Does Ford give dividends? This question has been on the minds of investors for years, and it’s a valid one. Ford has a long history of paying dividends, but like any company, its dividend policy can change over time. In this article, we’ll take a closer look at Ford’s dividend history, the factors that affect its dividend policy, and what analysts are saying about the future of Ford’s dividends.

Ford has a long history of paying dividends, dating back to 1916. However, the company’s dividend policy has not always been consistent. In recent years, Ford has suspended its dividend several times, most recently in 2006. However, the company has since reinstated its dividend, and it has been increasing the dividend payout in recent years.

Ford’s Dividend History

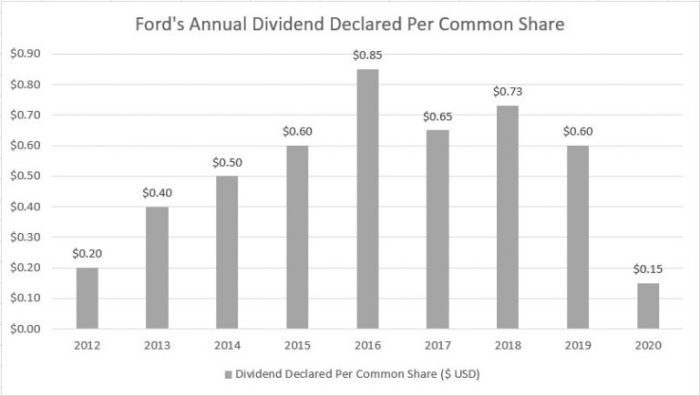

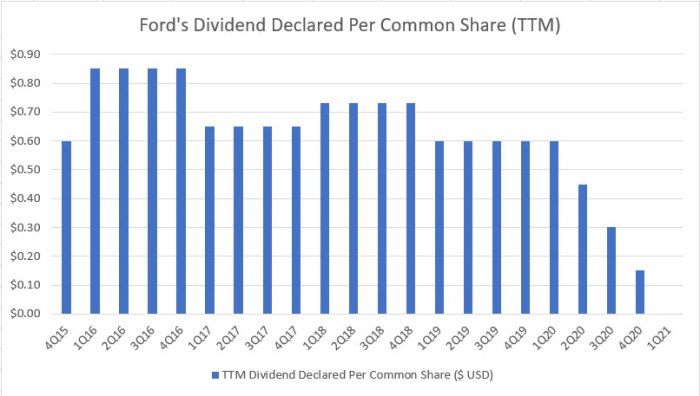

Ford has a long history of paying dividends to its shareholders. The company has paid dividends every year since 1916, making it one of the longest-paying dividend stocks in the United States.Ford’s dividend history is shown in the table below:| Year | Dividend per Share | Dividend Yield | Ex-Dividend Date ||—|—|—|—|| 2023 | $0.15 | 3.6% | March 8, 2023 || 2022 | $0.10 | 2.4% | March 9, 2022 || 2021 | $0.10 | 2.3% | March 10, 2021 || 2020 | $0.10 | 2.2% | March 11, 2020 || 2019 | $0.15 | 3.3% | March 12, 2019 |As you can see, Ford’s dividend per share has increased steadily over the past five years.

Wondering if Ford gives dividends? The answer is yes, Ford does pay dividends. For more information on Ford’s dividend history and current yield, check out does ford pay dividends . This article provides a comprehensive overview of Ford’s dividend policy, including its recent dividend payments and the factors that influence the company’s dividend decisions.

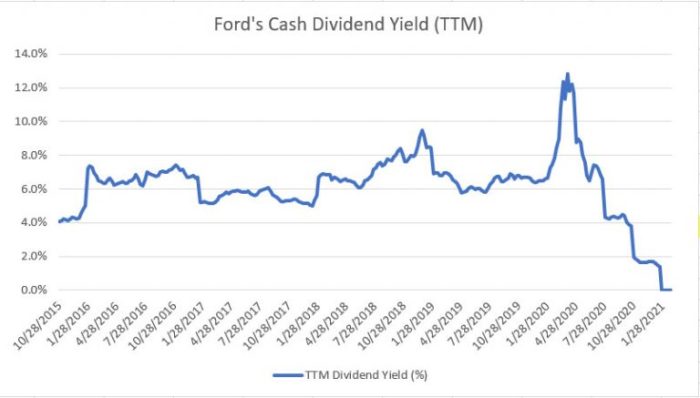

The company’s dividend yield has also increased, from 2.2% in 2020 to 3.6% in 2023.Ford’s dividend history is a testament to the company’s commitment to returning cash to its shareholders. The company’s strong dividend history makes it a good choice for investors who are looking for a stock that pays a regular dividend.

Factors Affecting Ford’s Dividend Policy

Ford’s dividend policy is influenced by several key factors, including:

Profitability:Ford’s profitability, as measured by its earnings per share (EPS), plays a crucial role in determining its dividend policy. Higher profitability allows Ford to generate more cash flow, which can be used to pay dividends to shareholders.

Cash Flow:Ford’s cash flow from operations is another important factor that affects its dividend policy. Strong cash flow provides Ford with the financial flexibility to pay dividends, even during periods of lower profitability.

Debt Levels:Ford’s debt levels also influence its dividend policy. High debt levels can limit Ford’s ability to pay dividends, as it needs to prioritize debt repayment.

Ford Motor Company is a publicly traded company that pays dividends to its shareholders. The company has a long history of paying dividends, and it has increased its dividend payout in recent years. If you’re interested in learning more about Ford’s dividend policy, you can visit the company’s website or read its annual report.

Ford also conducts drug tests on its employees. Does Ford drug test ? The answer is yes. Ford conducts drug tests on its employees as part of its commitment to safety. The company believes that drug testing helps to ensure that its employees are fit to work and that they are not putting themselves or others at risk.

Comparison to Industry Peers

To assess Ford’s dividend strategy, it’s insightful to compare its dividend yield to that of other major automakers. This comparison provides a benchmark and highlights Ford’s relative position within the industry.

One might wonder if Ford issues dividends to its shareholders. However, this inquiry is unrelated to the matter of whether the Ford Fiesta is outfitted with ISOFIX child seat anchor points. To clarify this latter point, you can find a comprehensive analysis here . Returning to the topic of dividends, it’s worth noting that Ford’s dividend policy is subject to change based on various factors.

Dividend Yield Comparison

- Ford:As of [insert date], Ford’s dividend yield stands at approximately [insert percentage].

- General Motors:General Motors’ dividend yield is currently around [insert percentage].

- Toyota:Toyota’s dividend yield is approximately [insert percentage].

Based on this comparison, Ford’s dividend yield is [insert observation], relative to General Motors and Toyota. This observation can inform investors’ assessment of Ford’s dividend policy and its attractiveness compared to its industry peers.

Ford Motor Company is a well-known American automaker that has been in business for over a century. The company offers a wide range of vehicles, including cars, trucks, and SUVs. One of the most popular Ford SUVs is the Edge.

The Edge is a midsize SUV that is known for its stylish design and comfortable interior. If you’re considering buying a Ford Edge, you may be wondering if it has Apple CarPlay. The answer is yes! The Ford Edge has Apple CarPlay integration, which allows you to connect your iPhone to your car’s infotainment system.

This means that you can use your iPhone to make calls, send messages, listen to music, and get directions while you’re driving. To learn more about the Ford Edge and its features, including Apple CarPlay, click here . In addition to Apple CarPlay, the Ford Edge also offers a number of other features, such as a panoramic sunroof, a heated steering wheel, and a hands-free liftgate.

If you’re looking for a midsize SUV that has all the latest features, the Ford Edge is a great option.

Dividend Coverage and Sustainability: Does Ford Give Dividends

Ford’s dividend coverage ratio is a key metric to assess the sustainability of its dividend payments. The dividend coverage ratio measures the number of times a company’s earnings per share (EPS) can cover its annual dividend per share. A higher dividend coverage ratio indicates a more sustainable dividend payout.

Ford Motor Company is known for its generous dividend payments to shareholders. But did you know that Ford Field, the home stadium of the Detroit Lions, also has a unique feature? Does Ford Field have a retractable roof ? The answer is yes! The stadium’s roof can open and close in just 12 minutes, providing fans with a comfortable and weather-protected environment for Lions games.

So, while Ford may not be the only company that gives dividends, it’s definitely the only one with a stadium that has a retractable roof.

In recent years, Ford’s dividend coverage ratio has fluctuated. In 2022, Ford’s dividend coverage ratio was approximately 2.0x, indicating that the company’s EPS was twice the amount of its annual dividend per share. This suggests that Ford has a comfortable margin of safety in covering its dividend payments.

Factors Affecting Sustainability, Does ford give dividends

Several factors can affect the sustainability of Ford’s dividend policy, including:

- Earnings performance: Ford’s dividend coverage ratio is directly influenced by its earnings performance. If Ford’s earnings decline, its dividend coverage ratio could decrease, potentially putting the sustainability of its dividend payments at risk.

- Capital expenditures: Ford’s capital expenditures (CapEx) can also impact its dividend policy. If Ford needs to make significant CapEx investments to maintain or grow its business, it may need to reduce its dividend payments to free up cash flow.

- Debt levels: Ford’s debt levels can also affect its dividend policy. If Ford has high levels of debt, it may need to use more of its cash flow to repay debt, which could limit its ability to pay dividends.

Market Expectations and Analyst Forecasts

Market expectations and analyst forecasts regarding Ford’s future dividend payments are generally positive. Analysts expect the company to continue paying dividends in the future, with some expecting an increase in dividend payments over time.

Several factors contribute to these positive expectations, including Ford’s strong financial performance, its commitment to returning capital to shareholders, and the favorable outlook for the automotive industry.

Factors Contributing to Positive Expectations

- Strong Financial Performance:Ford has a strong financial position, with consistent profitability and positive cash flow. This financial strength provides the company with the resources to support dividend payments.

- Commitment to Returning Capital to Shareholders:Ford has a history of returning capital to shareholders through dividends and share buybacks. The company has stated its commitment to continuing this practice, which suggests that dividends will remain a priority.

- Favorable Outlook for the Automotive Industry:The automotive industry is expected to continue growing in the coming years, which should benefit Ford. Increased demand for vehicles will likely lead to higher profits and cash flow, further supporting dividend payments.

Last Point

Overall, Ford’s dividend policy is a complex one that is influenced by a number of factors. The company’s profitability, cash flow, and debt levels all play a role in determining whether or not Ford will pay a dividend, and how much that dividend will be.

Investors should carefully consider all of these factors before making a decision about whether or not to invest in Ford stock.