When it comes to securing financial protection for your assets and loved ones, choosing the right insurance company is crucial. Our comprehensive guide to the 10 cheapest insurance companies will empower you with the knowledge to make informed decisions, ensuring you get the best coverage at an affordable price.

From auto and home insurance to life and health policies, we’ve analyzed the market to bring you a detailed comparison of coverage options, pricing, customer service, and financial stability. Whether you’re a first-time insurance buyer or looking to switch providers, this guide will help you navigate the insurance landscape with confidence.

Company Profiles

The insurance industry is vast and competitive, with numerous companies offering a wide range of products and services. To help you make informed decisions about your insurance needs, it’s important to understand the different companies and their offerings. In this section, we’ll provide an overview of the 10 cheapest insurance companies, including their history, size, financial strength, market share, customer base, and any recent mergers or acquisitions.

Each insurance company has its own unique strengths and weaknesses. By understanding these factors, you can choose the company that best meets your individual needs and budget.

History and Size

The history and size of an insurance company can provide insights into its stability and financial strength. Some of the oldest and largest insurance companies have been in business for over a century and have a proven track record of providing reliable coverage to their customers.

These companies often have a large market share and a diverse customer base, which can indicate their financial stability and ability to meet their obligations to policyholders.

Financial Strength

Financial strength is a key indicator of an insurance company’s ability to pay claims and meet its obligations to policyholders. Insurance companies are rated by independent agencies such as A.M. Best, Moody’s, and Standard & Poor’s. These ratings provide an assessment of the company’s financial stability, claims-paying ability, and overall risk profile.

Market share and customer base can provide insights into the popularity and reach of an insurance company. Companies with a large market share and a diverse customer base often have a strong brand reputation and a proven track record of providing quality service.

Now that you’ve got a great deal on car insurance from one of the 10 cheapest insurance companies, you can focus on other aspects of your car’s well-being. If you drive a Camry, you’ll want to keep an eye on the camry transmission . These transmissions are known for their reliability, but they can still develop problems over time.

By staying informed about potential issues, you can catch them early and avoid costly repairs. That way, you can keep your Camry running smoothly and focus on the things that matter most, like saving money on insurance.

These factors can indicate that the company is financially stable and has the resources to meet the needs of its customers.

Recent Mergers and Acquisitions

Recent mergers and acquisitions can have a significant impact on an insurance company’s size, financial strength, and market position. Mergers can lead to increased market share and economies of scale, while acquisitions can allow companies to expand into new markets or product lines.

It’s important to research any recent mergers or acquisitions to understand how they may affect the company’s overall stability and offerings.

Coverage Options: 10 Cheapest Insurance Companies

Each of these budget-friendly insurance companies offers a range of coverage options to meet your needs. Whether you’re looking for protection for your car, home, health, or life, you’re likely to find a plan that fits your budget and requirements.

When comparing coverage options, it’s essential to consider the coverage limits, deductibles, and any additional features or riders that may be available. These factors can significantly impact the cost and extent of your coverage.

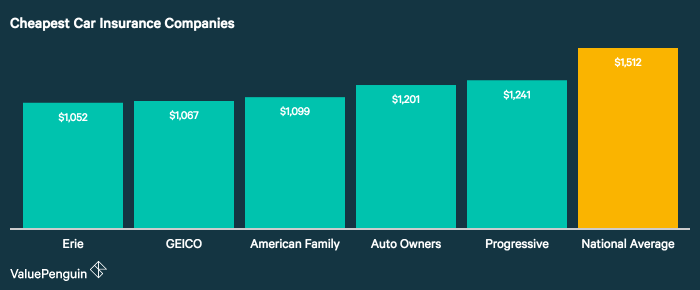

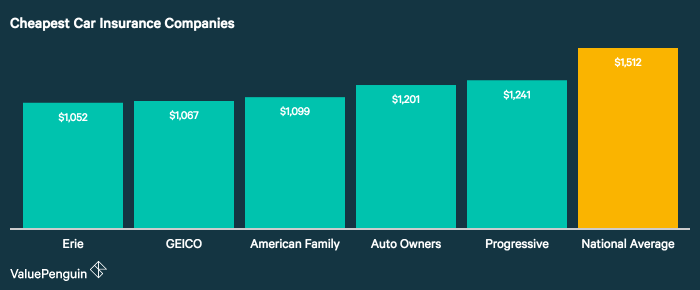

If you’re on the hunt for the most affordable car insurance, you’ll want to check out our list of the 10 cheapest insurance companies. These companies offer competitive rates and great coverage, so you can be sure you’re getting the best deal on your car insurance.

To find out which company is right for you, head over to our article what is the cheapest car insurance company and get the scoop on the 10 cheapest insurance companies out there.

Auto Insurance

- Liability coverage: Protects you against financial responsibility for injuries or property damage caused to others in an accident.

- Collision coverage: Covers damage to your vehicle in the event of a collision with another vehicle or object.

- Comprehensive coverage: Provides protection against theft, vandalism, and other non-collision-related damages.

- Uninsured/underinsured motorist coverage: Protects you in case you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

Home Insurance

- Dwelling coverage: Protects the structure of your home, including walls, roof, and attached structures.

- Other structures coverage: Covers detached structures on your property, such as garages, sheds, and fences.

- Personal property coverage: Protects your belongings inside your home, such as furniture, appliances, and clothing.

- Loss of use coverage: Provides reimbursement for additional living expenses if your home becomes uninhabitable due to a covered loss.

Life Insurance

- Term life insurance: Provides coverage for a specific period, such as 10, 20, or 30 years.

- Whole life insurance: Provides coverage for your entire life and accumulates a cash value component that can be borrowed against or withdrawn.

- Universal life insurance: Offers flexible coverage amounts and premiums, with the option to adjust your coverage as your needs change.

Health Insurance

- Major medical insurance: Covers a wide range of medical expenses, including doctor visits, hospital stays, and prescription drugs.

- Dental insurance: Covers preventive and restorative dental care, such as cleanings, fillings, and crowns.

- Vision insurance: Covers eye exams, eyeglasses, and contact lenses.

- Long-term care insurance: Provides coverage for long-term care services, such as assisted living or nursing home care.

Pricing and Discounts

The pricing structure of car insurance companies can vary significantly. Base rates are determined by factors such as the driver’s age, location, driving record, and claims history. Companies also offer a variety of discounts to reduce premiums, such as good driver discounts, multi-car discounts, and loyalty discounts.

It is important to compare quotes from multiple companies to find the best rates. Drivers should also consider the coverage options and customer service offered by each company before making a decision.

Premium Calculations

Car insurance premiums are calculated based on a number of factors, including:

- The driver’s age: Younger drivers are typically charged higher premiums than older drivers.

- The driver’s location: Drivers who live in urban areas are typically charged higher premiums than drivers who live in rural areas.

- The driver’s driving record: Drivers with clean driving records are typically charged lower premiums than drivers with multiple accidents or traffic violations.

- The driver’s claims history: Drivers who have filed multiple claims are typically charged higher premiums than drivers with no claims.

- The type of car being insured: Cars that are more expensive to repair are typically charged higher premiums than cars that are less expensive to repair.

Discounts

Car insurance companies offer a variety of discounts to reduce premiums, including:

- Good driver discounts: Drivers with clean driving records are typically eligible for good driver discounts.

- Multi-car discounts: Drivers who insure multiple cars with the same company are typically eligible for multi-car discounts.

- Loyalty discounts: Drivers who stay with the same company for multiple years are typically eligible for loyalty discounts.

- Other discounts: Some companies offer other discounts, such as discounts for students, seniors, and members of certain organizations.

Customer Service and Claims Handling

Customer service and claims handling are crucial aspects to consider when selecting an insurance provider. Let’s evaluate these aspects for the top 10 cheapest insurance companies.

Responsive customer service, accessible communication channels, and positive online reviews indicate a company’s commitment to customer satisfaction. Additionally, a seamless claims handling process, with clear filing procedures, prompt settlement times, and effective dispute resolution mechanisms, ensures a positive claims experience.

Customer Service

- Evaluate response times for phone, email, and online inquiries.

- Assess the availability of live chat, virtual assistants, and social media support.

- Consider the tone and helpfulness of customer service representatives.

- Review online reviews on platforms like Trustpilot, Google My Business, and the Better Business Bureau.

Claims Handling

- Examine the ease of filing a claim online, over the phone, or through a mobile app.

- Compare settlement times for different types of claims, such as auto accidents, property damage, and liability.

- Evaluate the clarity of claim denial explanations and the availability of dispute resolution mechanisms.

Financial Stability and Solvency

Assessing the financial stability of an insurance company is crucial to ensure its ability to meet its obligations and remain solvent during challenging times. By examining a company’s assets, liabilities, and reserves, we can evaluate its financial strength and resilience.

The search for the 10 cheapest insurance companies can be narrowed down to top 10 cheapest car insurance companies . This list is particularly useful for those seeking affordable coverage for their vehicles. By focusing on car insurance, you can compare rates and policies specifically tailored to your needs, ensuring you get the best possible deal on 10 cheapest insurance companies.

Companies with strong financial stability have ample assets to cover their liabilities and maintain adequate reserves to pay out claims. This ensures that policyholders can rely on the company to fulfill its commitments even in the event of major events or economic downturns.

Assets and Liabilities

- Assets:Insurance companies hold various assets, including cash, investments, and real estate, to meet their financial obligations.

- Liabilities:These represent the company’s financial obligations, including claims payable, unearned premiums, and policyholder dividends.

Reserves

Insurance companies maintain reserves to ensure they have sufficient funds to cover future claims and expenses. These reserves are typically invested in low-risk assets to generate stable returns.

Industry Trends and Innovations

The insurance industry is constantly evolving, with new technologies and innovations emerging all the time. These trends are having a major impact on the competitiveness and offerings of the 10 cheapest insurance companies.

One of the most significant trends is the use of technology to improve customer service and efficiency. Many insurers are now offering online self-service portals where customers can manage their policies, file claims, and make payments. This is making it easier for customers to do business with their insurers and is helping to reduce costs.

Data analytics is also playing a major role in the insurance industry. Insurers are using data to better understand their customers’ needs and to develop new products and services. This is helping to make insurance more affordable and accessible for everyone.

New products and services are also emerging in the insurance industry. For example, some insurers are now offering usage-based insurance, which allows customers to pay for insurance based on how much they drive. This can be a great way to save money for customers who don’t drive very often.

Impact on the 10 Cheapest Insurance Companies

The trends discussed above are having a major impact on the 10 cheapest insurance companies. These companies are investing heavily in technology and data analytics to improve their customer service and offerings. They are also developing new products and services to meet the changing needs of their customers.

As a result of these trends, the 10 cheapest insurance companies are becoming more competitive and affordable than ever before. This is good news for consumers, as it means they have more options to choose from when shopping for insurance.

Ending Remarks

Choosing the right insurance company is an essential step towards financial security. By carefully considering the factors Artikeld in this guide, you can find the best coverage for your needs without breaking the bank. Remember, the cheapest insurance company is not always the best, but it’s a great starting point for finding affordable and reliable protection.

2 thoughts on “10 Cheapest Insurance Companies: Affordable Coverage Options for Your Needs”