Does Ford do 0 financing? Yes, Ford offers 0% financing on select models. In this comprehensive guide, we’ll explore the ins and outs of Ford’s 0% financing options, including eligibility requirements, advantages, and disadvantages.

Whether you’re a first-time car buyer or a seasoned pro, this guide will provide you with all the information you need to make an informed decision about whether 0% financing is right for you.

Current Ford 0% Financing Offers

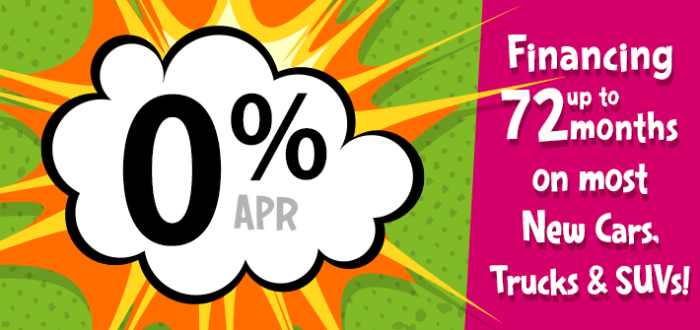

Ford is currently offering 0% financing on select models to qualified buyers. This offer is available for a limited time, so it’s important to act quickly if you’re interested.

Ford is known for its competitive financing options, including 0% financing on select models. If you’re considering a new Ford, it’s worth checking to see if you qualify for this special offer. While you’re researching Ford, you may also be wondering does ford field have a retractable roof ? The answer is yes, Ford Field, home to the Detroit Lions, features a retractable roof that can be opened or closed in just 12 minutes.

Back to the topic of financing, don’t miss out on the opportunity to save money with Ford’s 0% financing.

The terms and conditions of the 0% financing offer vary depending on the model you choose. However, in general, you can expect to finance your new Ford for up to 60 months with no interest. There may be some additional fees associated with the loan, so be sure to read the terms and conditions carefully before signing anything.

Eligibility

- Must have good credit

- Must be a U.S. resident

- Must be purchasing or leasing a new Ford vehicle

Available Models

- 2023 Ford F-150

- 2023 Ford Bronco

- 2023 Ford Explorer

- 2023 Ford Mustang

- 2023 Ford Ranger

How to Apply

To apply for 0% financing, you can visit your local Ford dealer or apply online. You will need to provide your personal information, financial information, and the details of the vehicle you’re interested in.

Considering the 0 financing options offered by Ford, you might wonder about their payment policies. Fortunately, Ford does accept credit card payments. You can find more information about their credit card payment policies here . So, while you’re exploring Ford’s 0 financing options, keep in mind that you have the convenience of using your credit card for payments.

Eligibility Requirements for 0% Financing

To qualify for 0% financing on a Ford vehicle, customers must meet specific eligibility criteria set by Ford Motor Credit Company (Ford Credit). These requirements include:

Credit Score:A strong credit score is essential for qualifying for 0% financing. Ford Credit typically requires a credit score of at least 720, but this may vary depending on the specific financing program and the customer’s financial history.

Ford is known for offering 0 financing on new vehicles, but did you know that Ford Credit also offers refinancing options? If you’re looking to lower your monthly payments or get a better interest rate, refinancing with Ford Credit could be a great option.

Learn more about Ford Credit refinancing to see if it’s right for you. Even if you don’t end up refinancing, Ford’s 0 financing deals can still save you money on your new car purchase.

Income Level:Customers must also meet certain income requirements to qualify for 0% financing. Ford Credit considers the customer’s income, debt-to-income ratio, and other financial obligations to determine if they can afford the monthly payments.

Other Factors:In addition to credit score and income, Ford Credit may also consider other factors when evaluating a customer’s eligibility for 0% financing. These factors may include the customer’s employment history, length of employment, and the type of vehicle being financed.

Approved Credit History

Customers with a history of making timely payments on their credit obligations are more likely to be approved for 0% financing. Ford Credit will review the customer’s credit report to assess their payment history, including any late payments, collections, or bankruptcies.

Sufficient Income

Customers must have sufficient income to cover the monthly payments on the financed vehicle. Ford Credit will consider the customer’s income, expenses, and debt obligations to determine if they can afford the loan.

If you’re curious about Ford’s financing options, you may wonder if they offer 0% financing. While Ford does offer financing incentives, the availability of 0% financing can vary depending on the model, trim level, and current promotions. To stay up-to-date on the latest deals, it’s a good idea to check with your local Ford dealership or explore the official Ford website.

On a related note, some people have been curious about the relationship between Ford and Fiona. If you’re interested in this topic, you can find more information here . Returning to the topic of financing, Ford’s financing options can help make your new vehicle purchase more affordable.

Acceptable Debt-to-Income Ratio

Ford Credit will also consider the customer’s debt-to-income ratio when evaluating their eligibility for 0% financing. This ratio compares the customer’s monthly debt payments to their monthly income. A higher debt-to-income ratio may reduce the customer’s chances of qualifying for 0% financing.

Comparison to Other Financing Options

Ford offers a variety of financing options to suit different needs and budgets. 0% financing is one of the most attractive options, but it’s not the only one available. Here’s a comparison of 0% financing to other financing options from Ford:

The following table summarizes the key differences between 0% financing and other financing options from Ford:

Interest Rates

- 0% financing: 0% interest rate

- Other financing options: Interest rates vary depending on the loan term and your creditworthiness

Loan Terms

- 0% financing: Typically available for shorter loan terms (e.g., 24 or 36 months)

- Other financing options: Available for longer loan terms (e.g., 60 or 72 months)

Monthly Payments, Does ford do 0 financing

- 0% financing: Lower monthly payments compared to other financing options

- Other financing options: Higher monthly payments, but lower total interest paid over the life of the loan

Advantages and Disadvantages of 0% Financing: Does Ford Do 0 Financing

0% financing can be a great way to save money on a new car, but it’s important to understand the advantages and disadvantages before you decide if it’s right for you.

While Ford might not offer 0 financing directly, it’s worth exploring does ford credit have a grace period to see if you qualify for any special financing options. Ford Credit may provide a grace period, allowing you to make your first payment later than the due date.

Be sure to check the terms and conditions carefully to understand any potential fees or penalties associated with the grace period.

Benefits of 0% Financing

- Lower monthly payments: 0% financing can help you lower your monthly payments, making it easier to afford a new car.

- Overall savings: Over the life of the loan, you could save a significant amount of money on interest charges.

Drawbacks of 0% Financing

- Shorter loan terms: 0% financing is typically only available for shorter loan terms, such as 24 or 36 months. This means you’ll have to make higher monthly payments than you would with a longer loan term.

- Higher down payment: To qualify for 0% financing, you may need to make a larger down payment than you would with a traditional loan.

- Not available on all models: 0% financing may not be available on all models or trim levels.

Tips for Maximizing 0% Financing

0% financing can be a great way to save money on a new car, but it’s important to understand the terms and conditions before you sign on the dotted line. Here are a few tips to help you make the most of 0% financing:

Negotiate the best terms.When you’re negotiating the terms of your loan, be sure to ask about the interest rate, the loan term, and the down payment. The interest rate is the most important factor, so be sure to compare rates from multiple lenders before you make a decision.

The loan term is the length of time you’ll have to repay the loan, and the down payment is the amount of money you’ll pay upfront.

Understand the fine print.Before you sign the loan agreement, be sure to read the fine print carefully. Make sure you understand all of the terms and conditions, including any fees or penalties that may apply. If you have any questions, be sure to ask your lender for clarification.

Avoid potential pitfalls.There are a few potential pitfalls to watch out for when you’re using 0% financing. One is that you may be tempted to overspend. When you’re not paying interest, it’s easy to forget that you’re still borrowing money. Be sure to stick to your budget and only borrow what you can afford to repay.

Another potential pitfall is that you may not be able to refinance your loan later on. If interest rates go down, you may not be able to refinance your loan at a lower rate. This is because 0% financing loans often have prepayment penalties.

Be sure to factor this into your decision when you’re considering 0% financing.

Loan Term

The loan term is the length of time you’ll have to repay the loan. Shorter loan terms will have higher monthly payments, but you’ll pay less interest over the life of the loan. Longer loan terms will have lower monthly payments, but you’ll pay more interest over the life of the loan.

The best loan term for you will depend on your individual circumstances. If you can afford the higher monthly payments, a shorter loan term is a good way to save money on interest. If you need to keep your monthly payments low, a longer loan term may be a better option.

Down Payment

The down payment is the amount of money you’ll pay upfront. A larger down payment will lower your monthly payments and the total amount of interest you’ll pay over the life of the loan.

The amount of down payment you can afford will depend on your budget and your financial situation. If you have a good credit score, you may be able to qualify for a loan with a lower down payment. However, if you have a lower credit score, you may need to make a larger down payment.

Fees and Penalties

Be sure to ask your lender about any fees or penalties that may apply to your loan. Some lenders charge an origination fee, which is a fee for processing your loan application. Other lenders may charge a prepayment penalty, which is a fee for paying off your loan early.

It’s important to understand all of the fees and penalties that may apply to your loan before you sign the loan agreement. This way, you can avoid any surprises down the road.

Final Review

Ultimately, the decision of whether or not to take advantage of Ford’s 0% financing offer is a personal one. By carefully considering the pros and cons and understanding your individual financial situation, you can make the best choice for your needs.

1 thought on “Does Ford Offer 0% Financing? Here’s Everything You Need to Know”