Will hyundai refinance my car – Are you curious about whether Hyundai offers refinancing options for car loans? In this comprehensive guide, we’ll explore everything you need to know about refinancing with Hyundai, from eligibility criteria to potential benefits and the step-by-step process. Whether you’re looking to lower your interest rates, reduce your monthly payments, or improve your loan terms, this guide will provide you with all the information you need to make an informed decision.

Hyundai offers a range of refinancing options tailored to meet the needs of its customers. With competitive interest rates and flexible loan terms, refinancing with Hyundai can potentially save you money and improve your overall financial situation. Whether you’re facing financial challenges or simply want to optimize your car loan, refinancing with Hyundai is worth considering.

Hyundai Refinance Overview

Hyundai Motor Finance Company offers refinancing options to qualified individuals who currently have an auto loan with another lender. Refinancing with Hyundai can provide several potential benefits, such as lower interest rates, reduced monthly payments, or a shorter loan term.

Eligibility Criteria and Requirements

To be eligible for Hyundai refinancing, you must meet the following criteria:

- Have a good credit score

- Be current on your existing auto loan payments

- Have a vehicle that is eligible for refinancing (generally, vehicles less than 10 years old with less than 120,000 miles)

- Provide proof of income and employment

Benefits of Refinancing with Hyundai

Refinancing a car loan with Hyundai can offer several potential benefits that can significantly impact your financial situation. These benefits include:

Lower Interest Rates

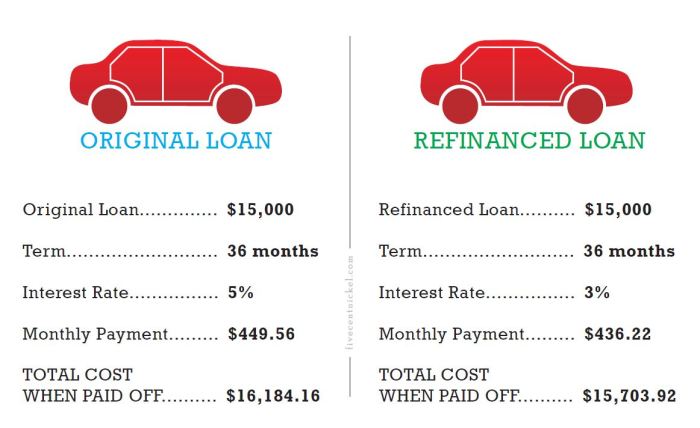

Refinancing with Hyundai may allow you to secure a lower interest rate on your car loan, which can lead to substantial savings over the life of the loan. A lower interest rate reduces the amount of interest you pay on the borrowed amount, resulting in lower monthly payments and a reduced overall cost of borrowing.

Reduced Monthly Payments

Lower interest rates typically translate into reduced monthly payments. With a lower monthly payment, you can free up more of your monthly budget for other expenses, savings, or investments. This can improve your overall financial flexibility and help you achieve your financial goals faster.

Improved Loan Terms

Refinancing with Hyundai may also allow you to improve the terms of your loan, such as extending the loan term or adjusting the repayment schedule. This can provide you with greater flexibility in managing your finances and make your car loan more manageable.

If you’re considering refinancing your Hyundai, you may be wondering if Hyundai will refinance your car. While Hyundai does offer refinancing options, you may also want to consider other lenders who may offer more competitive rates. For instance, BMW offers a variety of financing options, including refinancing for both new and used cars.

To learn more about BMW’s refinancing options, visit their website at will bmw install aftermarket parts . Alternatively, you can also contact your local Hyundai dealership to inquire about their refinancing options.

Process of Refinancing with Hyundai

Refinancing your car loan with Hyundai is a straightforward process that can save you money on your monthly payments. Here’s a step-by-step guide to help you get started:

Step 1: Check Your Eligibility

- You must have a Hyundai vehicle that is financed through Hyundai Motor Finance.

- Your loan must be in good standing, with no late payments.

- You must meet Hyundai’s credit requirements.

Step 2: Gather Your Documents

- Your Hyundai loan account number.

- Your vehicle’s VIN.

- Proof of income.

- Proof of insurance.

Step 3: Apply for Refinancing

- You can apply for refinancing online, by phone, or at a Hyundai dealership.

- You will need to provide your personal information, financial information, and loan details.

- Hyundai will review your application and make a decision.

Step 4: Review and Sign Your Loan Documents

- Once your application is approved, Hyundai will send you a loan agreement.

- Review the agreement carefully and sign it if you agree to the terms.

- Return the signed agreement to Hyundai.

Step 5: Fund Your New Loan

- Hyundai will pay off your old loan and fund your new loan.

- You will begin making payments on your new loan immediately.

Alternatives to Refinancing with Hyundai

While refinancing with Hyundai can be a viable option, it’s essential to consider alternative solutions that may better suit your specific financial situation.

Two primary alternatives to refinancing with Hyundai include refinancing with a different lender or selling the car.

Refinancing with a Different Lender

Refinancing with a different lender involves obtaining a new loan from a non-Hyundai lender with potentially more favorable terms, such as lower interest rates or longer repayment periods.

If you’re curious about refinancing your car with Hyundai, you’re in the right place. While we can’t answer that question here, we can direct you to a helpful resource that discusses when the BMW X5 will be redesigned . Once you have that information, you can come back and learn more about Hyundai refinancing options.

Advantages:

If you’re curious about whether Hyundai will refinance your car, the answer is likely yes. They offer competitive rates and flexible terms, making it a great option for those looking to lower their monthly payments or consolidate their debt. If you’re experiencing overheating issues with your BMW, it’s important to identify the cause.

Check for coolant leaks, faulty thermostats, or clogged radiators. You can find more information on potential causes and solutions in our article: what would cause my bmw to overheat . Once you’ve addressed the overheating issue, you can then focus on refinancing your Hyundai with confidence.

If you’re curious about refinancing your Hyundai, you’re not alone. Many car owners explore this option to potentially lower their monthly payments or secure a better interest rate. But before you dive into the process, it’s worth considering other automotive topics.

For instance, do you know which BMW models feature the renowned B58 engine? To find out, check out this informative article: What BMW Has a B58 . Once you’ve satisfied your automotive curiosity, you can return to the topic of Hyundai refinancing and explore your options.

- Access to a wider range of lenders and loan options

- Potential for more competitive interest rates and terms

Disadvantages:

- May require additional paperwork and processing time

- Potential for higher closing costs

Selling the Car, Will hyundai refinance my car

Selling the car outright is another alternative to consider if you no longer need it or can no longer afford the loan payments.

Advantages:

- Eliminate the car loan and associated monthly payments

- Receive a lump sum of money from the sale

Disadvantages:

Considering whether Hyundai will refinance your car? While you’re waiting for a response, you might find it interesting to know that BMW actually started as an aircraft engine manufacturer. Curious about their aviation history? Check out was bmw a plane company to learn more.

Coming back to your car, once Hyundai reviews your application, they’ll let you know if they can refinance your loan.

- May result in a financial loss if the car is sold for less than the loan balance

- Involves the hassle of selling a vehicle

The best alternative for you will depend on your individual circumstances and financial goals. Consider factors such as your current interest rate, loan term, monthly payments, and overall financial situation.

Factors to Consider Before Refinancing with Hyundai: Will Hyundai Refinance My Car

Before refinancing a car loan with Hyundai, it’s crucial to weigh the potential benefits against the risks. Here are some key factors to consider:

- Impact on Credit Score:Refinancing typically involves a hard credit inquiry, which can temporarily lower your credit score. Consider your overall credit profile and the potential impact on your score before proceeding.

- Fees Associated with Refinancing:Hyundai may charge fees for processing, origination, and other services related to refinancing. Factor these costs into your decision to ensure the savings outweigh the expenses.

- Long-Term Financial Implications:Refinancing can change the terms of your loan, including the interest rate, loan term, and monthly payments. Carefully assess the long-term financial implications to ensure the new loan aligns with your financial goals.

- Alternatives to Refinancing:Explore alternative options to refinancing, such as negotiating with your current lender for a lower interest rate or making extra payments to pay off your loan faster.

By considering these factors, you can make an informed decision about whether refinancing with Hyundai is the right move for you.

Tips for Refinancing with Hyundai

Refinancing a car loan with Hyundai can be a strategic move to save money, lower monthly payments, or secure a better interest rate. Here are some practical tips to help you navigate the refinancing process successfully.

Before you begin, it’s crucial to assess your financial situation, research different lenders, and understand the terms and conditions associated with refinancing. This preparation will empower you to make informed decisions and negotiate favorable terms.

Improving Your Credit Score

- Pay your bills on time, every time. Payment history is a major factor in determining your credit score.

- Reduce your credit utilization ratio. Keep your balances low relative to your available credit limits.

- Dispute any errors on your credit report. Inaccurate information can negatively impact your score.

- Consider using a credit monitoring service to track your progress and identify areas for improvement.

Negotiating Favorable Terms

- Shop around and compare offers from multiple lenders. Don’t settle for the first offer you receive.

- Be prepared to provide documentation to support your financial situation, such as pay stubs, bank statements, and proof of insurance.

- Don’t be afraid to negotiate the interest rate, loan term, and monthly payment. Lenders are often willing to work with you if you have a strong credit history.

- Consider getting pre-approved for a loan before you apply. This will give you a better understanding of your refinancing options.

Avoiding Common Pitfalls

- Don’t refinance if you don’t have a good reason. Refinancing can come with fees and other costs.

- Be aware of the prepayment penalty associated with your current loan. Refinancing may trigger this penalty, costing you money.

- Don’t extend the loan term to lower your monthly payment. This will ultimately cost you more interest over the life of the loan.

- Make sure you understand the terms and conditions of your new loan before you sign. Don’t hesitate to ask questions or seek professional advice if needed.

Summary

Refinancing your car loan with Hyundai can be a smart financial move, but it’s important to carefully consider all the factors involved. By understanding the eligibility criteria, benefits, process, and alternatives, you can make an informed decision that meets your individual needs.

If you’re considering refinancing your car loan, we encourage you to contact Hyundai directly to discuss your options and explore whether refinancing is right for you.