Get ready to save big on car insurance! Our guide to the top 5 cheapest car insurance companies will help you find the best coverage at the most affordable price. From defining “cheap car insurance” to comparing quotes and finding the perfect deal, we’ve got you covered.

So, buckle up and let’s explore the world of budget-friendly car insurance together. You might just be surprised at how much you can save!

Introduction

Cheap car insurance is a relative term that refers to insurance coverage that is affordable for the policyholder. The cost of car insurance varies depending on a number of factors, including the driver’s age, driving history, type of vehicle, and location.

If you’re looking for the top 5 cheapest car insurance, it’s worth considering which insurance company has the cheapest rates. Check out what insurance company has the cheapest rates to compare quotes and find the best deal for your needs.

It’s a great way to save money on your car insurance without sacrificing coverage.

There are a number of ways to save money on car insurance. One way is to shop around and compare quotes from different insurance companies. Another way is to increase your deductible. A higher deductible will lower your monthly premiums, but it will also mean that you will have to pay more out of pocket if you need to file a claim.

Factors Affecting Car Insurance Rates, Top 5 cheapest car insurance

- Age:Younger drivers are typically charged higher insurance rates than older drivers because they are statistically more likely to be involved in accidents.

- Driving history:Drivers with a clean driving record will typically pay lower insurance rates than drivers with a history of accidents or traffic violations.

- Type of vehicle:Sports cars and luxury vehicles are typically more expensive to insure than sedans and economy cars.

- Location:Drivers who live in areas with high rates of car theft or accidents will typically pay higher insurance rates than drivers who live in areas with lower rates of crime.

The Top 5 Cheapest Car Insurance Companies

Car insurance rates can vary widely depending on a number of factors, including your age, driving history, and the type of car you drive. If you’re looking for the cheapest car insurance, it’s important to compare quotes from multiple companies.

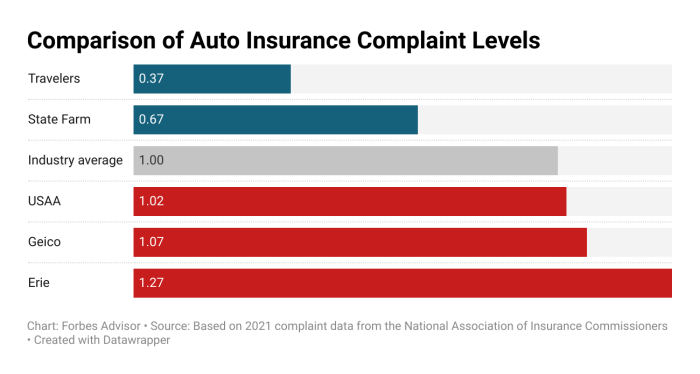

Here are the top 5 cheapest car insurance companies, according to a recent study by the National Association of Insurance Commissioners (NAIC):

The Top 5 Cheapest Car Insurance Companies

| Company | Average Annual Premium |

|---|---|

| Geico | $565 |

| State Farm | $659 |

| Progressive | $725 |

| Allstate | $767 |

| Farmers | $803 |

As you can see, Geico offers the cheapest car insurance rates, with an average annual premium of just $565. State Farm and Progressive are also relatively affordable, with average annual premiums of $659 and $725, respectively.

How to Get the Cheapest Car Insurance

Car insurance can be a significant expense, but there are ways to save money without sacrificing coverage. Here are some tips on how to get the cheapest car insurance:

Shop around.The best way to find the cheapest car insurance is to shop around and compare quotes from multiple insurance companies. There are many online comparison tools that can help you do this quickly and easily.

If you’re looking for the top 5 cheapest car insurance options, you’re in luck! There are many reputable providers that offer competitive rates. However, if you’re looking for the latest information on the lamborghini urus 2023 release date , be sure to check out our comprehensive guide.

Once you’ve got your new car, don’t forget to compare quotes from multiple insurance providers to find the best deal on your coverage.

Raise Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Raising your deductible can lower your monthly premiums. However, you should only raise your deductible if you are comfortable paying the higher amount in the event of an accident.

Factors to Consider When Choosing Car Insurance: Top 5 Cheapest Car Insurance

Choosing the right car insurance policy is crucial to ensure you have the necessary coverage and financial protection. Several factors come into play when selecting a policy, and it’s essential to consider them carefully to make an informed decision.

Coverage Limits

Coverage limits refer to the maximum amount of money your insurance policy will pay for covered expenses. It’s important to choose limits that align with your needs and financial situation. Higher limits provide more comprehensive coverage but may result in higher premiums.

Deductibles

A deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically lead to lower premiums. However, it’s crucial to select a deductible you can afford to pay in the event of an accident or claim.

If you’re looking for the best deals on car insurance, you’ll want to check out the top 5 cheapest options. These companies offer low rates and great coverage, so you can be sure you’re getting the best value for your money.

For example, you can get a quote for a 2023 Honda CR-V EX-L w/o BSI for as low as $100 per month. That’s a great deal on a great car! So be sure to compare quotes from the top 5 cheapest car insurance companies before you make a decision.

Discounts

Many insurance companies offer discounts to policyholders who meet certain criteria, such as:

- Safe driving records

- Multiple policies (bundling)

- Defensive driving courses

- Vehicle safety features

Taking advantage of discounts can significantly reduce your premiums and save you money.

Conclusion

Finding the cheapest car insurance doesn’t have to be a daunting task. By considering the factors discussed above and comparing quotes from multiple providers, you can save a significant amount of money on your insurance premiums. Remember, your driving history, vehicle type, and location all play a role in determining your insurance rates.

To get started, gather information about your driving history and vehicle, and then visit the websites of several insurance companies to request quotes. By comparing the quotes you receive, you can find the best deal on car insurance that meets your needs and budget.

Epilogue

Choosing the right car insurance can be a daunting task, but it doesn’t have to be. By following our tips and comparing quotes from multiple companies, you can find the perfect coverage that fits your budget and protects you on the road.

So, don’t wait any longer, start saving today!