Does honda financial refinance – Considering refinancing your Honda? Dive into the world of Honda Financial’s refinancing options, from loan terms to eligibility criteria, and discover if it’s the right move for you.

Let’s explore the ins and outs of Honda Financial’s refinancing services, compare them with other lenders, and guide you through the application process. Plus, we’ll uncover alternative options to refinancing and help you make an informed decision that suits your financial situation.

Refinancing with Honda Financial

Refinancing your auto loan with Honda Financial can offer several benefits, including:

Lower interest rates

Before you refinance with Honda Financial, you might want to check out if your Honda Elevate has cruise control. This feature can make long drives more comfortable and less tiring. You can find out more about it here . After that, you can make an informed decision about whether refinancing with Honda Financial is the right move for you.

Refinancing with Honda Financial can potentially lower your interest rate, reducing your monthly payments and overall loan cost.

Extended loan terms

You may be able to extend your loan term, giving you more time to pay off your loan and potentially lowering your monthly payments.

When it comes to refinancing your Honda, Honda Financial Services offers competitive rates and flexible terms to meet your needs. If you’re looking to upgrade your Honda Civic with the latest technology, you may be wondering if it has Apple CarPlay.

Click here to find out if your Civic is compatible with Apple CarPlay. Refinancing with Honda Financial can help you get the financing you need to make your dream car a reality.

Improved credit score

Making on-time payments on your refinanced loan can help improve your credit score, making it easier to qualify for favorable interest rates on future loans.

Eligibility Criteria

To be eligible for refinancing with Honda Financial, you must:

- Have an existing auto loan with Honda Financial

- Be current on your loan payments

- Meet Honda Financial’s credit requirements

- Provide proof of income and insurance

Loan Terms and Interest Rates

The loan terms and interest rates offered by Honda Financial will vary based on your creditworthiness and the current market conditions. However, as an example, Honda Financial may offer refinancing loans with terms ranging from 24 to 84 months and interest rates as low as 2.99% APR.

Does Honda Financial refinance auto loans? I’m not sure, but I can tell you that the Honda BR-V doesn’t have cruise control. Read more about the Honda BR-V here . Back to Honda Financial, you can check their website or give them a call to inquire about refinancing options.

Comparison with Other Lenders

When comparing Honda Financial’s refinancing options with those of other lenders, it’s essential to consider several factors that impact the overall cost and terms of the loan.

If you’re considering refinancing your Honda, you might be wondering if Honda Financial offers refinancing. They do! In fact, they offer a variety of refinancing options to fit your needs. If you’re also curious about the Honda Element, you might be wondering if it has a timing belt.

Does the Honda Element have a timing belt ? Whether you have questions about Honda refinancing or the Honda Element, you can find the answers you need online.

The following table provides a side-by-side comparison of key aspects to help you make an informed decision:

Loan Terms

- Loan amounts: Compare the minimum and maximum loan amounts offered by Honda Financial and other lenders.

- Loan terms: Check the range of loan terms available, typically expressed in months or years.

- Prepayment penalties: Determine if there are any penalties for paying off the loan early.

Interest Rates

- Interest rates: Compare the annual percentage rate (APR) offered by Honda Financial and other lenders, including both fixed and variable rates.

- Rate discounts: Check if there are any discounts or incentives for automatic payments, loyalty programs, or other factors.

- Fees: Compare the origination fees, closing costs, and other administrative fees associated with the loan.

Other Considerations, Does honda financial refinance

- Customer service: Consider the reputation and responsiveness of the lender’s customer service.

- Online tools: Check if the lender offers online account management, mobile apps, and other convenient features.

- Additional services: Some lenders may offer additional services such as gap insurance, extended warranties, or roadside assistance.

Impact on Monthly Payments

Refinancing your auto loan with Honda Financial can significantly impact your monthly payments. Refinancing involves replacing your existing loan with a new one, potentially offering lower interest rates and more favorable terms. By securing a lower interest rate, you can reduce the total amount of interest paid over the life of the loan, resulting in lower monthly payments.

If you’re wondering if Honda Financial offers refinancing options, the answer is yes. They provide competitive rates and flexible terms to help you lower your monthly payments or shorten your loan term. Incidentally, did you know that Honda owns Acura? Click here to learn more about the relationship between these two automotive giants.

Returning to the topic of refinancing, if you’re a Honda Financial customer, it’s worth exploring your refinancing options to potentially save money on your auto loan.

To illustrate the potential savings, let’s consider a few loan scenarios:

| Loan Amount | Original Interest Rate | New Interest Rate | Original Monthly Payment | New Monthly Payment | Savings |

|---|---|---|---|---|---|

| $25,000 | 6.00% | 4.50% | $504.99 | $456.25 | $48.74 |

| $30,000 | 7.50% | 5.00% | $622.47 | $551.26 | $71.21 |

| $35,000 | 8.00% | 5.50% | $740.39 | $608.69 | $131.70 |

As you can observe from the table, refinancing to a lower interest rate can result in substantial monthly savings. The amount of savings achieved depends on factors such as the original loan amount, the difference between the old and new interest rates, and the remaining loan term.

Application Process

Refinancing your Honda vehicle with Honda Financial is a straightforward process that can be completed online or by mail.

Here’s a step-by-step guide to applying for refinancing with Honda Financial:

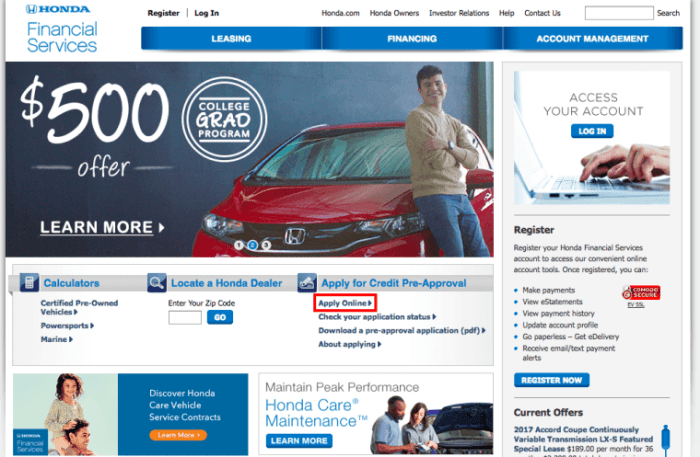

Online Application

- Visit the Honda Financial website and click on the “Refinance” tab.

- Enter your personal and vehicle information.

- Provide details about your current loan, including the loan amount, interest rate, and monthly payment.

- Submit your application and wait for a decision.

Mail-In Application

- Download the Honda Financial refinance application form from the website.

- Complete the form and mail it to the address provided on the form.

- Include copies of your driver’s license, vehicle registration, and proof of income.

- Wait for a decision by mail.

Required Documents

- Driver’s license

- Vehicle registration

- Proof of income (e.g., pay stubs, tax returns)

- Current loan statement

Approval Process and Timeline

Once you submit your application, Honda Financial will review your credit history, income, and debt-to-income ratio to determine if you qualify for refinancing.

The approval process typically takes 2-3 business days. If you are approved, Honda Financial will send you a loan offer with the new interest rate and monthly payment.

You will have 30 days to review the loan offer and decide whether to accept it.

Alternatives to Refinancing

Refinancing isn’t always the only solution to manage your auto loan. Explore alternative options like debt consolidation or loan modification to find the best fit for your circumstances.

Debt Consolidation

Debt consolidation combines multiple debts into a single loan with a lower interest rate. This can reduce your monthly payments and simplify your debt management.

- Pros:Lower interest rates, simplified payments, improved credit score (if done responsibly).

- Cons:May require collateral, can extend the loan term, and may result in higher fees.

Loan Modification

Loan modification involves working with your lender to change the terms of your existing loan. This could include reducing the interest rate, extending the loan term, or reducing the principal balance.

- Pros:Can keep your car, avoid repossession, and potentially reduce monthly payments.

- Cons:May not be available for all borrowers, can impact your credit score, and may result in higher fees.

Choosing the best option depends on your individual situation and financial goals. Consider your current debt, income, and credit history to determine the best path forward.

Ending Remarks: Does Honda Financial Refinance

Whether you’re seeking lower monthly payments, better loan terms, or simply want to understand your refinancing options, Honda Financial has solutions to meet your needs. Compare, consider, and make the choice that empowers you financially.

2 thoughts on “Does Honda Financial Refinance? Here’s What You Need to Know”