it also possesses strengths and opportunities for future growth. By understanding the underlying dynamics, investors can make informed decisions about the future of their Volkswagen investments.

Volkswagen’s recent stock decline can be attributed to a number of factors, including the company’s ongoing legal troubles and its failure to meet sales targets. The company’s reputation has also been tarnished by the emissions scandal, which has led to a loss of consumer confidence.

Volkswagen’s stock has also been affected by the company’s acquisition of Porsche, which has added to the company’s debt burden. Despite these challenges, Volkswagen remains a major player in the automotive industry, and its stock is likely to rebound in the long term.

In the meantime, investors may want to consider the company’s recent acquisition of Porsche, which could potentially boost the company’s profits in the future. For more information on the acquisition, please visit did volkswagen buy porsche .

Volkswagen stock has been taking a hit lately due to the ongoing chip shortage and supply chain disruptions. However, the company’s long-term prospects remain strong, especially considering its recent acquisition of Audi. Did Volkswagen buy Audi? Yes, Volkswagen acquired Audi in 1964, and the two companies have been working together ever since.

This strategic move has allowed Volkswagen to expand its product portfolio and gain a foothold in the luxury car market. Despite the current challenges, Volkswagen’s strong fundamentals and long-term growth potential make it a stock worth considering for investors.

Volkswagen’s stock has been on a downward trend lately, but that doesn’t mean you can’t find a great Volkswagen SUV with third-row seating. The Volkswagen Atlas and Atlas Cross Sport are both excellent choices, offering plenty of space and features for families.

To learn more about which Volkswagen has 3rd row seating, click here . Despite the stock’s performance, Volkswagen continues to produce high-quality vehicles that meet the needs of drivers and families alike.