Does honda financial services have a grace period – Curious about the grace period offered by Honda Financial Services? Wonder no more! This guide delves into the details, providing a clear understanding of how it works, its implications, and the support available during this period.

From payment due dates to late fees and communication methods, we’ve got you covered. So, buckle up and let’s explore the ins and outs of Honda Financial Services’ grace period policy.

Grace Period Duration: Does Honda Financial Services Have A Grace Period

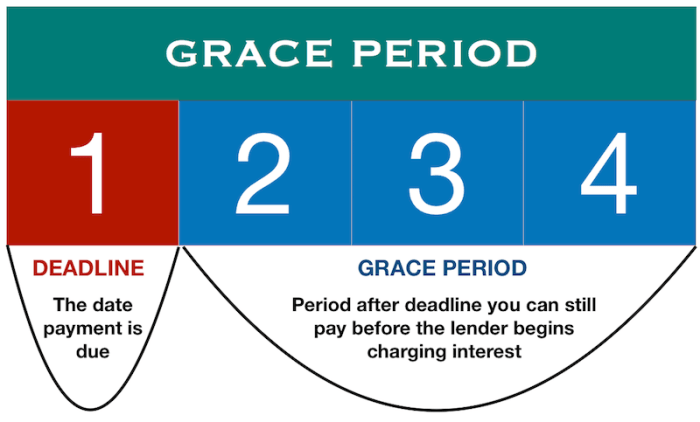

Honda Financial Services offers a 15-day grace period for loan payments. This grace period applies to all types of loans, including auto loans, motorcycle loans, and powersports loans.

Before your Honda Financial Services payment is due, you have a grace period. If you need auto repairs during this time, you can check if does honda do repairs . Their services may be covered under your Honda Financial Services contract.

Make sure to inquire about any potential charges or limitations to ensure a smooth and timely repair process.

Payment Due Dates

During the grace period, your payment due date remains the same as it was before the grace period began. This means that you have until the original due date to make your payment without incurring any late fees.

However, if you have made arrangements with Honda Financial Services to extend your due date, your new due date will be reflected on your account statement and online account.

Adjustments or Extensions

In some cases, Honda Financial Services may be willing to adjust or extend your due date. This may be done if you are experiencing financial hardship or if there are other extenuating circumstances.

To request an adjustment or extension, you should contact Honda Financial Services as soon as possible. They will review your request and make a decision on a case-by-case basis.

If you’re wondering whether Honda Financial Services offers a grace period for late payments, you can find out more about their policies on their website. While you’re there, you may also want to check out if does honda financial have an app . It could be a convenient way to manage your account and make payments on the go.

Returning to the topic of grace periods, it’s always best to contact Honda Financial Services directly to confirm their current policy and any exceptions that may apply.

Late Fees and Penalties

Missing payments beyond the grace period can have negative consequences. Honda Financial Services may impose late fees or penalties on past-due accounts.

The amount of the late fee varies depending on the loan type and the number of days the payment is late. Late fees are typically a percentage of the past-due payment amount, ranging from $25 to $100 or more.

Waivers and Exceptions, Does honda financial services have a grace period

In some cases, Honda Financial Services may waive or reduce late fees if the customer contacts them promptly and provides a valid reason for the late payment. For example, if the customer was hospitalized or experienced a financial hardship, Honda Financial Services may be willing to work with them to avoid or reduce late fees.

Communication and Notifications

Honda Financial Services prioritizes clear and timely communication with customers during the grace period to ensure prompt payment and avoid potential late fees. The company utilizes a range of channels to keep customers informed about their payment status.

Payment reminders are typically sent via email and SMS messages, providing customers with a convenient and accessible way to stay on top of their payments. These reminders include the payment due date, the amount due, and instructions on how to make the payment.

Online and Mobile Platforms

In addition to email and SMS notifications, Honda Financial Services offers online and mobile platforms that allow customers to track their payment status during the grace period. By logging into their account or using the mobile app, customers can view their payment history, check their balance, and make payments online or via mobile devices.

Does Honda Financial Services have a grace period? You might be wondering this if you’re facing financial hardship. While we can’t answer that question here, we can tell you that Honda does offer free oil changes for the first two years or 24,000 miles of ownership.

Does Honda do free oil changes ? Yes, they do! So, if you’re looking for a way to save money on your car maintenance, be sure to take advantage of this offer. And if you’re still having trouble making your car payments, be sure to contact Honda Financial Services to see if they can help you.

Late Notices

If a payment is not received by the end of the grace period, Honda Financial Services will send a late notice. This notice will inform the customer of the late payment, the amount past due, and any applicable late fees or penalties.

Late notices are typically sent via email and regular mail, providing customers with ample opportunity to address the overdue payment.

Before making a decision on Honda Financial Services’ grace period, it’s wise to explore all options. For instance, if you’re considering a Honda Fit, you might wonder does Honda Fit have VTEC ? This advanced engine technology can enhance performance and efficiency.

Understanding the features of different Honda models can help you make an informed choice that aligns with your needs. Returning to the initial topic, Honda Financial Services may offer a grace period to provide flexibility in managing your payments.

Exceptions and Special Circumstances

In certain situations, exceptions or special circumstances may affect the grace period offered by Honda Financial Services.

Customers may be eligible for an extended or modified grace period under the following circumstances:

Military Deployment

- Active military members may qualify for a grace period extension if they are deployed overseas.

- Documentation of deployment orders is typically required to verify eligibility.

Natural Disasters

- In the event of a natural disaster, such as a hurricane or earthquake, Honda Financial Services may extend the grace period for affected customers.

- Customers should contact Honda Financial Services to report the situation and request assistance.

Financial Hardship

- Customers experiencing financial hardship may be eligible for payment assistance or hardship programs.

- These programs can provide temporary relief from payment obligations or modify the payment plan to make it more manageable.

Comparison to Other Lenders

Honda Financial Services offers a grace period that is comparable to other auto lenders in the industry. Most lenders provide a grace period of 10 to 15 days for car payments. Honda’s grace period falls within this range, allowing customers ample time to make their payments without incurring late fees.

One unique feature of Honda’s grace period policy is that it does not reset with each payment. This means that if a customer makes a payment late but within the grace period, they will still have the full grace period available for their next payment.

This is an advantage over some other lenders who reset the grace period with each payment, which can make it more difficult for customers to avoid late fees if they have multiple late payments in a row.

Industry Standards and Best Practices

The industry standard for grace periods on auto loans is 10 to 15 days. This is a reasonable amount of time to allow customers to make their payments without incurring late fees. However, some lenders may offer longer grace periods, such as 21 days or even 30 days.

These longer grace periods can be beneficial for customers who have unpredictable income or who may need extra time to make their payments.

Honda Financial Services does not offer a grace period for late payments. If you’re considering trading in your Honda, you may want to check out Honda’s trade-in program. Does Honda do trade ins ? Yes, they do! Trading in your Honda can be a great way to get a new car and save money.

However, it’s important to remember that you won’t be able to make late payments on your Honda Financial Services loan without incurring penalties.

Impact on Credit History

Failing to make payments during or after the grace period can negatively affect your credit history. Late or missed payments are reported to credit bureaus, which can lower your credit score.

Typically, a single missed payment will not have a significant impact on your credit score, but multiple or prolonged late payments can cause a significant drop. The impact of late payments on your credit score depends on several factors, including your overall payment history, the number of missed payments, and the severity of the delinquency.

Reporting Timelines

Credit bureaus typically receive payment information from lenders within 30 days of the due date. If a payment is not received by the due date, it will be reported as late. Late payments will remain on your credit report for up to seven years.

Consequences of Late or Missed Payments

Late or missed payments can have several negative consequences, including:

- Lower credit score

- Difficulty obtaining new credit or loans

- Higher interest rates on new loans

- Increased insurance premiums

Mitigating Negative Effects

If you have missed a payment, there are steps you can take to mitigate the negative effects on your credit score:

- Make the missed payment as soon as possible.

- Contact your lender and explain the situation. They may be willing to work with you to avoid reporting the late payment.

- Dispute any inaccurate information on your credit report.

- Build your credit history by making timely payments on other accounts.

Customer Support and Resources

Honda Financial Services offers various customer support resources during the grace period to assist customers with payment management.

Phone Lines

Customers can contact Honda Financial Services via phone lines to speak with a customer service representative. The phone lines are typically open during business hours, providing immediate assistance to customers who have questions or require guidance regarding their payments.

Online Chat

Honda Financial Services provides an online chat feature on its website, allowing customers to connect with a virtual assistant or customer service representative in real-time. This channel offers a convenient way for customers to receive quick answers and support without having to make a phone call.

Self-Help Tools

Honda Financial Services offers a range of self-help tools on its website to empower customers to manage their payments independently during the grace period. These tools include:

- Online account access: Customers can create an online account to view their account details, make payments, and set up automatic payments.

- Payment calculators: Honda Financial Services provides online payment calculators that help customers estimate their monthly payments based on loan amount, interest rate, and loan term.

- Frequently asked questions (FAQs): The website includes a comprehensive section of FAQs that address common questions related to payments, grace periods, and other account-related topics.

These customer support resources and self-help tools enable customers to navigate the grace period effectively and ensure timely payments.

Final Thoughts

Whether you’re a seasoned Honda owner or considering financing your next ride, understanding the grace period is crucial. By leveraging the information provided in this guide, you can navigate this period with confidence, ensuring timely payments and maintaining a positive credit history.

6 thoughts on “Does Honda Financial Services Offer a Grace Period?”