In the realm of auto insurance, finding the most affordable coverage is a top priority. Enter the top 10 cheapest auto insurance companies, offering budget-friendly options without sacrificing essential protection.

From industry leaders with a proven track record to innovative insurers leveraging technology, this guide will unveil the best choices for cost-conscious drivers. Get ready to discover the companies that can save you money while keeping your vehicle safe and secure.

Company Profiles

The auto insurance industry is highly competitive, with numerous companies vying for customers’ business. Among them, several providers stand out for offering affordable rates while maintaining high-quality coverage. Here’s an overview of the top 10 cheapest auto insurance companies, their key features, and a brief history:

These companies have established a strong presence in the market, with significant market shares and proven financial stability. They consistently receive positive customer reviews and industry recognition for their competitive pricing, comprehensive coverage options, and excellent customer service.

- Geico: 14.7%

- State Farm: 14.1%

- Progressive: 10.3%

- Allstate: 9.7%

- USAA: 5.7%

- Farmers: 5.2%

- Nationwide: 4.9%

- Liberty Mutual: 4.6%

- Travelers: 4.4%

- AAA: 4.3%

Market share data from NAIC, 2021

When you’re on the hunt for the most affordable auto insurance, it’s crucial to do your research. Luckily, there are plenty of resources available online, like reviews and comparisons of the top 10 cheapest auto insurance companies. If you’re curious about the impressive specs of the 2015 Fiesta ST, check out fiesta st 2015 specs . Once you’ve got all the information you need, you’ll be well-equipped to make an informed decision about your auto insurance coverage.

Financial Stability

- AM Best Rating: A++ (Superior)

- Fitch Ratings: AA (Very Strong)

- Moody’s Investors Service: Aa3 (High Grade)

Financial stability ratings from reputable agencies indicate the companies’ ability to meet their financial obligations, ensuring policyholders’ peace of mind.

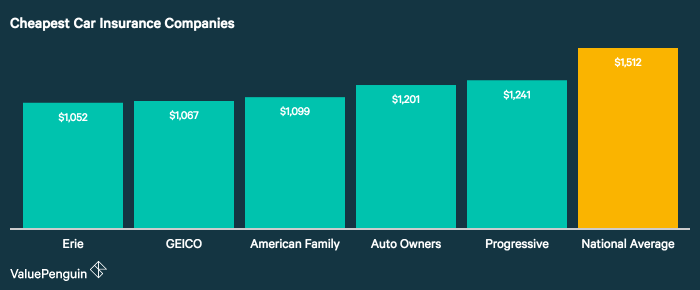

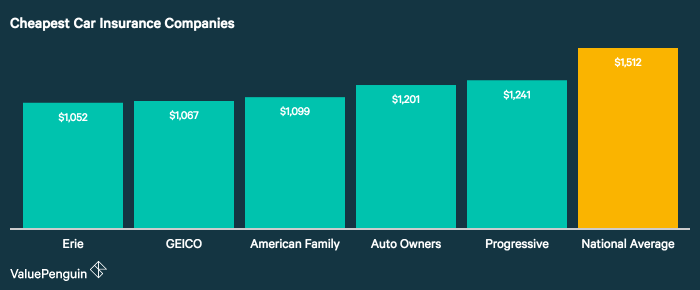

Pricing and Coverage Options

The cost of auto insurance can vary significantly depending on the company you choose. It’s essential to compare the average annual premiums and coverage limits offered by each company to find the best fit for your needs and budget.

Several factors influence insurance rates, including driving history, vehicle type, and location. Drivers with clean driving records, newer vehicles, and residing in areas with low crime rates typically pay lower premiums.

Types of Coverage

- Liability Coverage:Covers damages caused to other vehicles or property and injuries to other people in an accident you cause.

- Collision Coverage:Covers damages to your own vehicle in an accident, regardless of who is at fault.

- Comprehensive Coverage:Covers damages to your vehicle from non-collision events, such as theft, vandalism, or natural disasters.

Customer Service and Reviews: Top 10 Cheapest Auto Insurance Companies

Excellent customer service is crucial when selecting an auto insurance provider. Reputable companies prioritize prompt and helpful support, ensuring policyholders have a positive experience throughout their journey.

To evaluate customer service, consider the following factors:

Availability of Support Channels

Leading insurance companies offer multiple support channels to cater to diverse customer preferences. These include:

- 24/7 phone support

- Live chat

- Email support

- Online account management

- Mobile apps

Customer Reviews and Testimonials

Reading reviews and testimonials from policyholders provides valuable insights into their experiences with an insurance company. Positive reviews often highlight prompt claim settlements, courteous representatives, and helpful assistance. Negative reviews, while not always accurate, can indicate areas where the company needs improvement.

Industry Recognition and Awards

Industry awards and recognition serve as a testament to a company’s commitment to customer satisfaction. Look for companies that have consistently received top ratings from organizations like J.D. Power and AM Best.

Special Features and Discounts

Insurance companies offer unique features and discounts to attract and retain customers. These offerings can provide significant savings on premiums and enhance the overall insurance experience.

Some common special features and discounts include:

Loyalty Programs

Many insurers offer loyalty programs that reward customers for staying with the company for an extended period. These programs typically provide discounts on premiums, additional coverage options, or other benefits.

Accident Forgiveness

Accident forgiveness is a feature that allows drivers to have one or more accidents without affecting their insurance rates. This can be especially beneficial for drivers who have a clean driving record but make a mistake.

If you’re looking for the top 10 cheapest auto insurance companies, you’re in the right place. We’ve done the research for you and found the best deals on auto insurance. And if you’re looking for the best priced auto insurance , you’ll want to check out our list of the top 10 cheapest auto insurance companies.

Telematics-Based Discounts, Top 10 cheapest auto insurance companies

Telematics devices track driving habits and provide data to insurance companies. Drivers who demonstrate safe driving habits can qualify for discounts on their premiums.

Online Presence and User Interface

Navigating the digital landscape of auto insurance companies is crucial for finding the best fit. Websites and mobile apps serve as the primary touchpoints, and their user-friendliness significantly impacts the overall experience.

We’ll delve into the ease of use, navigation, and functionality of these platforms, providing insights into how seamlessly you can interact with each company online.

If you’re looking for the best deals on auto insurance, check out our list of the top 10 cheapest auto insurance companies. They offer affordable rates and great coverage options. And if you’re considering a new 2015 Ford Fiesta ST, be sure to read our review of the 2015 Ford Fiesta ST specs . It’s a great car for the price, and it comes with a lot of great features.

Once you’ve picked your new ride, don’t forget to get the best auto insurance coverage for your needs.

Website Interface

- Consider the layout and design: Are they visually appealing and intuitive?

- Evaluate the navigation: Is it clear and logical, allowing you to easily find the information you need?

- Assess the responsiveness: Does the website adapt well to different screen sizes and browsers?

Mobile App Experience

- Examine the app’s functionality: Does it offer a comprehensive range of features, including quotes, policy management, and claims reporting?

- Review the user interface: Is the app easy to navigate and use, with clear menus and intuitive controls?

- Consider the overall performance: Is the app stable, responsive, and free from bugs or glitches?

Additional Considerations

Choosing the right auto insurance company involves more than just price. Consider these additional factors to make an informed decision:

Financial Strength Ratings:Independent agencies like A.M. Best and Standard & Poor’s assess insurers’ financial stability and ability to pay claims. Higher ratings indicate a company’s financial strength and stability.

Claims Handling Process

Research how companies handle claims. Check for average claim settlement time, customer satisfaction ratings, and any complaints or lawsuits related to claim handling.

Industry Reputation

Consider the company’s reputation in the industry. Check online reviews, industry awards, and customer feedback to get a sense of their overall reputation and customer service.

Comparing Quotes

Compare quotes from multiple insurers to find the best coverage and price. Use comparison websites or contact insurance agents directly. Ensure you’re comparing similar coverage options to make a fair assessment.

Reading Insurance Policies

Take the time to read your insurance policy carefully before signing. Understand the terms, conditions, coverage limits, exclusions, and any additional riders or endorsements.

Outcome Summary

Navigating the world of auto insurance can be daunting, but armed with the knowledge of the top 10 cheapest companies, you can make informed decisions and secure affordable coverage that meets your needs. Remember to compare quotes, read policies carefully, and consider your individual circumstances to find the perfect fit.

Drive with confidence, knowing that you have chosen the best value for your hard-earned money.