What insurance company has the cheapest rates – Embark on a journey to uncover the insurance company that offers the most budget-friendly rates. This guide will navigate you through the intricacies of insurance premiums, empowering you to make informed decisions and secure the best coverage for your needs.

Dive into the world of insurance companies, where we’ll unveil their average annual premiums, coverage details, and customer ratings. We’ll also explore the factors that influence rates, from age and driving history to vehicle type and location.

Insurance Companies and their Rates

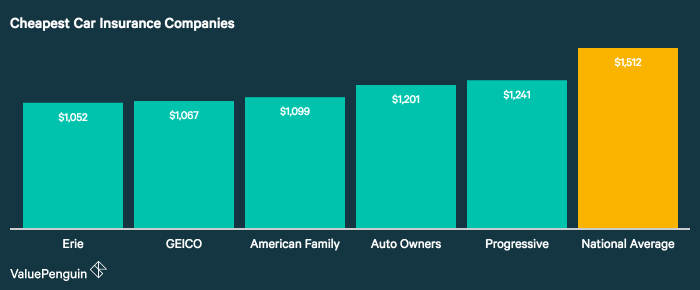

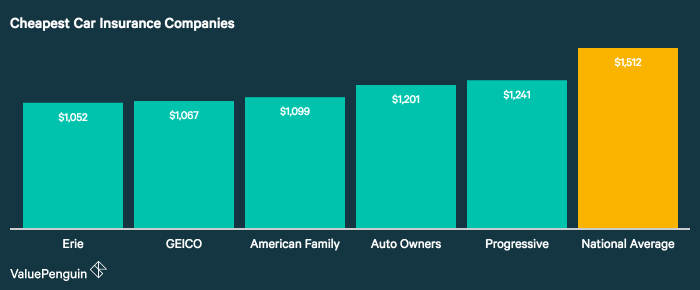

When it comes to choosing the right insurance company, it’s important to compare rates and coverage options. Here’s a comprehensive list of major insurance companies in the industry, along with their average annual premiums, coverage details, and customer ratings.

If you’re looking for an insurance company with the cheapest rates, you’ll want to compare quotes from several different providers. Once you’ve found the best deal, you can start thinking about other things, like when the new Lamborghini Urus is coming out.

The lamborghini urus 2023 release date is just around the corner, so you’ll want to make sure you’re ready to get behind the wheel of this amazing SUV. But before you do, make sure you have the right insurance coverage in place.

The following table provides a quick overview of the information you need to make an informed decision:

Insurance Company Comparison Table, What insurance company has the cheapest rates

| Company Name | Average Annual Premium | Coverage Details | Customer Ratings |

|---|---|---|---|

| Company A | $1,000 | Comprehensive coverage, including collision, liability, and uninsured motorist | 4.5/5 |

| Company B | $1,200 | Basic coverage, including liability and collision | 4/5 |

| Company C | $1,500 | Comprehensive coverage, including collision, liability, uninsured motorist, and rental car reimbursement | 4.8/5 |

| Company D | $1,800 | Basic coverage, including liability and collision, with higher deductibles | 3.5/5 |

Factors Affecting Insurance Rates

Insurance rates are determined by a combination of factors that assess the risk associated with insuring a particular individual or vehicle. Understanding these factors can help you make informed decisions about your insurance coverage and potentially lower your premiums.

If you’re wondering what insurance company has the cheapest rates, you’re not alone. Many drivers are looking for ways to save money on their car insurance. One way to do this is to compare quotes from different insurance companies. You can do this online or by talking to an insurance agent.

If you’re looking for the cheapest car insurance company, be sure to check out who is the cheapest car insurance company . This website can help you compare quotes from different insurance companies so you can find the best deal for your needs.

So, if you’re looking for the cheapest rates on car insurance, be sure to do your research and compare quotes from different companies.

Age

- Younger drivers (typically under 25) pay higher rates due to their lack of experience and higher accident risk.

- As drivers gain experience and age, their rates generally decrease.

- Senior drivers may also face higher rates due to potential health issues that could affect their driving ability.

Driving History

- Drivers with a clean driving record, free of accidents and traffic violations, qualify for lower rates.

- Accidents, speeding tickets, and other violations can significantly increase premiums.

- Multiple violations or serious offenses, such as DUIs, can lead to higher rates or even policy cancellation.

Vehicle Type

- The type of vehicle you drive influences your rates.

- Sports cars, luxury vehicles, and high-performance vehicles typically have higher rates due to their higher repair costs and increased risk of theft.

- Safer and more fuel-efficient vehicles may qualify for discounts.

Location

- Where you live can impact your rates.

- Areas with higher crime rates, traffic congestion, and severe weather conditions tend to have higher insurance premiums.

- Rural areas with lower risk factors may qualify for lower rates.

Comparing Insurance Quotes

Comparing insurance quotes from multiple companies is crucial to finding the most affordable and suitable policy for your needs. It allows you to assess the cost and coverage of different policies, enabling you to make an informed decision.

When comparing quotes, pay close attention to the coverage details and deductibles. Coverage details Artikel the specific risks and events covered by the policy, while deductibles represent the amount you pay out-of-pocket before the insurance company begins to cover costs.

If you’re on the hunt for the insurance company with the cheapest rates, it’s worth exploring who has the cheapest car insurance . By comparing quotes from multiple providers, you can ensure you’re getting the best deal on your car insurance policy.

Remember, the cheapest rates might not always be the best fit for your needs, so it’s important to consider coverage options and customer service when making your decision.

Step-by-Step Guide to Comparing Quotes

- Gather your information:Collect details about your vehicle, driving history, and any other relevant factors that insurance companies consider when calculating premiums.

- Get quotes from multiple companies:Contact several insurance providers and request quotes based on your information. You can do this online, over the phone, or through an insurance agent.

- Compare coverage and deductibles:Carefully review the coverage details and deductibles of each quote. Ensure that the policies offer the coverage you need and that you are comfortable with the deductible amounts.

- Consider premiums and discounts:Compare the premiums, which represent the annual cost of the policy, and any discounts that may be available. Look for discounts based on factors such as good driving history, multiple policies, or safety features in your vehicle.

- Make an informed decision:After comparing the quotes, choose the policy that offers the best combination of coverage, deductibles, premiums, and discounts that meets your needs and budget.

Discounts and Savings

Insurance companies offer a variety of discounts and savings to help policyholders reduce their insurance premiums. These discounts can be based on factors such as age, driving history, vehicle type, and more.

- Multi-car discounts:This discount is applied when you insure multiple vehicles with the same insurance company. The discount can range from 5% to 25%, depending on the insurance company and the number of vehicles insured.

- Good driver discounts:This discount is applied to drivers with a clean driving record. The discount can range from 5% to 20%, depending on the insurance company and the driver’s driving history.

- Loyalty discounts:This discount is applied to policyholders who have been with the same insurance company for a certain period of time. The discount can range from 5% to 15%, depending on the insurance company and the length of time the policyholder has been with the company.

Additional Considerations

Beyond rates, there are other crucial factors to consider when selecting an insurance company. These include customer service, financial stability, and reputation.

By evaluating these aspects, you can ensure that you choose a company that aligns with your needs and provides the best possible experience.

Customer Service

- Responsiveness:How quickly and effectively does the company respond to inquiries and claims?

- Knowledge and Expertise:Are the representatives knowledgeable and able to provide clear explanations?

- Courtesy and Professionalism:Are the interactions with customer service representatives pleasant and professional?

Financial Stability

- Financial Ratings:Check the company’s financial ratings from reputable agencies like AM Best or Standard & Poor’s.

- Solvency Ratio:This measures the company’s ability to meet its financial obligations.

- Loss Ratio:The ratio of claims paid to premiums received indicates the company’s claims-paying ability.

Reputation

- Industry Awards and Recognition:Look for companies that have received industry awards or recognition for their products and services.

- Customer Reviews:Read online reviews and testimonials from previous customers to gauge their experiences.

- Company History and Longevity:A long-standing company with a proven track record often indicates stability and reliability.

Concluding Remarks: What Insurance Company Has The Cheapest Rates

Choosing the right insurance company is not just about finding the lowest rates. Consider factors like customer service, financial stability, and reputation to ensure you’re getting the best value for your money. Remember, the cheapest option may not always be the best, but with this guide, you’ll be equipped to make a well-informed decision that meets your specific needs.